RBA flags end of certainty with automation and competition to hit workers

Australia has entered an uncertain chapter of its economic history, the Reserve Bank governor has declared.

Australia has entered an uncertain chapter of its economic history, marked by meagre wage growth, intense global competition among retailers, high household debt and elevated house prices, the Reserve Bank governor has declared.

In a speech in Sydney last night, Philip Lowe said automation and growing competition from foreign workers were sapping workers’ wages — now growing at their slowest pace in 50 years — and dragging down prices in ways that had confounded the Reserve Bank’s economists.

“We are still trying to understand this,” Dr Lowe conceded, revealing confusion at the top of the nation’s peak economic establishment that has already enveloped its counterparts in Europe and the US.

“In the past, the pressure of competition from globalisation and from technology was felt most acutely in the manufacturing industry. Now these same forces of competition are being felt in an increasingly wide range of services industries.

“Not only are wage increases low, but some people had been moving out of high-paying jobs associated with the mining sector into lower-paying jobs.”

Dr Lowe said cutting income tax wasn’t a solution to lower wage growth, but could be pursued for “other reasons”.

The governor said Western Australia and Queensland had shaken off their post-mining-boom torpor and were enjoying jobs growth almost as strong as in the southeastern states, which had been buoyed by a debt-fuelled housing construction boom.

“It’s time to open a new chapter in Australia’s economic history,” Dr Lowe said at the annual dinner of Australian Business Economists.

He suggested the oft-remarked “transition” era was over. “It’s time to move to a new narrative,” he said.

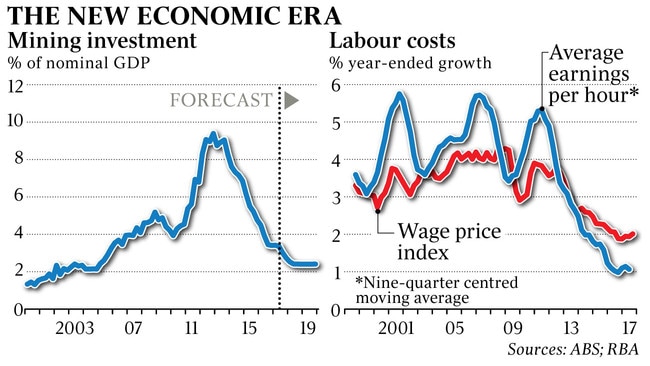

Dr Lowe highlighted how mining investment’s share of GDP had fallen back to about where it was before the boom began about a decade ago, and investment by non-mining firms was, finally, starting to pick up the slack.

“A gentle upswing does seem to be taking place and the forward indicators suggest it will continue,” he said.

Dr Lowe said conventional indicators of economic activity — GDP and the unemployment rate — were still expected to improve slightly over the next couple of years, broadly in line with government forecasts. But Australia appeared to be poised to face the same conundrum the US, Britain and other advanced countries were facing: strong jobs growth and falling unemployment alongside weak or falling wage growth.

“The normal tendency for firms to pay higher wages in tight labour markets appears to be muted,” Dr Lowe said.

Dr Lowe pointed out that, unlike in the US and Britain, Australia’s unemployment rate had not yet fallen below 5 per cent, which is considered “full employment”, at which point wages are supposed to start accelerating.

The Turnbull government, which is counting on a sharp rebound in wage growth by 2020 from record low levels to propel the budget back to surplus, and improve its political standing, is unlikely to cheer the governor’s remarks.

Since August, Treasurer Scott Morrison has been holding out hope for a wages revival.

The unemployment rate has fallen steadily this year, dropping to 5.4 per cent in October, the lowest for almost five years, but growth in average earnings per hour have tumbled from about 3 per cent to 1 per cent since then.

News last week that the Australian Bureau of Statistics’ wage price index rose only 2 per cent over the year to September — despite a 3.3 per cent rise in the minimum wage in July, affecting up to 2.3 million workers — set off a depreciation of the Australian dollar, which hit a five-month low of US75.3c yesterday.

“It is more likely that the next move in interest rates will be up, rather than down, but the continuing spare capacity in the economy and subdued outlook for inflation mean that there is not a strong case for a near-term adjustment,” Dr Lowe said. “The RBA has kept its official cash rate at a record low of 1.5 per cent since August 2016, with markets betting the next hike won’t occur until the end of next year.

“Low growth in wages means low inflation, which means low interest rates, which means high asset valuations.”

Dr Lowe noted house prices had dipped in Sydney but continued to outpace income growth in Melbourne where population growth was strong.

“To be clear, the RBA does not have a target for housing prices but a return to more sustainable growth in housing prices does reduce the medium-term risks,” he said. His remarks gave a tick to the banking regulator’s efforts to stifle growth in interest-only loans and lending for investment properties.

The RBA reiterated its concern the rising household-debt-to-income ratio, among the highest in the world, posed a risk to economic stability should consumers rein in spending.

Consumer inflation, which was 1.8 per cent over the year to September, is set to fall further when the December figures are released early next year, because the ABS will have updated the weights used to construct the CPI to take into account spending on cheaper goods and services.