Rebuilding a truly dynamic economy absolutely essential to the recovery

We can think of the response to the pandemic in terms of the phases of response, recover, and thrive.

The reality is that these phases are intertwined and deal with the short term as well as longer-term impacts on the economy, and cyclical versus structural elements of the economy.

The tragic reality of the pandemic is clear for all to see: around one million Australians have lost their jobs or dropped out of the labour market, while small and medium-sized businesses, with their higher fixed costs, smaller cash reserves and barriers to lending, are barely keeping their heads above water.

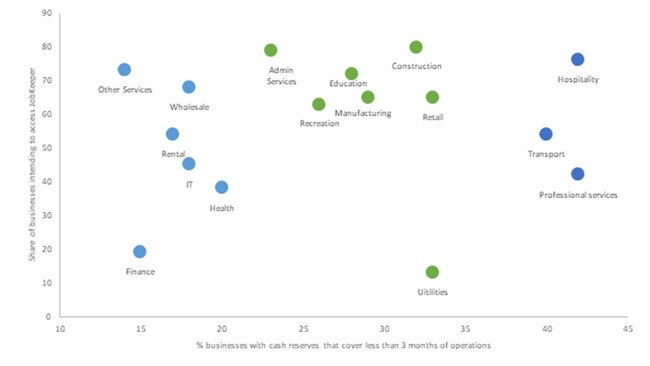

Indeed, the latest ABS Business Indicators survey observes that nearly 30 per cent of small businesses have cash on hand to support operations for less than three months.

Many larger businesses, with deeper pockets and better access to capital, have taken drastic actions to stay afloat, and some sectors have really copped it in the neck.

But the first-round impact of COVID-19 has now given way to the second-round impacts where sectors and business less exposed to the immediate effects of the pandemic are now facing the consequences of lower growth, lowered consumption, lowered investment and confidence laid waste in the economy.

Our own analysis suggests that one in five businesses are now vulnerable to the economic cliff approaching in September.

Using ABS and federal government data, we estimate around 240,000 businesses in the hospitality, professional services, and transport industries are at high risk of failure come September.

Around 40 per cent of businesses in these three industries have indicated their cash reserves can cover less than three months of operations in the current environment.

All told, that’s nearly 10 per cent of all Australian businesses at risk of going under.

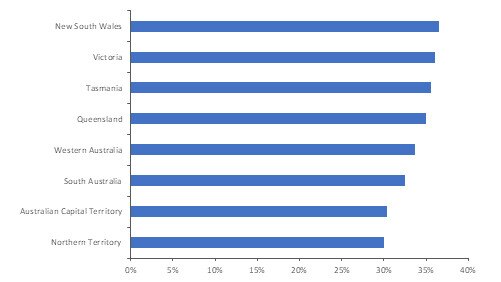

Governments and central banks, including our own RBA, have acted quickly and well. Fiscal stimulus has flowed, and our own analysis places the Australian economy in a better position over the next 12 months than we envisaged a few months back. But the prognosis is still not that great — just not as bad as we thought.

As this stop-start recovery takes hold, the competitive landscape of the Australian economy is shifting. Those with means, particularly larger businesses, are well placed to take advantage and increase market share.

Remember, though, this is occurring in an economy which was already dominated, in most sectors, but a few large firms. “Oligopolistic” is how economists have described the economy.

As we shift our thinking to recovery and thriving, we need to pay close attention to this structural characteristic of the economy.

Economies and consumers do well when there are more businesses out there vying for attention and simply keeping prices more affordable.

Moreover, the entry of new firms means that consumers stand the best chance of someone catering to their needs — innovating firms creating more bespoke goods and services to satisfy needs.

This dynamism, from innovation and competition, is critical to the welfare of all Australians.

As we think about how our economy thrives, we must critically assess the growing calls for homegrown champions, for bringing all supply chains back home — onshoring, they call it now — and for industry development, against how they drive innovation and competition in different sectors and different markets in Australia.

To do otherwise is to give in to the jingoism of nationalism which comes with economic consequences that don’t suit a small open economy like ours which has undeniably benefited from globalisation.

With foreign investment, trade and immigration all sidelined by the current pandemic, how we set our economy up to thrive is severely constrained.

Our policymakers and regulators, as they navigate the response and recovery phases of the economy, must have this dynamism in mind as we generate the policy settings for Australia to thrive.

Already, the pandemic is wreaking structural havoc on the Australian economy and placing many businesses, especially small and medium-sized ones, at risk.

We owe it to the economic welfare of all Australians to think about our future through the prism of dynamism — innovation and competition sitting alongside each other.

Dr Pradeep Philip is head of Deloitte Access Economics. Kristian Kolding leads the Macroeconomic practice in Deloitte Access Economics.

While much attention is, rightly, being paid to the health efforts to suppress the pandemic and the future of JobKeeper and JobSeeker, less attention has been paid to the dynamism of the economy and the importance of innovation and competition as the effects of COVID-19 have structurally battered the economy.