Reserve Bank alarm over China debt bomb

Reserve Bank governor Philip Lowe has declared China’s economy is a threat to financial stability and growth.

Reserve Bank governor Philip Lowe has declared China’s “complex, opaque and highly indebted” economy is a threat to financial stability and growth, laying bare the risk of “serious accidents” as the economic giant — Australia’s biggest trading partner — tries to curb its ballooning debts.

In a speech at the University of Technology Sydney last night, Dr Lowe said Chinese citizens “buying and selling assets like you and I” would wreak havoc on global asset prices, sending house prices soaring around the world, unless the process was “managed”.

“The desire to hold assets in other countries will be strong ... If it’s on a much larger scale (than now), it would be problematic,” he said.

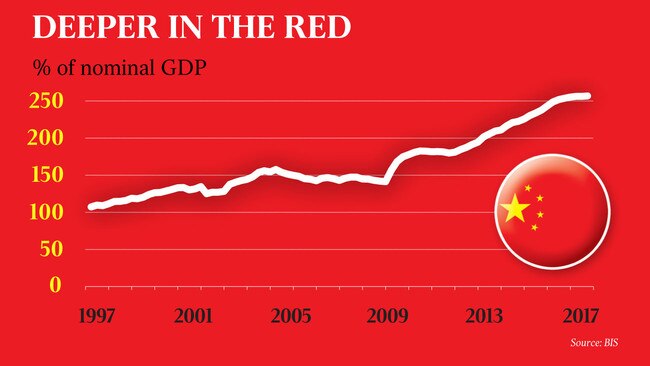

Dr Lowe said the RBA was studying China’s financial system closely, given its “unusually high” debt burden, the equivalent of 260 per cent of its national income and up from about 150 per cent a decade ago — a bigger rise than that of any other major nation.

“Among the largest economic risks that Australia faces is something going wrong in China,” he said. “And perhaps the single biggest risk to the Chinese economy at the moment lies in the financial sector and the big run up in debt there over the past decade.”

The governor’s remarks will attract extra scrutiny in light of the worsening of relations between Beijing and Canberra. Chinese Foreign Minister Wang Yi this week blamed Australia for causing tensions between the two countries and Liberal MP Andrew Hastie used parliamentary privilege on Tuesday night to name Australian-Chinese businessman Chau Chak Wing as an unindicted co-conspirator identified by the FBI in a UN bribery case.

Dr Lowe — speaking as a guest of the Australia-China Relations Institute, not far from UTS’s Dr Chau Chak Wing Building — said it was in both nations’ “strong interest” to manage “this important relationship well … The deepening relationship has also benefited China in many ways. We will, of course, have differences from time to time but we will surely be better placed to deal with these if we understand one another well.”

Dr Lowe said a prosperous China “as part of a rules-based international system” was in Australia’s interest. “It may turn out that pressure from the US (on trade) is forcing (China) to move a bit more quickly,” he said.

He revealed that the Reserve Bank now employed three staff full-time in Beijing to monitor Chinese economic and financial developments.

“The complex web that has developed in China is characterised by opaque risk transfers, implicit guarantees and complex connections,” Dr Lowe said.

“The influence of the state and the incentives within financial institutions have almost surely distorted credit allocation and led to some poor lending decisions.”

More than 3500 “shadow banks” — financial institutions that are not regulated — have emerged in China, providing an array of riskier financial products outside the state-controlled banking system.

“To the extent that experience elsewhere in the world is any guide, it is difficult to escape the conclusion that this complex web in a highly indebted economy is a risky situation,” Dr Lowe said.

Shadow banks in China now collectively make up 45 per cent of credit, up from 25 per cent a decade ago.

“The build-up of financial risks like those seen in China is almost always followed by a marked slowdown in GDP growth of a financial China’s debts,” the governor said.

However he stressed an economic collapse in China was not inevitable.

Chinese President Xi Jinping has called for a gradual reduction in the level of debt as a share of GDP and authorities are trying to increase transparency and impose more stringent oversight of shadow and official banks.

Dr Lowe said it was too early to tell whether Chinese authorities would be successful.

“It is a very significant task,” he said. “The experience of other countries suggests caution, and elsewhere there have been serious accidents along the way.”

He urged Chinese leaders to “learn from this experience”.

Credit growth in China has slowed to about 7 per cent, the same level as GDP growth.

Dr Lowe said China’s economy, the world’s largest, was on track to become twice as large as the US economy when China’s per-person income reached half of that in the US — “something which should be achievable”.

China, which accounts for one-third of Australia’s exports and about one-fifth of our imports, was increasingly important for education and tourism, he said.

“Chinese visitors tend to stay longer and spend more money than other visitors,” Dr Lowe said.

He pointed out that Chinese tourists accounted for about 25 per cent of tourist expenditure. Last year, 1.4 million Chinese tourists visited Australia, up from 400,000 a decade ago.

Over the same period, Chinese student enrolments in Australia have roughly doubled to just under 200,000.

“The Chinese-born resident population in Australia has grown at an average rate of around 8 per cent a year,” Dr Lowe said.

The International Monetary Fund yesterday downplayed Australia’s dependence on China.

“China may be Australia’s largest trading partner, but the rest of Asia is also rapidly growing and is a potential market for Australia’s future expansion,” a new working paper concluded.

The modelling suggested a recession in China would cause “small changes” in Australia’s GDP.