There no longer appears to be any point in keeping fire power in reserve, with the central bank set to deploy quantitative easing (QE) to lower government bond yields and put downward pressure on the Australian dollar.

A big rally in the Australian dollar could further crunch the resource-rich economy which is going through its first recession in nearly 30 years, and dash hopes of a rebound in the badly battered job market.

In recent weeks, Australia’s 10-year government bond yields have risen — among the highest in the world — which has worried the RBA.

The central bank has judged that the increase was probably due to the fact that the RBA has yet to roll out a QE program.

Even if Australian government bond yields are just 20 basis points above their US counterparts, it could be enough to fuel stronger buying of the Australian dollar.

With the federal government’s big spending 2020-21 budget published earlier this month, a path has been cleared for the RBA to do more.

There seems little reason to wait.

While RBA governor Philip Lowe told an investment conference last week that no decision had been locked in by the bank’s board, he stressed that it was important for policymakers to do what “we reasonably can” to support job growth. That means doing things like cutting interest rates further, even if it is of marginal benefit.

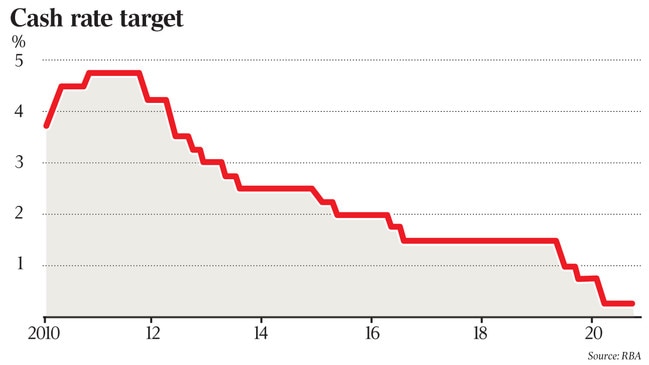

The RBA is expected to lower the official cash rate from 0.25 per cent now to 0.10 per cent, with the three-year government bond target to be cut similarly.

The RBA has the option of doing a drip feed of measures over the coming months, but a bigger bang approach at its Melbourne Cup Day meeting in November looks far more likely.

Dr Lowe will also likely remind markets that even after announcing more stimulus in November, the central bank will always have the option of increasing the size of its bond buying program over time, if needed.

So be careful not to conclude that the RBA is spent. However, it is unlikely to embrace the option of negative interest rates.

There is no love for it at the RBA.

The RBA has held back some of its firepower over recent months in part because it didn’t think it would get policy traction due to massive upheavals in the economy like forced lockdown of firms and the closure of borders. But now, as the economy is showing early signs of a return to a version of normalcy, there is increased reason for more monetary stimulus.

The RBA will also publish new forecasts for GDP growth and inflation a few days after its policy meeting on November 3, which are likely to flesh out its reasons for delivering further easing.

James Glynn is a Sydney-based senior economics reporter with The Wall Street Journal

The Reserve Bank may go all in at its policy meeting next month and is likely to cut its official cash rate to near zero, lower its target for three-year government bond yields, and announce a substantial quantitative easing program for the first time in its history.