Mega super funds to dominate economy

Super will be dominated by mega-funds that will in turn dominate the Australian economy, Rice Warner predicts.

The superannuation industry will be dominated by a small number of megafunds with assets of more than $100bn, with industry leader Australian Super having $325bn in assets in five years’ time, according to a new report by actuaries Rice Warner.

The report comes as industry super funds, including the $150bn AustralianSuper, play a key role behind the scenes in working with the Westpac board in handling its response to the Austrac allegations.

Industry funds AustralianSuper, Cbus and Hostplus supported the Westpac board last week by voting against a spill of the board in the wake of shareholders’ “second strike” vote.

This followed tough talks in Melbourne two weeks ago, when the funds told chairman Lindsay Maxsted that chief executive Brian Hartzer had to go.

AustralianSuper is one of the largest Australian investors in Westpac, with a holding of $1.8bn.

The three industry funds are believed to be closely watching future developments at the bank, including a review of the events that led to the Austrac allegations and the appointment of a new chief executive and chairman.

The Rice Warner report predicts that the size of super funds will rise with increasing contributions and a new push for mergers.

The consulting firm’s latest Superannuation Market Projections report predicts assets in the superannuation industry will rise from the current $2.7 trillion to $7 trillion by 2034.

It predicts that by this time, the super industry will be dominated by more than a dozen megafunds with more than $200bn under management.

Within the next five years, it predicts the industry could be dominated by nine major super fund groups that together control assets of more than $1.7 trillion.

“Within five years, we can expect at least nine funds to exceed $100bn,” it says.

It sees the industry dominated by a merged QSuper and Sunsuper with assets of $350bn, AustralianSuper with assets of $325bn, AMP with assets of $200bn, a merged First State Super and VicSuper with $175bn and NAB and UniSuper with $150bn each.

It predicts that the assets of funds run by the Commonwealth Bank and BT will rise to $125bn each by 2024, with the combined IOOF and OnePath having assets of around $100bn.

Dominating the economy

The report predicts that the superannuation industry will dominate the Australian economy, exceeding the amount of assets held in the banking industry.

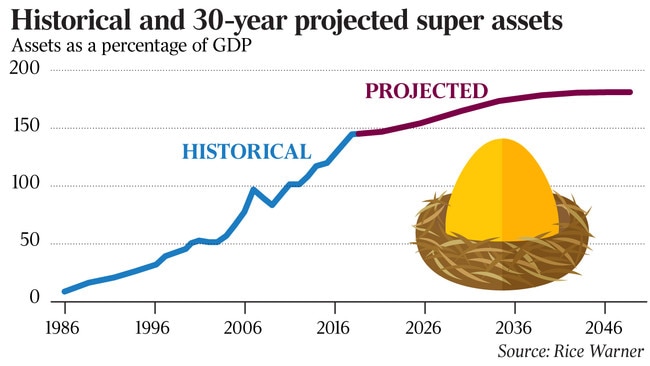

It estimates that superannuation will grow as a percentage of the Australian economy from just under 150 per cent now to 180 per cent by 2040, despite the fact that the retirement of the baby boomers can be expected to trigger an increased drawdown of funds in the retirement phase.

The report predicts that fund mergers and technological improvements will see the rise of a dozen megafunds with assets of $200bn in the next 10 years.

It forecasts that the growing size of super funds will see more investment outside Australia and in unlisted assets such as direct company ownership, property and infrastructure. But their growing size will also see the megafunds play a bigger role in the governance of major listed companies.

Rice Warner predicts that the growth of the super industry will be given a boost with the move towards mandatory super contributions of 12 per cent of wages from 2021, up from 9.5 per cent.

One of the biggest growth segments will be the MySuper low-cost default products, which Rice Warner believes will represent as much as 25 per cent of super funds assets by 2034.

The report predicts that the big super funds will move into other areas of financial services, which it says could see them required to hold more capital.

“Large funds are already innovative in moving into ownership of other financial services businesses, usually via private equity or venture capital,” it says.

“As these risks are borne by members, little capital is required at present. “However the process is not transparent and the structure is cumbersome.

“Hence it is likely that funds will need to hold more reserves as capital to back those activities.”

It predicts that the super funds industry will “evolve to be a more mature and sophisticated industry”, with increased investment in technology improving the service given to members.

Funds will set up businesses focusing on “retirement solutions” with specialised administration that can provide more tailored advice for retirees.

The report estimates that the retirement segment of the industry — assets held by people in retirement — will fall from 31.5 per cent to just under 30 per cent over the 15 years as increased pension payments are made to baby boomers who have moved into retirement.

It predicts that there will also be a run-off of some big self managed super funds.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout