Rents set to fall for next five years

Renters in Sydney and Melbourne will be the major beneficiaries of the largest shock to population growth since World War I.

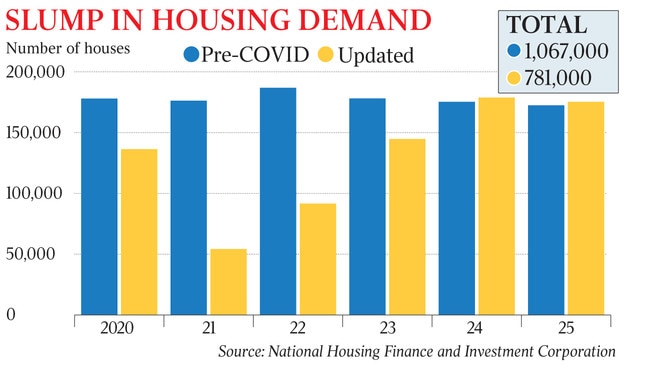

Renters in Sydney and Melbourne will be the major beneficiaries of the largest shock to population growth since World War I, as the government’s housing agency predicted that a 286,000 plunge in housing demand over the next five years would trigger a trend of falling rents.

A decline in net overseas migration in this year and the next will drive the sharp fall in net household formation — which is the key driver of demand for homes — according to the National Housing Finance and Investment Corporation.

As a key source of demand for new housing evaporates, NHFIC’s inaugural State of the Nation’s Housing report forecasts dwelling supply will outstrip demand in this and the next two calendar years, peaking with an oversupply of 126,700 dwellings in 2021.

Demand would then again exceed supply from 2023 onwards.

Rental growth after inflation will decline by 0.1 per cent this year before falling in real terms by 2.1 per cent in 2021, 1.8 per cent in 2022, and 0.7 per cent in 2023.

NHFIC estimates rents will be flat in 2024 before recording growth of 0.4 per cent in 2025.

The pandemic is set to break a long-term trend of rising rents that has created an increasing issue for those who don’t own their own home, particularly households on lower incomes. Over the decade to 2020, rents increased by 20 per cent — well above wages growth — whereas falling interest rates contributed to a 15 per cent drop in average mortgage repayments.

While the dynamics of supply and demand will lead to a recalibration of rents, overbuilding will not have the same depressing effect on house prices, NHFIC says.

Property values will prove more resilient thanks to the sharp fall in borrowing costs this year and the better-than-expected economic rebound, which has further buoyed sentiment. And the report also warns that “despite falls in rental prices, particularly for inner city dwellings in Sydney and Melbourne, it does not necessarily mean dwellings will become more affordable for all renters”.

“This is because one of the drivers of the demand shock has been a disproportionate loss of employment in industries where workers were more likely to be renting.”

Australian Bureau of Statistics data shows that between March and October there was a 17 per cent plunge in hospitality jobs, while 13 per cent of arts and recreation jobs were also lost.

The NHFIC report quotes survey figures that show 63 per cent of rental households lost employment or income in October as a result of the COVID-19 recession.

In the two biggest east coast capitals, where the drop in demand from segments such as international students is most acute, overbuilding will peak next year at more that 42,000 dwellings in Melbourne and almost 37,000 dwellings in Sydney.

“In inner-city areas of Sydney and Melbourne, a blend of back-logged rental listings, reduced demand and the economic downturn will most likely result in downward pressure on rents,” the report says.

“But the economic hit to jobs will to some degree offset some of the improvement in affordability. In markets like Perth, rising rents, low levels of supply and low wage growth will see upward pressure on rental affordability.”

There will also be modest oversupply in Brisbane between 2020 and 2022, but the report notes that “the Brisbane market seems relatively resilient compared to Sydney and Melbourne in response to the demand shock, mainly because it is less reliant upon international students in the longer-term rental market”.

Beyond the coming few years, the pandemic is not expected to create a structural improvement in rental affordability. With demand set to outstrip supply again by the middle of the decade, the lagged response from the construction sector means “the affordability of rental accommodation could deteriorate over the longer term”.

“A lower period of housing demand due to the global pandemic presents an opportunity to reset policy frameworks to ensure that actual planning policies can accommodate future population growth without adverse consequences for affordability,” the report says.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout