Coronavirus: Mobile data unmasks Melbourne’s Covid crisis

Lockdown 2.0 and the requirement to wear a mask have rendered Melbourne a ghost town, while data shows Sydney is beginning to return to normal.

Lockdown 2.0 and the requirement to wear a mask have rendered Melbourne a ghost town, with mobile location data showing foot traffic in key hubs of economic activity continues to plummet while movement in Sydney begins to return to normal.

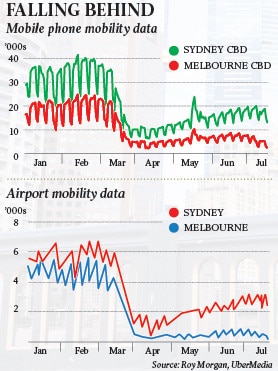

Mobile phone location data collected by UberMedia and Roy Morgan shows that when the initial coronavirus lockdown occurred across Australia in late March, the number of unique visitors to Melbourne and Sydney CBDs collapsed by 70 and 60 per cent respectively as the country was urged to work from home.

As restrictions gradually lifted over May and June, foot traffic in Sydney’s CBD recovered to 55 per cent of pre-COVID and continues to slowly lift.

Foot traffic in Melbourne recovered to about 50 per cent before plunging to 35 per cent of normal levels once lockdown was imposed over the Melbourne and Mitchell Shire area in July, and continues to trend downwards.

Foot traffic in other key areas like Flinders Street station has seen further sustained drops as Melburnians eschew public transport, with the number of unique visitors dropping by almost 90 per cent compared to March, while Chadstone shopping centre saw visitor numbers almost recover to early March levels as the country emerged from lockdown before again plummeting at the start of July.

Roy Morgan CEO Michele Levine said that while Sydney continued its return to normality, Melburnians will become more housebound, with the requirement to wear a mask in a public place and the diagnosis of 2310 cases of coronavirus in the last week alone making people worried. “What we have seen is that with the first lockdown, visitation to the city dropped and then it started to creep back up again and with the second lockdown, it dropped substantially, but not as far,” Ms Levine told The Australian, adding that Melburnians were initially “fatigued” over having to stay indoors.

“Coming in to work even in the second lockdown may have been a nice escape from working from home with kids … but now people are starting to get worried. People are finding it hard to work with a mask in the office. People are not finding it as much of an escape.

“When people had to wear masks, it kind of changed everything … Once we lift that requirement we will see people return, albeit slowly.”

If the lockdown 2.0 is extended beyond its initial six-week application period and foot traffic to economic hubs continues to decline, the economic impact will continue to mount.

Payroll data released on Tuesday showed Victoria shedding workers at twice the national rate as Melbourne moved into lockdown, with the number of payroll jobs falling by 1.4 per cent in the week to July 11, compared to a 0.6 per cent drop nationally.

The figures came as ANZ’s weekly consumer sentiment fell for a fifth straight week, to 89 points for the week of July 20. It was back below the global financial crisis trough, but above its March low.

NAB chief economist Alan Oster said that the six-week lockdown was already forecast to knock 1 per cent off Australia’s quarterly growth, and that the impact would only worsen the longer the lockdown lasted.

“What we’ve done is we’ve looked at our own internal data and what happened in the first lockdown, and we applied that same thing over a six week period,” Mr Oster said.

“In very simple terms, it says that the Victorian economy in the September quarter might shrink by 5 per cent.

“It’s about 20 per cent of Australia, therefore it takes 1 per cent off GDP in the third quarter for Australia in total.

“It gets progressively bigger the longer the lockdown lasts.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout