RBA sees risks and rewards in Chinese yuan’s rise

Australia can expect more trade in the yuan as China moves to liberalise its currency, says a report from the Reserve Bank.

Australia could expect to see more trade in the yuan as the Chinese government moves to liberalise its currency, according to a report from the Reserve Bank.

But it also warns that increased regional capital flows, as a result of the liberalisation of the yuan, could present “possible financial stability challenges” for Australia if capital flows became more volatile.

A paper in the RBA’s latest Bulletin, released last week, estimates there is now a pool of yuan deposits in Australia of between $4 billion and $8bn.

The paper, by Callan Windsor and David Halperin from the RBA’s international department, says there has been a steady increase in the share of Australia’s merchandise trade with China invoiced in yuan, although this has been from a low base.

The authors estimate that about 2.5 per cent or $1.5bn of Australia’s imports from China are invoiced in yuan while only 0.5 per cent, or $600 million, of the nation’s exports are invoiced in yuan. While China is Australia’s largest trading partner, Australia’s use of the Chinese currency in trade has been relatively low compared with other countries.

Some exporters, such as iron ore companies, preferring to continue to trade in US dollars.

To date, less than 1.5 per cent of Australia’s total trade with China is invoiced in yuan, the report says. It adds that Chinese authorities began serious moves to liberalise the currency from 2009 with a number of measures designed to encourage more trading in yuan. But it notes that in more recent times, the focus on liberalisation has been overtaken by attention to other government policies such as addressing concerns about too much borrowing in the financial system.

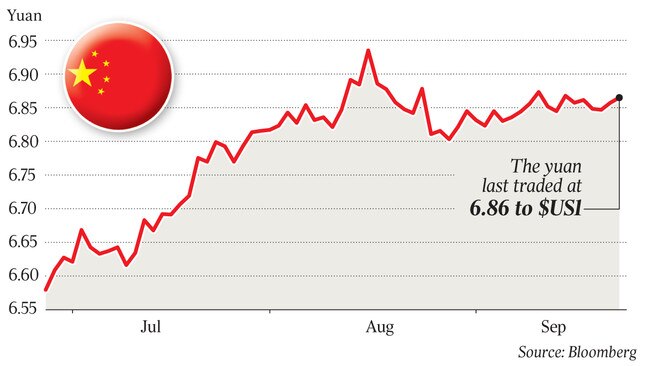

Chinese authorities have moved to intervene in the currency market to head off unwanted forces for its appreciation, and more recently with the impact of the trade wars with the US — forces for depreciation.

“If China continues to gradually open up the capital account and move towards a more flexible exchange rate, the second phase of internationalisation could see the yuan emerge as a widely used regional currency in Asia,” the RBA paper says.

“As a small open economy, with an already liberalised capital account, Australia will also likely attract an increased volume of financial flows from China. A more internationalised yuan could see it feature somewhat more prominently in Australian economic and financial transactions.”

It says that this would mean Australia would benefit from greater access to capital from offshore, but warns that it could also have some “possible financial stability challenges” in the medium term if the volatility of capital flows increased.

The report says Asia, particularly East Asia, could become the “natural habitat” for the yuan “to develop into a widely used international currency”.

China’s Belt and Road Initiative is also likely to become an “important driver” of yuan usage in Asia, it says.

“Strong participation by Chinese companies in the construction of Belt and Road projects will increase demand for yuan trade settlements, further promoting two-way yuan flows through the current account,” the report says.

The currencies of large commodity exporters, such as Australia, are now likely to respond to news from China in the same ways as the yuan, it says.

“Any news that affects the relative price of the yuan now also affects the relative price of the Australian and New Zealand dollars in a way that is commensurate with the large weight of yuan in their currency baskets,” it says. The first phase of liberalising the currency, from 2009 to 2015, “served as a catalyst for important financial reforms in China”.

“These reforms have allowed market forces to play a more decisive role in the allocation of resources in the economy, and further opened up China to the rest of the world,” the report says.

If the next phase of liberalisation sees a much larger use of the Chinese currency in the Asian region, it would “significantly increase direct financial linkages between the Asian region and China”.

The Chinese yuan bypassed the Australian dollar as the world’s fifth most traded currency some years ago. It has held fifth position for the past few years, coming in behind the US dollar, euro, British pound and Japanese yen, according to a recent report from currency transfer specialist SWIFT.

The Australian dollar has ranked eighth in world currency trading — behind the yuan, Canadian dollar and Hong Kong dollar.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout