Next interest rates move still up: RBA

The RBA has kicked off 2019 by keeping the cash rate on hold and signalling it still believes the next move in rates will be up.

Australia’s central bank kicked off 2019 by keeping the official cash rate on hold and, while trimming its forecasts for economic growth and inflation, the Reserve Bank remained sufficiently optimistic to signal that it still believes the next move in rates will be up.

After its first policy-setting meeting since December, the RBA left its cash rate on hold at a record low 1.5 per cent yesterday. The cash rate has not been adjusted since August 2016.

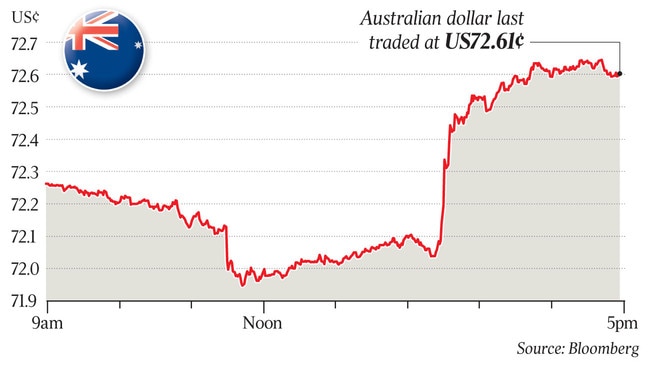

But the dollar surged more than half a US cent to US72.65c as the RBA indicated it would not be slashing its economic forecasts any time soon, despite recent concern about the global economy and financial markets, as well as plunging house prices and disappointing growth in Australia.

The market yesterday was unwinding the chance of a cut that had been priced in by year end.

But economists doubted the RBA would be able to lift rates for the next two years. “With these revised forecasts, the RBA is clearly less comfortable with its previous positive outlook,” said Bill Evans, chief economist at Westpac.

“With our forecasts of 2.6 per cent growth in 2019 and 2020, it still seems that the more likely outcome will be for steady rates, even if as we expect the RBA will eventually have to adopt growth forecasts much closer to Westpac’s current view.”

Westpac has long forecast that the RBA cash rate will remain on hold this year and next.

Ahead of Friday’s quarterly Statement on Monetary Policy, when the bank’s exact economic forecasts will be revealed, governor Philip Lowe will be grilled on his economic and policy views when he delivers a lunchtime speech today on “The Year Ahead” at the National Press Club in Sydney.

Following the meeting of the central bank’s board yesterday, Dr Lowe said “further progress in reducing unemployment and having inflation return to target is expected”, although this progress was “likely to be gradual.

“Taking account of the available information, the board judged that holding the stance of monetary policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time,” Dr Lowe said, repeating the line used in recent months.

Acknowledging weaker global economic data since the December board meeting, Dr Lowe said the outlook for global growth “remains reasonable, although downside risks have increased”.

Global financial conditions “remain accommodative” despite a tightening late last year as financial risk assets fell before a partial recovery, and “market participants no longer expect a further tightening of monetary policy in the United States”, Dr Lowe said.

He also said the RBA now expected the Australian economy to grow by “around 3 per cent” this year and “by a little less in 2020” due to slower growth in exports of resources.

The new forecasts compared with the RBA’s previous forecasts of 3.25 per cent and 3 per cent respectively, but were still above its estimate of the trend or “potential” growth of 2.75 per cent.

And Dr Lowe said the RBA remained upbeat on employment, saying the unemployment rate was expected to fall to 4.75 per cent “over the next couple of years”, from 5 per cent recently.

Previously, unemployment was expected to hit 4.75 per cent by mid-next year, suggesting it could take six months longer, but Dr Lowe maintained that this should result in some further lift in wages growth.

Significantly, he said the RBA continued to expect underlying inflation to pick up over the next couple of years, although it was “likely to be gradual and take a little longer than earlier expected”.

The RBA trimmed its underlying inflation forecast to 2 per cent for 2019, versus 2.25 per cent previously forecast, while still expecting it to hit 2.25 per cent in 2020.

Although it said headline inflation was expected to fall in the near term because of lower petrol prices, its core inflation forecasts were still inside its 2-3 per cent target band.

Combined with its above-trend growth forecasts, this implies the bank still has a mild tightening bias.

The RBA’s upbeat commentary comes despite growing gloom around the economy, with the nation in the midst of the biggest fall in house prices since the global financial crisis a decade ago. Recent surveys of business conditions show firms growing more concerned about the outlook for profits and trading conditions.

Earlier yesterday, data showed consumer spending was much weaker than expected in December, with retail sales falling over the month, adding to fears that soft wages growth and sliding house prices have put a brake on spending.

Retail sales fell by 0.4 per cent compared with November, and rose by just 0.1 per cent in the fourth quarter, according to the Australian Bureau of Statistics.

After cutting the cash rate to 1.5 per cent in August 2016 to support growth after a decade-long mining investment boom, the RBA has kept rates unchanged for a record 30 months.

Low rates helped fuel an unprecedented housing boom that has now peaked after macroprudential controls were implemented to curb risky lending, with accelerating falls in prices, finance and auction clearance rates.

The controls come after other central banks backed away from plans to tighten monetary policy.

The US Federal Reserve last week said that in light of global economic and financial developments and muted inflation pressures, it would be patient as it determined what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.

Similarly, last month the European Central Bank formally changing its risk outlook from balanced in December to downside risk from a combination of geopolitics, protectionism and global factors.

Additional reporting: James Glynn