RBA tipped to forecast full employment in two years

Reserve Bank governor Philip Lowe is expected to reveal updated forecasts showing Australia will reach full employment in two years’ time.

Reserve Bank governor Philip Lowe is expected to reveal updated forecasts showing Australia will reach full employment in two years’ time, but he is unlikely to budge from his view that rates will stay at virtually zero until 2024 “at the earliest”.

Ahead of Tuesday’s RBA board meeting, economists said they expected no change in monetary policy settings, but that the accompanying statement would outline a sharply upgraded economic outlook, to be revealed in full in Friday’s statement on monetary policy.

Improving economic prospects are likely to reassure potential homebuyers, who pushed national house prices up another 1.8 per cent in April, according to CoreLogic figures. The new data showed home values were up 6.8 per cent over the three months, and 10 per cent since September. Over the year, prices climbed by 7.8 per cent — 6.4 per cent in the capital cities, and 13 per cent in the regions.

Still, there were signs the property boom that has followed the worst recession in a century was slowing: prices climbed 2.8 per cent in March, which was the fastest monthly pace in three decades.

Citi economist Josh Williamson expected national property prices to jump 15 per cent this year, before growth sharply slows to just 1.5 per cent next year.

“With wages growth unlikely to rise meaningfully, and interest rates not expected to move lower, we believe affordability has peaked and it will likely worsen in the coming months,” Mr Williamson said.

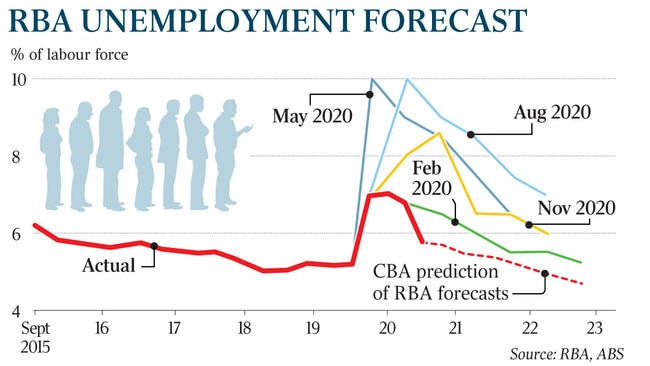

ANZ head of Australian economics David Plank expected the Reserve Bank’s updated outlook would show the jobless rate dropping to 4.5 per cent by June 2023, compared to the RBA’s February forecast of 5.25 per cent.

CBA tipped the RBA would forecast unemployment to drop to 4.75 per cent by mid-2023. This would be at the bottom end of Treasury’s recent estimate that unemployment needs to fall to 4.5-5 per cent in order to produce a meaningful lift in wages, and therefore inflation. Dr Lowe has said it many need to fall towards 4 per cent.

Josh Frydenberg has said next Tuesday’s budget will be aimed at entrenching the recovery into a durable expansion, and has put achieving an unemployment rate of below 5 per cent at the heart of the Morrison government’s fiscal strategy.

But Mr Plank said he expected the central bank’s economists would not upgrade its inflation forecasts of 1.75 per cent over the same time frame, as wages growth would likely be forecast to be only 2.25 per cent by June 2023 — “still well below where it needs the figure to be to get inflation sustainably in the target zone”.

There was further evidence on Monday that the labour market had maintained its solid momentum post-JobKeeper, after ANZ figures showed job advertisements rose for the 11th consecutive month in April. The data showed a 4.7 per cent rise to 196,612, or 28 per cent higher than in January last year before the pandemic struck. The proportion of job ads to the labour force is at 1.4 per cent, the highest since late 2011.

ANZ senior economist Catherine Birch said it was not surprising job ads had risen again in April as “businesses looking to hire new workers are, on the whole, unlikely to be those that were heavily dependent on the JobKeeper payment”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout