More jobs mean RBA to rethink cut

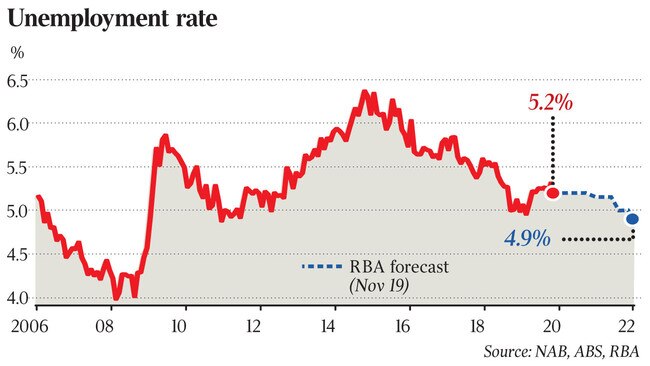

The jobless rate has ticked down to 5.2 per cent, marginally reducing the chance of an official interest rate cut in February.

The jobless rate has ticked down to 5.2 per cent, marginally reducing the chance of an official interest rate cut in February, when the Reserve Bank reconvenes after a summer break.

The economy created about 40,000 new jobs over the month to November, the ABS said on Thursday, around double what economists had expected and more than enough to offset a slide in jobs the previous month.

Josh Frydenberg welcomed the figures, which snapped an upward trend in the jobless rate that prompted the government to lift its forecast unemployment rate to 5.25 per cent.

“What is particularly pleasing leading into Christmas is the ongoing strength in female employment; 63 per cent of jobs created in the last 12 months have been taken up by women, and nine out of 10 of those have been full-time,” he said.

Unemployment fell to 5.2 per cent in November from 5.3 per cent in October, as a total of 39,900 jobs were added, above an expected rise of 15,000. Full-time employment grew by 4200, while part-time jobs rose by 35,700.

“The RBA cut three times this year with an unemployment rate in a 5.2 to 5.3 per cent zone, and shaky progress since then justifies further easing in February,” said JP Morgan economist Tom Kennedy, reflecting widespread expectations of a February cut.

“With the unemployment rate set to rise further, wage growth will probably keep softening and given that the RBA considers the current rate of wage growth too soft to meet its 2-3 per cent inflation target, it has still more work to do,” added Capital Economics’ Marcel Theiliant.

The better jobless figures follow three interest rate cuts and a reduction in income tax mid-year. The RBA left its official cash rate on hold at a record low 0.75 per cent this month, signalling it would wait until its February meeting to sift the economic data and review its overall stance.

RBA board member Ian Harper said this week a lot of stimulus was building in the economy as mortgage interest rates fell and the dollar weakened, and here was a risk the economy would have become overstimulated if the RBA had rushed to cut further in recent months, he said.

The drop in unemployment comes as global uncertainty looks set to ease, with Brexit more likely in the wake of UK elections and the US and China appearing closer on a trade deal.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout