Reserve Bank charts new growth path as interest rates are cut to 0.75pc

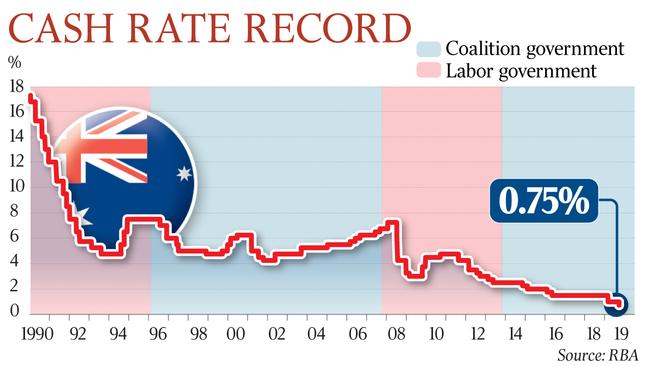

The Reserve Bank has slashed the official interest rate to a low of 0.75 per cent and signalled it is prepared to make further cuts.

The Reserve Bank has slashed the official interest rate to a low of 0.75 per cent and signalled it is prepared to make further cuts — charting new ground in monetary policy — in a bid to revive household spending, boost wages growth and drive employment.

Hours after the historic decision, two of the nation’s biggest lenders — the Commonwealth Bank and National Australia Bank — defied Josh Frydenberg by refusing to pass on in full the cut to the official cash rate, which now sits below 1 per cent for the first time. In a statement after Tuesday’s RBA board meeting, governor Philip Lowe said the move would “support employment and income growth” and “provide greater confidence that inflation will be consistent with the medium-term target”.

The cut follows a slump in economic growth and rising uncertainty stemming from the escalating US-China trade war.

Dr Lowe said it would also prevent an economically damaging rise in the dollar stemming from even lower interest rates overseas.

The Treasurer, brushing off fears the RBA cut signalled economic weakness, said it would deliver benefits for households and complement the government’s $158bn personal income tax package. He demanded the banks pass on the rate cut “in full”.

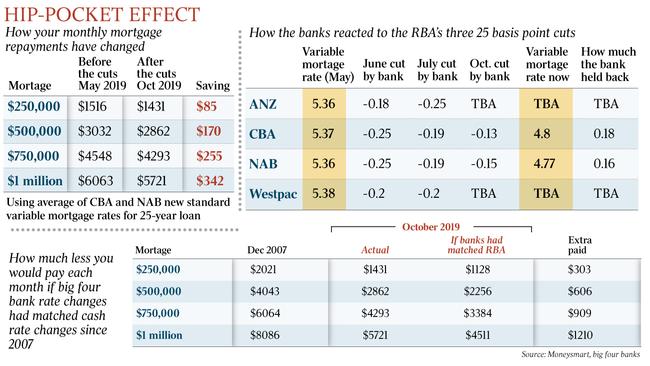

“What this means for an Australian family with a mortgage of $400,000 is $720 less a year in interest payments. That’s a significant benefit to an Australian family,” Mr Frydenberg said.

Setting the stage for a stoush with the government, CBA and NAB, passed on about half of the cut — 0.13 and 0.15 percentage points respectively — to their mortgage holders. CBA cited a “difficult balancing act between the multiple, valid interests of our stakeholders” while NAB’s chief customer officer, Mike Baird, said that “with the RBA cash rate at historic lows, the cost of deposits comes under pressure”.

In cutting rates for the third time in five months, the RBA chose not to heed warnings from former treasurer Peter Costello, top economists and senior business figures that ever lower interest rates would hurt confidence or revive a housing bubble.

Victorian Liberal MP Tim Wilson, chairman of the House of Representatives economics committee, weighed in last night to express his disappointment. “I’ve yet to be convinced cuts have any positive impact,” he said. “The reverse is likely by discouraging savings and those that have to spend.”

Mr Frydenberg said jobs were being created and the economy continued to grow, although the economy faced “significant” challenges. “Those challenges are internationally with the global trade tensions between China and the US, but they’re also domestically, particularly with the punishing impact of the drought and floods,” the Treasurer said.

Pressure for a rate cut grew after economic growth fell to 1.4 per cent over the year to June, short of the Reserve Bank’s and government growth forecasts. It also followed weaker than expected retail growth in July as well as a rise in the jobless rate to 5.3 per cent in August.

“The main domestic uncertainty continues to be the outlook for consumption, with the sustained period of only modest increases in household disposable income continuing to weigh on consumer spending,” Dr Lowe said. “In cutting the cash rate, the board also took account of the forces leading to the trend to lower interest rates globally and the effects this trend is having on the Australian economy and inflation outcomes.”

Speaking at a dinner in Melbourne after the board meeting, Dr Lowe said the economy had been through a “soft patch”, but he expected the rate cut would see growth return to trend, about 2.5 per cent a year, over the next 12 months. It would also push inflation, which has been below the RBA’s key performance metric since late 2014, back above 2 per cent by 2021. The Australian dollar fell more than 0.7 per cent to a four-week low of just over US67c, as investors pencilled in further interest rate cuts, while the benchmark share index finished the session up 0.8 per cent at 6742.

Labor Treasury spokesman Jim Chalmers said the policy shift illustrated the economy’s weakness and called on the government to bring forward legislated tax cuts, increase infrastructure spending or boost Newstart Allowance to help drive growth. “The slowest economic growth in a decade, interest rates at a quarter of what they were in the darkest days of the global financial crisis, stagnant wages, weak consumption, productivity and living standards going backwards, record household debt — right across the board there are issues in the Australian economy which are being left unattended,” Mr Chalmers said.

Anthony Doyle, investment specialist at funds management giant Fidelity, said that by cutting rates so aggressively, the RBA was “hoping to generate a stronger labour market, higher wage growth and to stimulate domestic consumption”.

The cumulative impact of the three cuts to the official interest rate, on a mortgage holder with a $500,000 loan, are about $170 a month or double the maximum tax cut available under the government’s tax plan. However, the same mortgage holder is paying about $600 a month more than they would have had the banks followed RBA cash rate changes since 2007.

About 80 per cent of the nation’s $1.8 trillion stock of home loans have variable interest rates.

Based on prices in financial markets, the chance of a fourth cut, before Christmas, rose to almost 70 per cent yesterday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout