RBA predicts real wage cuts until 2023, despite accelerating pay growth

Workers will suffer real wage cuts until global inflationary pulse from the Ukraine war and supply chain woes ease, despite accelerating pay growth.

Unions are demanding the government support the case for a higher minimum wage while employers warn against unaffordable pay claims after the Reserve Bank predicted real wages would go backwards until late 2023.

The RBA’s quarterly updated outlook, contained in Friday’s statement on monetary policy, includes the radical upgrade to the bank’s inflation forecasts that underpinned Tuesday’s rate hike to 0.35 per cent – the first increase since November 2010.

The RBA predicted consumer price growth would peak at nearly 6 per cent by December, from 5.1 per cent over the year to March, before easing to 3 per cent as the global inflationary pulse from the Ukraine war and Covid supply chain issues eased through 2023.

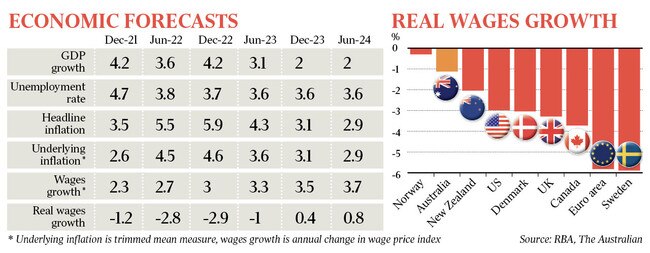

The RBA’s new outlook shows strong growth this year, slowing sharply next year as fiscal and monetary support withdraws.

“A strong expansion in the Australian economy is under way and inflation will increase further,” the statement reads. “The unemployment rate is forecast to decline to around 3.5 per cent in early 2023 – the lowest level since 1974 – and remain around this level thereafter.”

The tighter labour market would push pay higher, from 2.3 per cent in 2021 to 3 per cent this year and 3.5 per cent in 2023. But real wages would drop by as much as 3 per cent this year, and only lift by 0.4 per cent at the end of next year.

Josh Frydenberg said the RBA outlook now showed wages were set to grow at their fastest pace in a decade. “We know families are doing it tough and that is why we implemented a targeted, temporary and responsible cost of living package in the budget,” he said.

KPMG chief economist Brendan Rynne said: “We are going to see an erosion of living standards in the next two years.”

He said the forecast return to positive real wages growth by the end of 2023 wouldn’t be enough to recuperate the fall in workers’ real purchasing power through the pandemic and its aftermath.

Melbourne University professor Jeff Borland said: “It’s clear that real wages are declining – the key question is when will that reverse.” Professor Borland, one of the country’s top labour market economists, said inertia in the wage-setting process helped explain the subdued lift in wages, despite unemployment heading to its lowest in almost 50 years and a record level of job vacancies.

The RBA statement noted that “real wages have fallen significantly in advanced economies over the past year”. “This has reduced household purchasing power and contributed to sizeable declines in consumer confidence over recent months,” the statement reads.

Despite this, the RBA forecasts consumption growth will remain strong through this year and the next, an upbeat outlook Dr Rynne said represented households running down the $240bn savings buffer built up in the pandemic.

ACTU secretary Sally McManus said the latest RBA outlook showed workers were set to endure 21 months of consecutive real wage cuts, and called on the government to support a pay rise for those on the minimum wage.

“The Morrison government could be standing up for the wages of working people by supporting a pay rise for a quarter of all working people in the annual wage review, or supporting the wage case being run by aged-care workers,” Ms McManus said.

However, Australian Chamber of Commerce and Industry chief executive Andrew McKellar warned it was “critical that we take a more cautious approach to lifting wages”.

“The Reserve Bank’s statement raises concerns that inflation could rise even further over the forecast period if excessive wage increases are sought without achieving productivity gains,” Mr McKellar said.

“Narrowing margins means businesses are already being forced to pass on higher costs to consumers. Aggressive wages growth will only spur further inflation growth.”

Australian Industry Group chief executive Innes Willox said the RBA’s statement anticipated the continuation of moderate wages growth and for further inroads to be made into unemployment and underemployment.

“This would be a very positive outcome for Australia, (but) the bank also clearly points to the risk that the path of additional jobs creation could be closed off by excessive wages growth,” he said.

The SOMP confirmed that the RBA’s board “is committed to doing what is necessary to ensure that inflation in Australia returns to target over time”, and that “this will require a further lift in interest rates over the period ahead”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout