Reserve Bank gives up hope on wages, inflation growth

The Reserve Bank has abandoned its expectation for any pick-up in wage growth over its forecast period.

The Reserve Bank has abandoned its expectation for any pick-up in wage growth over its forecast period and now says it will not fulfil its inflation mandate until 2022 at the earliest.

The more downbeat official forecasts from the central bank’s economists were contained in the RBA’s quarterly statement on monetary policy, released on Friday. While the downgrades were minor, they were the most recent in a string of downbeat changes to the bank’s outlook over recent quarters.

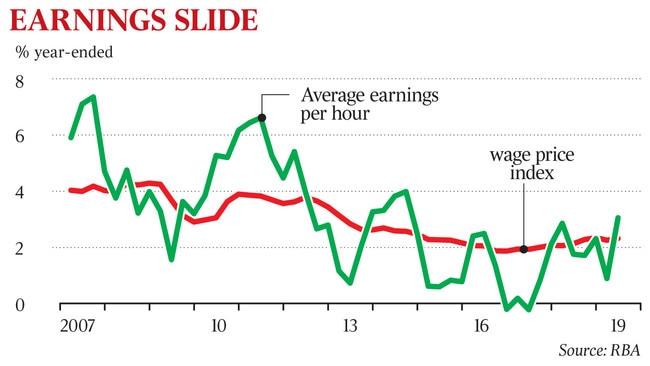

Previously, the bank’s economists had forecast a minor appreciation in pay packets, but now expect growth in their favoured measure of pay, the wage price index, to stay at 2.3 per cent on an annual basis until December 2021.

The more downbeat wage expectations fed into a less optimistic outlook on consumer price growth.

In August, the bank expected annual inflation to reach 2 per cent by June 2021. It now expects only 1.9 per cent growth in consumer prices by that date and for inflation to remain unchanged until the end of that year.

If correct, inflation will have been below its targeted 2-3 per cent band for at least six years. Headline inflation to June this year was 1.6 per cent.

“The downward revision to inflation does indicate they see at least one more rate cut next year,” Ernst & Young chief economist Joanne Masters said.

The unemployment rate is expected to remain at 5.2 per cent for the rest of this year and the next, before falling to 4.9 per cent in 2021. This is still well above the 4.5 per cent jobless rate monetary policymakers say is needed to push wages higher.

In Friday’s updated forecasts, the bank said it expected “moderate” GDP growth over the second half of this year, which would bring growth over 2019 to 2.3 per cent — lower than the 2.4 per cent growth it expected in August.

The economy grew by 1.4 per cent over the year to June. But the bank’s economists kept to their forecast for a solid rebound in GDP growth in 2020 and 2021, to 2.8 per cent and 3.1 per cent, respectively.

The opening chapter of the statement — which economists said most likely reflected RBA governor Philip Lowe’s views — said “the Australian economy is gradually coming out of a soft patch”.

The RBA repeated that it believed the economy had “reached a gentle turning point”, a line Dr Lowe included in Tuesday’s statement accompanying the decision to keep rates at 0.75 per cent.

Josh Frydenberg has also pointed to the RBA’s essentially upbeat view on the economy as the Treasurer resists calls to provide more immediate support for the economy. But Ms Masters described the bank’s forecasts as “optimistic”.

“The RBA’s gentle turning point requires all the ducks to line up, including an acceleration in business investment that we are just not seeing, and for dwelling investment to turn up sharply,” she said.

Indeed, the more pessimistic forecasts on GDP growth, inflation and wages offered no glimpse of a true turning point in the low-growth, low-inflation economic environment, suggesting easy monetary conditions would remain for years to come.

As the Reserve Bank watches and waits for evidence of a more meaningful upswing in the economy, the statement showed it was growing more concerned that persistently weak income growth and inflation may become baked in to Australians’ expectations and make a more substantial recovery more difficult.

“Recent developments show that a protracted period of weak income growth will eventually induce households to adjust their spending patterns, though this can take a while,” the statement read.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout