Rate cuts to go on despite jobless drop

A ‘temporary’ drop in the jobless rate will give the Reserve Bank room to breathe before any further cuts to the official cash rate.

A “temporary” drop in the jobless rate will give the Reserve Bank room to breathe before any further cuts to the official cash rate.

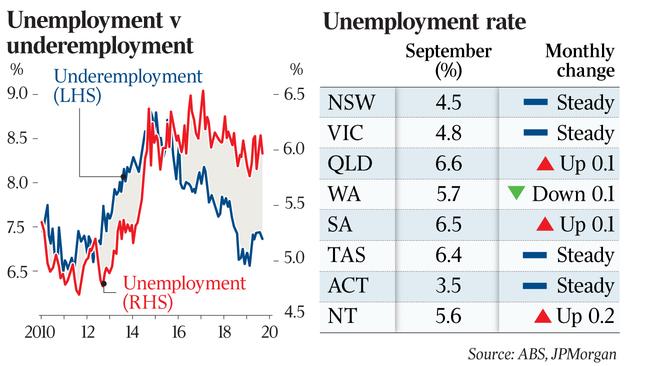

A drop in the number of Australians employed or looking for work, from 66.2 to 66.1 per cent, drove the unexpected decline in the jobless rate from 5.3 per cent in August to 5.2 per cent in September. Economists said that lessened the chances of a second straight RBA rate cut in November.

But a slowing of the overall rate of jobs growth led most analysts to conclude that the slight fall in unemployment — which is still well above the central bank’s target of 4.5 per cent — would not be enough to derail moves to lower the cash rate below its record low level of 0.75 per cent.

Capital Economics analyst Marcel Thieliant said “it won’t be long” before unemployment starts to rise again, which would trigger fresh RBA rate cuts.

“Employment surveys point to jobs growth slowing to around 2 per cent by early next year and falling job vacancies suggest that the slowdown could be even more pronounced,” he said. “While job advertisements haven’t fallen much further in recent months, they still point to an unemployment rate of around 5.5 per cent.”

According to the Australian Bureau of Statistics, the number of employed Australians rose by a net 14,700 to 12.93 million during the month, with a 26,200 increase in people with full-time work and an 11,400 decrease in people with part-time work.

Jobs Minister Michaelia Cash said the figures “underscore the continued strength and resilience” of the local labour market.

“Employment has increased every month for the last three years,’’ Senator Cash said.

“This is the greatest number of consecutive monthly increases in employment recorded since the inception of the monthly labour force series in February 1978.’’

The female jobless rate fell from 5.2 per cent to a decade low of 5 per cent. However, the male jobless rate rose from 5.3 per cent to 5.4 per cent.

CommSec chief economist Craig James said the fall in the headline unemployment rate was “just what the doctor ordered”.

“More jobs being created with a jobless rate going south rather than north. Fewer people are unemployed,” Mr James said. “Employment has grown for three straight years. That is something worth celebrating.”

Unemployment has been one of the main factors suppressing wage growth, consumption and inflation, with the result that the Reserve Bank has cut the cash rate three times in the past five months.

Westpac economist Simon Murray said the 8.3 per cent underemployment rate — which measures workers who can’t get enough hours or are in unsuitable work — was still “quite high” and was evidence of broader labour market weakness.

“We think this month’s modest decline in the unemployment rate will be temporary and emphasise we are still a long way away from the RBA’s full employment aim of 4.5 per cent,” he said. “It does, however, allow the RBA some more time to monitor the economy before having to act again.”

This week the International Monetary Fund’s World Economic Outlook cut its growth forecast for the Australian economy from 2.1 to 1.7 per cent — a level below the government’s and the Reserve Bank’s forecasts of about 2.25 per cent. The downgrade in Australia’s growth forecast was twice the global downgrade, and the IMF called on governments to loosen their purse strings to bolster their flailing economies.

The Reserve Bank has sliced the official cash rate three times this year to a record low of 0.75 per cent in a bid to drive unemployment lower amid sluggish economic growth.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout