Property boom boosts household wealth by $500bn: ABS

A booming property market has helped add another half a trillion dollars to Australia’s household wealth, taking the total to just over $12 trillion.

A booming property market has helped add another half a trillion dollars to Australia’s household wealth, taking the total to just over $12 trillion.

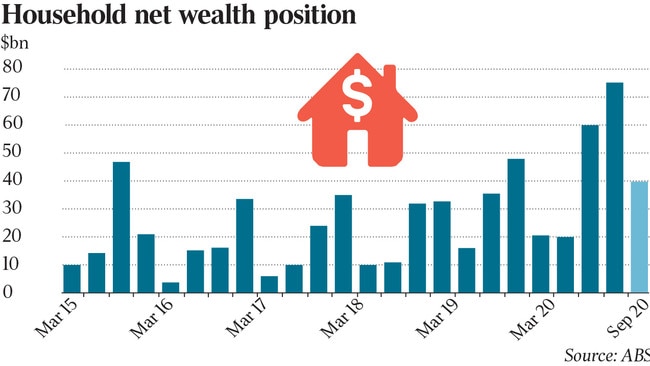

The nation recorded its biggest gain in quarterly wealth since 2009 despite COVID-19 concerns and employment fears when JobKeeper ends.

According to the Australian Bureau of Statistics, total household wealth increased 4.3 per cent, or $501.5bn, in the last three months of the year, marking the highest quarterly growth rate since the December quarter of 2009.

This puts total household wealth and wealth per capita at record levels of $12.03 trillion and $467,709.

As anyone who has recently bid on a house will know, the red hot property market — lifting city prices as well as those in regional and rural Australia — was a key driver increasing the wealth of Australians in the December quarter.

During the quarter, residential assets grew by $246.5bn, or 3.5 per cent, the biggest rise since the December quarter of 2016, reflecting increased housing market activity over the quarter.

That leap came on top of a $200bn-plus rise in house values for the September quarter.

The ABS said that property prices contributed 3.1 percentage points to growth in residential assets.

Household residential assets were worth $7.37 trillion at the end of 2020.

ABS head of finance and wealth Katherine Keenan said the December quarter growth in household wealth was driven by rising residential property prices, reflecting record low interest rates, support through government programs such as the First Home Buyer and the HomeBuilder schemes, and pent-up demand from buyers.

“The growth in residential assets was seen across both owner-occupier and investor housing in the December quarter.

“Owner-occupier housing loans grew 1.9 per cent, which was the strongest growth seen in four years, while investor housing loans grew 0.4 per cent, which was the first positive growth recorded in the past two years,” Ms Keenan said.

The housing debt to income ratio decreased from 139.2 to 139 over the quarter, as growth in income (1.2 per cent) exceeded growth in housing debt (1 per cent). The ratio has fallen for the past four quarters, recording a 2.5 per cent decline through the year, the largest fall since 1990.

Income was boosted by government income support packages implemented in response to the COVID-19 pandemic, including JobKeeper and the Coronavirus Supplement.

With the continued recovery of onshore and overseas financial markets, non-financial corporations increased their holdings of equity.

There was an $18bn increase in share and other equity investments and a $9.9bn increase in deposits.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout