NAB business survey: post-election confidence proves short-lived

A post-election bounce in business confidence was short-lived despite interest rate cuts.

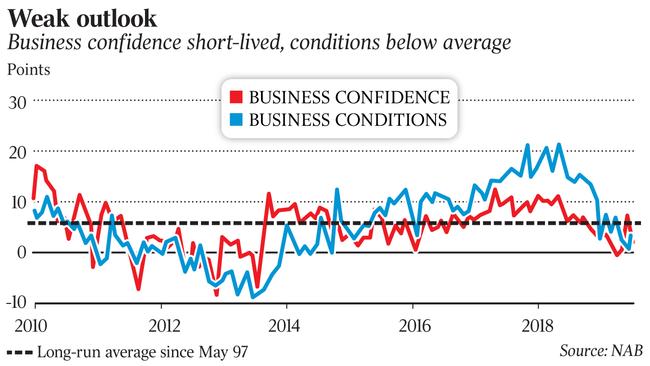

A post-election bounce in business confidence was short-lived despite the start of official interest rate cuts last month.

In a blow for the newly re-elected Morrison government, which will maintain the pressure for further easing of monetary and fiscal policy, NAB’s monthly business survey showed confidence fell five points to +2 for June, after rising seven points after the federal election in May. Business conditions rose two points amid improvements in the trading and employment subindexes, but remained below average, at +3.

Forward orders remain below average at -4, suggesting a near-term improvement in business activity is unlikely, NAB said.

“Business confidence appears to have unwound its spike in May, which we think was driven by a short-term election bounce and increased optimism around a renewed interest rate easing cycle by the RBA,” NAB chief economist Alan Oster said. “While business conditions increased slightly in the month, they remain well below average after trending lower for over a year now.

‘‘The decrease in conditions has been relatively broad-based across states and industries — suggesting that there has been sector-wide loss of momentum over the past year.”

After flagging the potential for renewed interest rate cuts in May — following a sharp slowdown in economic growth since mid-2018 and a persistent undershoot of its inflation target — the Reserve Bank cut interest rates in June, its first move since 2016. The RBA eased again last week, lowering the overnight cash rate target to a record low of 1 per cent.

NAB said recent data suggested the economy was unlikely to record a significant pick-up in growth for the second quarter. “Forward looking indicators suggest there is unlikely to be a material improvement in conditions over the next few months with forward orders remaining very weak,” Mr Oster said.

“This suggests the pipeline of demand is weak and is consistent with below-average confidence.”

Survey measures of inflationary pressure were also weak in June, with output price growth remaining low and retail prices showing a decline in the month. Still, capacity utilisation increased sharply in June, with a number of industries experiencing an improvement.

“Two positives in the month were employment and capacity utilisation,” Mr Oster said.

“The employment index rebounded to be well above average and is important in the context of the outlook for the labour market.

‘‘For now, labour market developments appear to be the key driver of monetary policy, with weak wage growth seeing both slower household income growth and weak inflationary pressure.

“Both a tighter labour market and higher capacity utilisation would see inflation pressures build — so we will continue to watch to see if the improvement in these measures is sustained.”

ANZ economist Catherine Birch said that while “mixed”, the report “doesn’t provide the ‘smoking gun’ the RBA needs to ease in August”.

In a statement last month, the RBA said: “The board will continue to monitor developments in the labour market closely and adjust monetary policy if needed to support sustainable growth in the economy and the achievement of the inflation target over time.”

JPMorgan senior economist Ben Jarman said the labour market-related components of the NAB survey were more positive.

“If these results can hold, it would suggest tentative signs of stabilisation in the labour market owing to prospective policy support and perhaps political factors post-election, arresting the upward impulse to the unemployment rate of recent months,” he said. “It is early days to call this, and for the capacity utilisation gains to appear more durable, trading conditions need to do better in the second half of the year.”