Mortgage jitters ahead of RBA’s call on interest rates

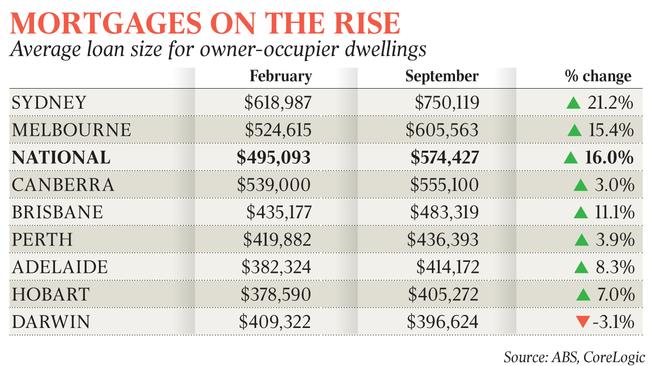

The average size of a new Sydney mortgage has pushed past $750,000, heightening the risk for borrowers if the Reserve Bank begins lifting interest rates.

The average size of a new mortgage in Sydney has pushed past $750,000, heightening the risk of borrowers being left overextended from any decision by the Reserve Bank to begin lifting interest rates sooner than initially forecast.

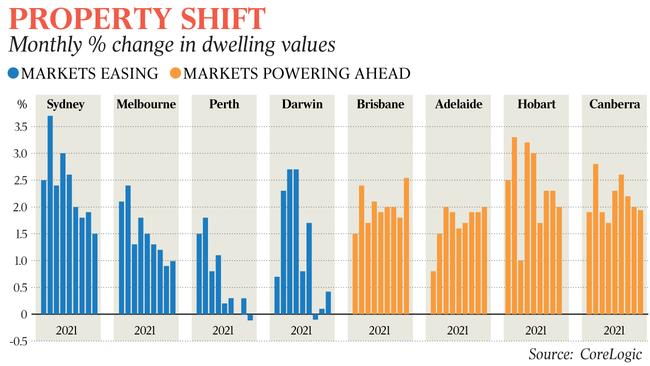

The borrowing figures came as CoreLogic data showed dwelling values climbed by 1.5 per cent in October across the capital cities, to be 21 per cent higher than a year earlier. Regional home prices added a further 1.9 per cent last month, to be up 24 per cent on a year before.

As banks from Monday applied a higher mandatory interest rate buffer on mortgage applications, CBA senior economist Belinda Allen said she expected property prices to climb by a further 7 per cent next year, but raised the prospect further lending curbs by regulators could lead to a weaker result.

“There are a number of moving pieces impacting the housing market at the moment,” Ms Allen said.

“Affordability issues and the prospects of higher interest rates are front of mind, as well as rising supply coming on to the market as lockdowns end.”

As home prices have climbed, Australians have taken advantage of record low borrowing rates through the pandemic to take on ever higher levels of debt.

In the country’s most expensive city, Sydney, dwelling prices have jumped 25 per cent to a median value approaching $1.1m, the CoreLogic figures showed.

Correspondingly, the average new owner-occupier loan size over roughly the same period jumped by 22 per cent to more than $750,000 in the NSW state capital, according to lending data released on Monday by the Australian Bureau of Statistics. Victoria recorded the next highest average new loan size, at $606,000.

The average new mortgage commitment in the ACT was $555,000, just below the national average of $574,000. The lowest average new loan size in September was in the NT and Tasmania, at about $400,000.

The peak in mortgage sizes comes as economists say the Reserve Bank will announce at Tuesday’s meeting that it now expects the cash rate will need to rise from its historic low of 0.1 per cent in 2023 – a year ahead of schedule. Economists predict the first hike since November 2010 – under former RBA governor Glenn Stevens – could happen by late next year.

The trigger to the change in expectations was consumer price data released last week that showed underlying inflation in the September quarter had breached the central bank’s 2-3 per cent target range – if only just – for the first time since 2015.

GSFM investment strategist Stephen Miller said by recasting its guidance around the timing of rate rises, monetary policymakers “will be acknowledging not only have they underestimated inflation, but also its persistence”.

NAB director of economics Tapas Strickland said he expected the cash rate to rise from mid-2023, hitting 1.75-2 per cent by the end of 2024. Mr Strickland estimated that the combined impact of climbing borrowing costs and stricter serviceability tests over that time frame could reduce borrowing capacity by 15-20 per cent.

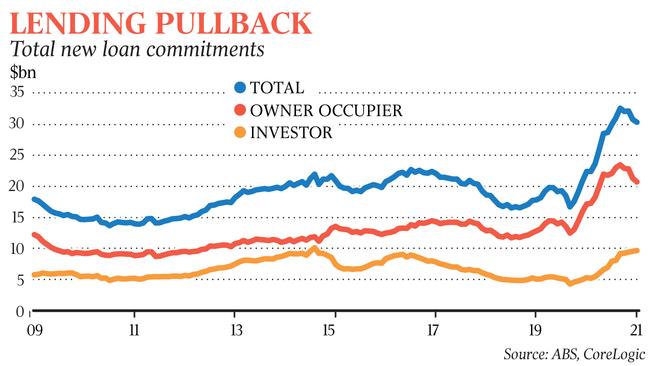

Even ahead of regulatory tightening and the threat of earlier rate rises, the frenetic pace of total new home borrowing had already slowed through 2021, the ABS lending data showed.

Total new housing commitments, excluding refinancing, fell by 1.4 per cent to $30.3bn in September. The decline in new home financing was led by a 2.7 per cent drop in owner-occupier lending to $20.7bn – the fourth straight monthly decline, but still nearly 50 per cent up on pre-Covid numbers, the ABS data showed.

New mortgage lending to Victorian owner-occupiers recorded an outsized 17 per cent drop in September as lockdowns stymied activity in the state, and NAB economists predicted a lift in housing activity into the end of the year as health restrictions ease.

In contrast, lending commitments to property speculators has grown for 12 straight months, rising a further 1.5 per cent in September to $9.6bn – just 5 per cent shy of the peak in April 2015, and 85 per cent above pre-Covid levels.

The value of new lending to first-home buyers fell by 1.9 per cent in the month, to be down by 23 per cent since the recent high in January 2021.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout