RBA finger poised over the rate rise trigger if inflation rears its ugly head

The RBA has an uncomfortable decision to make at its August board meeting if Wednesday’s June quarterly inflation data exceeds its expectations.

The Reserve Bank will have an uncomfortable decision to make at its August board meeting if crucial inflation data for the June quarter exceeds its expectations on Wednesday.

Hotter than expected monthly inflation data in the past two months leads economists to expect the consumer price index for the June quarter to show inflation accelerated to 3.8 per cent from 3.6 per cent three months ago. Underlying “trimmed mean” inflation is expected to be stuck at 4.0 per cent.

The consensus forecast for underlying inflation exceeds the RBA’s forecasts of 3.8 per cent for the June quarter. Despite a 3.25 per cent increase in its cash rate target since May 2022, inflation remains well above the RBA’s 2 to 3 per cent inflation target.

Headline inflation has been above the RBA’s target every quarter since mid-2021. Bad based on the RBA’s forecasts, it’s expected to remain there until the end of 2025 – four-and-a-half years in total.

If inflation stops falling, the RBA may see no choice but to lift interest rates again to stop a rise in inflation expectations that could become self-fulfilling via wage demands, potentially necessitating even higher interest rates than would have been needed if the RBA had acted pre-emptively.

In the minutes of its most recent meeting, the RBA board said: “Raising the cash rate at this meeting could be appropriate if members formed the view that policy settings were not sufficiently restrictive to return inflation to target within a reasonable time frame.

“This could be the case if it was judged that inflation was returning to target more slowly than previously assumed or that the gap between aggregate demand and aggregate supply was not closing quickly enough.”

Deutsche Bank Australia chief economist Phil Odonaghoe thinks that cracks are already emerging in the RBA’s narrative that inflation expectations “remain consistent with the inflation target”.

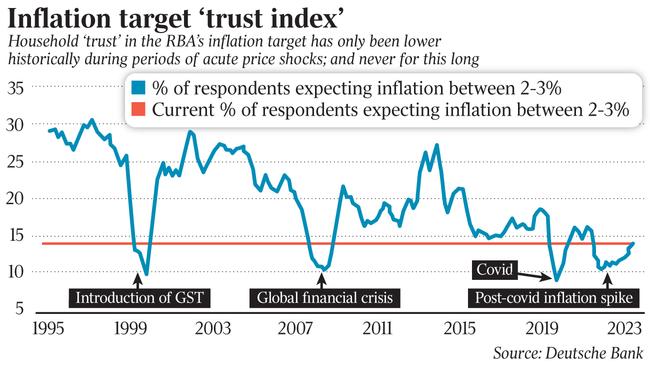

Trust in the RBA’s inflation target has “never been this low for this long”, he says.

Odonaghoe is one of six financial markets economists expecting the RBA to raise rates in August.

Money market pricing implies only a one in five chance of a rate increase at the RBA’s August 5-6 meeting. Rate rise pricing peaks at an almost one-in-four chance at the November RBA meeting.

A full interest rate cut of 25 basis points isn’t fully expected by the money market until May 2025.

Odonaghoe says the public’s trust in the RBA’s inflation target since it was introduced in 1993 explains why inflation expectations were “relatively well anchored” after inflation spiked in 2022.

Before the target was started in 1993, there was a large positive gap between inflation expectations and actual inflation outcomes. Between 1973 and 1993 the average gap was 3.4 percentage points.

In other words, the data suggests that in the absence of a transparent ‘anchor’ for inflation, consumers incorporated an “uncertainty premium” into their thinking about the inflation outlook.

To the extent that this was reflected in the behaviour of price and wage setters, it goes a long way to help explain why the level of inflation was noticeably higher in this first phase than in the second.

Moreover, a “structural shift” in the relationship between expected and actual inflation emerged with the introduction of the 2-3 per cent target in 1993. From 1993 to 2024 the average gap between expected inflation and actual inflation was 1.7 percentage points – half as large as in the pre-inflation-target era.

The March quarter of 2022 was the first time in 20 years when household inflation expectations, as measured by the Melbourne institute, were below headline inflation.

“The upshot is that households appear to have developed a level of trust in the RBA’s inflation target, likely driven by a combination of public commentary highlighting the target as well actual inflation outcomes that have also been broadly consistent with the target,” Odonaghoe says.

This faith in the inflation target appears to have allowed the RBA to draw on something akin to an inflation target “dividend” – it didn’t need to lift rates even higher to control inflation expectations.

Household inflation expectations are relatively contained and “declined notably from their mid-2022 peak”. But to the extent this reflects a measure of “trust” in the RBA’s inflation target, any evidence of weakening in that trust takes on extra significance, Odonaghoe says.

According to the Melbourne Institute’s monthly household inflation expectations survey, the proportion of respondents expecting inflation to be back inside the 2-3 per cent target range has only been this low in periods of acute price shocks and never for as long as in the current episode.

Deutsche Bank’s Inflation Expectations Index shows that after a trend decline, inflation expectations fell slightly in the June quarter after trending down since the March quarter of 2023.

“If that continues over the second half of the year, the RBA’s willingness to tolerate above-target inflation outcomes until the end of 2025 could prove costly,” Odonaghoe says.

“As it navigates the ‘narrow path’ back to target, the bank has repeatedly made clear it is alert to the risk that inflation expectations could decouple from the inflation target.

“We continue to think the RBA will lift the cash rate by 25 basis points at its upcoming meeting in August based on stronger-than-expected inflation outcomes in the first half of 2024.”

But while long-term government bond yields may shoot up if the inflation data exceeds market estimates yet the RBA doesn’t respond by lifting interest rates, it would not be compelled to hike.

“We wouldn’t expect an inflation result in line with our forecasts of 3.9 per cent for both measures to result in RBA tightening, especially given the move higher in the unemployment rate over the past year, sustained weak economic growth, low consumer confidence and deteriorating business conditions,” says ANZ head of Australian economics Adam Boyton.

As to what number might cause the RBA to tighten, he says there is “no automatic outcome”.

“A 4.1 per cent trimmed mean and headline CPI would be an uncomfortable outcome and present the RBA board with a difficult judgment call, but it doesn’t preclude the staff forecasts showing a credible path back to target by 2026,” Boynton says.

Morgans Financial chief economist Michael Knox says his model explaining 89 per cent of monthly variation in the cash rate target since 1990 shows the recent rebound in inflation is “not yet sufficient to generate the need for a rise in rates”.

His model also shows the outlook for inflation is more sensitive after the unemployment rate hit a 50-year lows around 4.5 per cent in recent years and it is “far more likely” that unemployment will go above 5 per cent in 2025, lowering inflation and precluding the need for another rate rise.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout