Regulators plot tactics to tame property boom

The banking regulator is preparing a suite of measures to take the heat out of the runaway property market and rein in the financial risks posed by high-debt loans.

The banking regulator is preparing a suite of measures to take the heat out of the runaway property market and rein in the financial risks posed by growing numbers of home buyers taking out high-debt loans.

In the clearest sign yet that regulators are preparing to intervene to curb overborrowing and reduce the risk of a housing market meltdown, minutes from last Friday’s quarterly meeting of the Council of Financial Regulators revealed members “discussed possible macroprudential policy responses” and tasked the Australian Prudential Regulation Authority with putting together a “framework” of potential measures.

The peak co-ordinating body for the country’s financial regulators – which is chaired by Reserve Bank governor Philip Lowe and includes senior officials from the APRA, the Australian Securities and Investments Commission, the Australian Competition & Consumer Commission and Treasury – were “mindful that a period of credit growth materially outpacing growth in household income would add to the medium-term risks facing the economy, notwithstanding that lending standards remain sound”.

Josh Frydenberg attended last week’s CFR meeting for the first time since the height of the Covid crisis in mid-2020, when regulators, the RBA and the Morrison government were working closely together to co-ordinate a national response to the pandemic.

The Treasurer on Wednesday morning said regulators continued to “deliberate” on what lending rules could be imposed, but noted that any interventions would not have an impact on the vast majority of future borrowers. “What we do know is that the investors or the first-home buyers, or others who may be affected by this will be a very small proportion of the overall market,” he said.

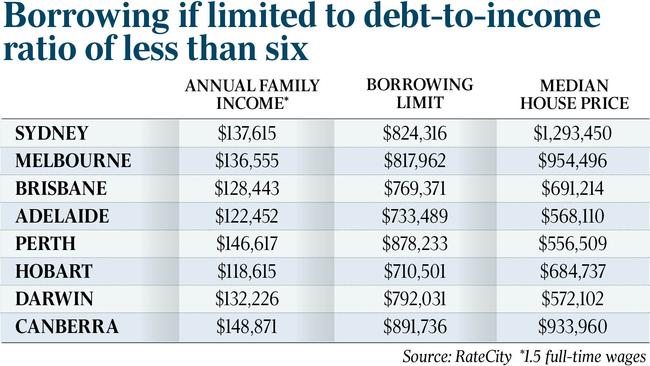

Officials have been flagging that the climbing number of mortgages made at more than six times the borrower’s income will be the key focus of any potential intervention.

Just under 22 per cent of new mortgages in the June quarter were at debt-to-income ratios above six versus 16 per cent a year before, according to APRA. About $34.2bn in loans written over the three months to June were to those borrowing more than six times their income.

Two individuals on a full-time median wage of about $90,000, at a DTI ratio of six, could jointly borrow up to nearly $1.1m.

The minutes from the CFR meeting noted that “recent lockdowns have reduced transactions and new listings, but prices are still rising briskly in most markets”.

Moreover, “commitments for new housing loans remain at a high level, suggesting that credit growth is likely to remain relatively strong”, the minutes read. “Against this background, the council discussed possible macroprudential policy responses.”

The minutes also revealed that “over the next couple of months, APRA also plans to publish an information paper on its framework for implementing macroprudential policy” and that the regulator would “continue to consult with the council on the implementation of any particular measure”.

Mr Frydenberg said Australia’s experience of climbing house prices during the pandemic was not unique in a global context, and acting now to rein in potential financial stability risks stemming from the property market “means less is required later”.

“Historically low rates are fuelling higher house prices, and what has been pleasing to see is that owner-occupiers and first-home buyers have been coming into the market in greater numbers than we have seen in previous cycles,” he said.

“We’ve also got to be conscious of the balance between credit growth and income growth, and … of future risks building up in the system.

“That is why APRA is looking very closely, the RBA is looking very closely, at what particular levers they have at their disposal to ensure we maintain stability in our housing market.”

Jarden chief economist Carlos Cacho said the Treasurer’s presence at the meeting signalled regulators believed the need to cool the hot property market had become more urgent.

He said he expected an announcement early next year on rules that would restrict but not totally end the flow of new lending in excess of six times the borrower’s income, a ratio previously identified by APRA as the threshold for heightened risk.

CBA head of Australian economics Gareth Aird agreed that the regulator was “almost certainly going to do something” to take the heat out of the property market.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout