RBA says low rates will stay even if housing bubble returns

The Reserve Bank is rejecting suggestions it should be keeping the heat out of the housing market.

The Reserve Bank has rejected suggestions it should be keeping the heat out of the housing market as it pours billions of dollars into quantitative efforts to keep the cash rate low and turn around the nation’s economic retreat.

As housing prices have started to recover from COVID-linked hit to the economy, Reserve Bank governor Philip Lowe signalled ultra-low interest rates would stay in place even if a housing bubble started to return.

The combination of strong federal and state government stimulus designed to buoy the housing market and low interest rates have already helped to push prices into positive territory in all capital cities last month.

Speaking at a parliamentary economics committee meeting in Canberra, Dr Lowe said the aim of the bank in lowering borrowing cost was to “free up cashflow” for households to spend.

“It would be inappropriate for us to target asset prices,” Dr Lowe said.

“That’s not our job and shouldn’t be our job. What the monetary system can do is influence the average level of prices of goods and services.”

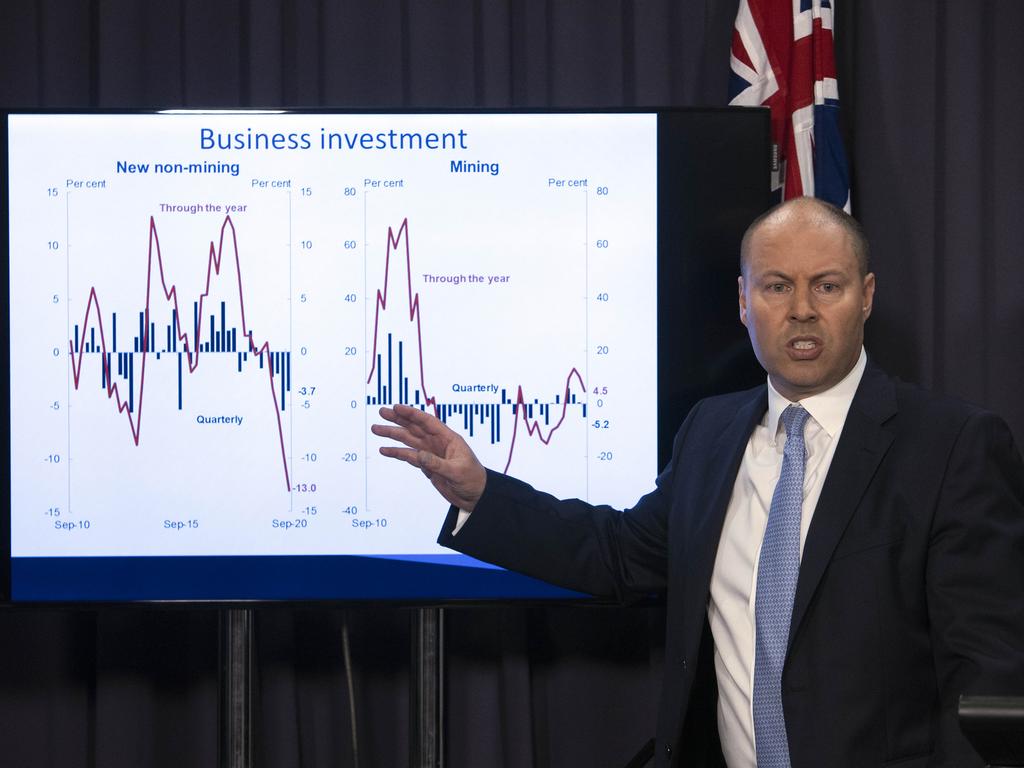

His comments came as GDP figures released on Wednesday revealed Australia had emerged from the grips of the COVID-19 recession on the back unprecedented fiscal and monetary support. The economy grew 3.3 per cent over the three months to the end of September, ABS figures showed. This was better than the 2.5 per cent most economists had expected and partly reversed the 7 per cent drop in the second quarter.

Dr Lowe said it was clear property prices would rise on the back of record low rates.

“That shouldn’t surprise us. Lower interest rates do mean higher house prices, that’s part of the transmission mechanism,” he said.

Bank bosses have already reported a surge in demand for housing loans, on the combination of the recent round of interest rate cuts, pent-up demand and growing consumer confidence.

The major banks have in recent weeks been revising their expectations for house prices, given dire scenarios for unemployment and COVID-19 infections have not played out.

Meanwhile latest house price modelling from data firm SQM Research has forecast that residential property prices could rise as much as 9 per cent next year if COVID-19 remains contained in Australia.

SQM managing director Louis Christopher believes the addition of the upcoming changes to responsible lending laws and improving consumer confidence will cause house prices to rise a further 5-9 per cent over the course of next year.

Perth is tipped to be the best-performing capital city, followed closely by Sydney and Adelaide.

CoreLogic figures released this week showed home values were well on the path to recovery across many areas of Australia last month.

It was the second consecutive month of price rises — from 0.4 per cent in Sydney and 0.7 per cent in Melbourne, to 1.9 per cent in Darwin and Canberra, according to the figures.

Still, Dr Lowe said the RBA was witnessing an uneven shift in prices across regions and markets.

“Apartment prices are still falling. Rents are falling, that’s good for renters,” he said. “People are choosing where they can to live in houses during the COVID times. It does appear that the trend is towards higher house prices.”

But the current trajectory of the housing market, once again on the march as the broader economy improves, is likely to remain constrained, according to Dr Lowe.

He said as long as population growth remained low it was “hard to see a shift in house prices”.

“At the moment I’m not particularly concerned about housing prices rising too dramatically, largely due to population growth dynamics,” he said.

“Sydney and Melbourne have been most affected by the rapid slowdown in population.”

Population growth fell 1.4 per cent in March as the pandemic closed in.

The budget papers revealed the government was expecting population growth to slide to its lowest levels since 1942, with projections for NSW’s population to decline by 2000 people. Victoria’s population is projected to only grow by 13,000 people in the 2021 financial year and 30,000 in 2022.

But GDP figures out on Wednesday revealed the pandemic downturn had proved shorter and shallower, with the nation returning to growth.

The positive September quarter growth figures, on the back of the Melbourne lockdown, take the year-to-date GDP growth to a fall of 3.8 per cent.

NAB chief economist Alan Oster said the latest GDP figures were “a big kickback”, but the economy was still likely to fall short of pre-pandemic GDP until at least the end of next year.

“If you just took 2019 and assumed the virus didn’t happen and the economy would grow 2 per cent, you’d be at 2025-26 before you caught up,” Mr Oster said.

“You can get back to the same level, but you can’t get back to where you would have been were it not for the virus.”

Dr Lowe said support from the government to bridge the viral hit was key to ensuring Australia did not suffer a significant economic contraction.

“In the current environment the biggest stability risks is a protracted period of high unemployment rather than borrowing.”