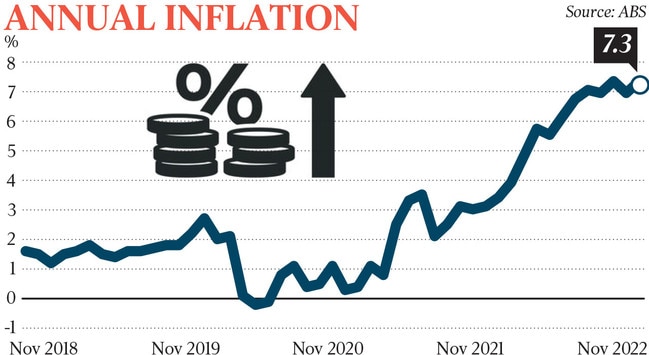

November inflation jump to 7.4 per cent fuels RBA rate rise expectations

Consumers spent more on housing, food and transport in November, leaving inflation at levels well above the Reserve Bank’s 2-3 per cent target.

November inflation data, released on Wednesday, has rekindled expectations of further interest rate increases.

The official monthly CPI data showed stronger-than-expected increases in headline and core inflation for November, to levels that remain well above the Reserve Bank’s 2-3 per cent target band.

The Australian Bureau of Statistics said the newly-created monthly CPI – which excludes about 40 per cent of price categories in the longstanding quarterly CPI basket – rose 7.3 per cent over the year, exceeding a consensus estimate of 7.2 per cent.

Trimmed mean CPI – which excludes some volatile items – rose 5.6 per cent.

The most significant contributors to the annual rise in November were housing, food & non-alcoholic beverages, transport, furniture, household equipment & services and recreation & culture.

“High labour and material costs contributed to the annual rise in new dwelling prices, although, the rate of price growth for new dwellings has eased compared to the 20.4 per cent annual rise seen in October,” said Michelle Marquardt, ABS’ head of prices statistics.

Bond yields and the Australian dollar rose after the CPI data and the concurrent release of November retail sales showing 1.4 per cent rise on-month versus an expected 0.6 per cent increase.

The 3-year Australian Commonwealth Government bond yield rose 8 basis points to 3.41 per cent, and the Australian dollar rose 0.3 per cent to US69.10c.

Shares pushed higher, the S&P/ASX 200 index rising 1 per cent to a four-week high of 7202 points.

Goldman Sachs Australia chief economist Andrew Boak said that while the monthly data should be interpreted with caution, the November rebound supported the argument that underlying inflation in Australia remains well above the RBA’s target and will require further rate hikes.

But AMP Capital senior economist Diana Mousina said inflation is tracking in line with expectations.

“The RBA is forecasting 8 per cent headline CPI for the December quarter and we expect a lower peak of around 7.5 per cent,” she said. “Based on the monthly CPI figures, there are no signs that inflation is going to be higher than forecast.”

“Goods prices are moderating as global supply chain issues have improved considerably, and as interest rate hikes will continue to slow demand for discretionary consumer goods, commodity prices have tumbled compared to a year, housing-related costs are moderating with newly advertised rents for houses slowly trending down, and Australian wage indicators continue to indicate wages growth oscillating between 3-4 per cent in annual terms.”

But ANZ senior economist Adelaide Timbrell said the CPI data “reduces any risk of a pause in February for the RBA and reinforces our view that the peak cash rate will be at least 3.85 per cent.”

The RBA has hiked rates from 0.1 per cent to 3.1 per cent since May 2022 to curb inflation.

Federal Treasurer Jim Chalmers said data showed “the pinch being felt by Australian households.”

“The November result doesn’t fully include the latest energy prices that are a direct result of nine months of Russian aggression and nine years of Coalition incompetence,” he added.

“There is also uncertainty around the impacts of ongoing flooding that continues to devastate communities across the country.”

“Even after inflation peaks in our economy, we need to remain vigilant to the global economic pressures that will continue to impact us for some time to come.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout