Markets take stock after wild ride

Financial markets were calmer on Tuesday but investors remained cautious after some of the biggest falls in sharemarkets this year.

Financial markets were calmer but investors remained cautious after a wild ride on Monday when plunging iron ore prices, caution about US monetary policy and a potential collapse of China’s biggest property developer sparked some of the biggest falls in sharemarkets this year.

After diving 2.1 per cent on Monday, Australia’s sharemarket bounced strongly from a fresh four-month low as iron ore stabilised after a multi-month rout, US futures pointed to a further rebound on Wall Street, and shares of China Evergrande stalled after diving 85 per cent year to date.

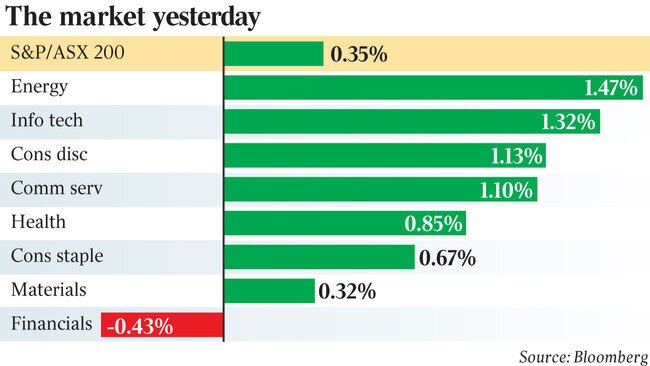

The S&P/ASX 200 closed up 0.4 per cent at 7273.8 points after falling 0.8 per cent to 7191.7 in early trade.

S&P 500 futures rose as much as 1.1 per cent in Asia-Pacific trading.

The US benchmark lost 1.7 per cent on Monday – its worst day in four months – but fought back from a 2.9 per cent intraday fall that briefly punctured its 100-day moving average.

A technical bounce was under way after the S&P 500 and the S&P/ASX 200 fell more than 5 per cent from their record highs and daily relative strength indicators hit the lowest points since March last year.

Singapore iron ore futures hovered around $93.50 a tonne after diving as much as 11.6 per cent to a 12-month low of $US90 a tonne on Monday amid reports that China ordered further cuts in steel production as part of its plan to curb pollution by capping output in 2021 at its 2020 level.

The dollar rose 0.3 per cent to US72.75c after hitting a four-week low of US72.2c.

As well as the outcome of numerous central bank meetings this week, including whether the Federal Reserve signals an intention to start tapering its bond buying when its meeting concludes at 4am AEST on Thursday, the iron ore market and events surrounding Evergrande will be key this week.

While the Australian market fared better than expected after such a big fall on Wall Street and brokers anticipated a deluge of money would flow back to the local sharemarket from more than $40bn of dividend payments from corporate Australia in September and October, the mood was cautious.

“With a massive amount of cash hitting investors’ accounts over the next two weeks, some will not be able to help themselves and throw some of that cash straight back into the market,” Bell Potter head of institutional sales and trading Richard Coppleson said.

“We know that September has a habit of being a bad month, but any event that occurs in September can easily mutate into something bigger.”

But while a disorderly collapse of Evergrande – which owes more than $US300bn ($415bn) – might be comparable to the Greek debt crisis or the Lehman Brothers collapse, both of which sent markets around the world into a spin, Beijing was expected to push for a restructure of its debt.

“Thursday is seen as a big day for the debt to be renegotiated short term – otherwise it’s an ugly collapse coming,” Mr Coppleson said. “They have an $US87m coupon payment due and the smart money is betting that that won’t happen, leaving many to ask what Beijing will do.

“Some go further and speculate that if Beijing lets this go you could see the Chinese property market collapse and commodities fall as well, but we have a long way before we get to that.”

China’s financial markets were due to resume trading on Wednesday after a two-day break.

Meanwhile Australia’s central bank backed a rise in Covid-19 vaccination rates and easing restrictions to restart economic growth in the December quarter after the prospect of a sharp contraction since mid-year led it to extend its bond-buying program this month.

Minutes from its September board meeting said there was “considerable uncertainty” about the timing and pace of the recovery, which was likely to be “slower than experienced earlier in 2021”.

“Much would depend on the health situation and the easing of restrictions on activity,” the RBA said.

It came amid reports that the NSW construction industry will be allowed to return to 100 per cent capacity next week, when authorities lift the limits in force on building sites. Victoria has announced a one-week shutdown of its construction industry over anti-vaccination riots.

The NSW construction sector was paused for two weeks in July as the state battled rising Covid-19 infections in the sector, and is yet to return to pre-pandemic levels of productivity.

“The outbreak of the Delta variant had interrupted the recovery in a manner that was more severe than expected a month earlier,” the RBA minutes said.

“While private demand had increased solidly in the June quarter, the spread of the Delta variant in NSW and Victoria had set back the recovery and created uneven conditions across states and industries.”

Gareth Aird, head of Australian economics at CBA, said: “NSW is expected to see a significant easing of restrictions from mid-October, which will be accompanied by a lift in spending and employment. Victoria is expected to follow suit a few weeks later but the lags between the official economic data and what is happening in the economy mean that the improvement won’t show up until December.”

Meanwhile, the RBA expects the economy to decline “materially” in the September quarter.

The minutes said the near-term outlook “resembled the downside scenario” in its August forecasts.

“Measures of population mobility in NSW and Victoria had declined to around the low levels reached during earlier lockdowns,” the RBA said.

“As in previous lockdowns, household consumption had been curtailed by reduced opportunities for households to spend.

“Dwelling and business investment were also likely to decline in the September quarter in response to restrictions in NSW and Victoria.”

Talks with business suggested restrictions affecting the construction industry “could delay activity for a period, with limited scope to make up for this in light of ongoing capacity constraints”.

Conditions in the established housing market “remained more robust” in recent months and have continued to rise strongly in most markets, albeit they have “slowed a little in Sydney and Melbourne” after rapid gains.

Consistent with the effect of the lockdowns on activity, the RBA said a further improvement in the labour market would be “delayed” but its business liaison suggested that “most firms did not expect the recent lockdowns to have a significant effect on wages growth in the year ahead”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout