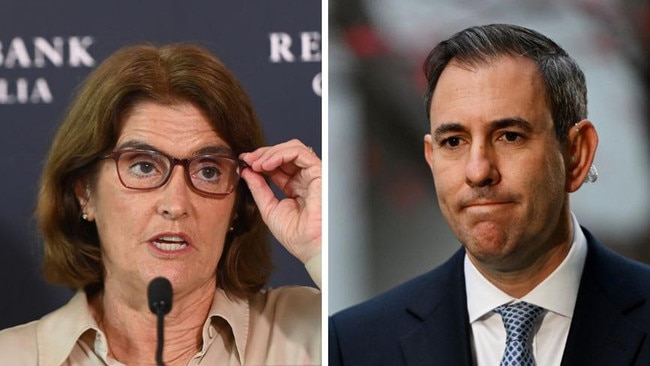

Reserve Bank Governor Michele Bullock alone in flight to tame inflation

And the central bank governor will be painfully aware of the plight of her predecessor, Philip Lowe.

Reserve Bank of Australia Governor Michele Bullock will have realised last week that she is now on her own when it comes to getting inflation down.

The grim understanding will have come to her after the federal government’s budget released last Tuesday contained little in the way of anything that will help her in the fight.

Key planks of the 2024-25 budget strategy included a cash handout for every household and an extension of government subsidies to help offset rising electricity costs and rents.

Economists argue that while the subsidies might mechanically lower headline inflation in the short term, they won’t reduce the more critical measure of core inflation, thus offering more of a placebo effect than the tough medicine needed to truly rein in price pressures.

The budget handouts come ahead of the delivery of income-tax cuts for every Australian worker from July 1 and a looming decision on how far to raise the basic wage that covers many thousands of workers.

So plenty of sugar is set to flow into the economy over the coming months, keeping the RBA on edge.

“It is a fairly decent stimulus,” said Jonathan Kearns, chief economist at Challenger and a former senior manager at the RBA.

“Given the budget is making inflation more persistent, I’d argue the RBA won’t be close to cutting anytime soon,” he said.

Minutes of the RBA’s latest policy meeting are due on Tuesday and will confirm that the central bank seriously considered raising interest rates this month.

The question for financial markets is how close the central bank came to delivering a 14th rate increase.

Bullock has warned that the balance of risks has shifted toward inflation staying higher for longer, so a call to hike further might have been much closer than many economists expected.

The heat could rise quickly around Bullock.

Australians are obsessed with property ownership and investment, making interest rates front-page news on a regular basis.

And Bullock can expect to face immense public pressure and scrutiny if the RBA tightens the policy screws further, especially with a federal election due by May next year.

With mortgage repayments already causing immense pain, the course of interest rates could well determine the election outcome.

Bullock will be painfully aware of the plight of her predecessor, Philip Lowe, who at one point received death threats from the public and scorching media criticism when he led the charge in 2022 to raise interest rates to counter the biggest surge in inflation since the early 1980s.

Lowe, one of Australia’s top economists, regularly faced off with media packs – including on the front lawn of his suburban home – and was publicly attacked by Prime Minister Anthony Albanese, himself an owner of investment properties.

While interest rates might not need to be raised further, it is a safe bet that they will stay higher for longer than most observers expect, with cuts likely delayed until next year.

The RBA was slow to start raising interest rates in 2022 and didn’t tighten policy settings as much as its global counterparts, so it is a safe assumption that it will be one of the last central banks to start cutting.

Amid the gloom, there was some good news for Bullock last week.

Data showed that wage growth may have peaked, while the unemployment rate rose, suggesting that some steam has left the labour market.

If wage growth has ebbed and companies are indeed starting to dismiss workers because the economy has slowed, it will shift the policy needle firmly toward interest-rate cuts before the end of the year.

For now, Bullock will feel isolated and alone in finally getting inflation back to the 2 per cent to 3 per cent target band, a place it hasn’t been for years.

Dow Jones newswires

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout