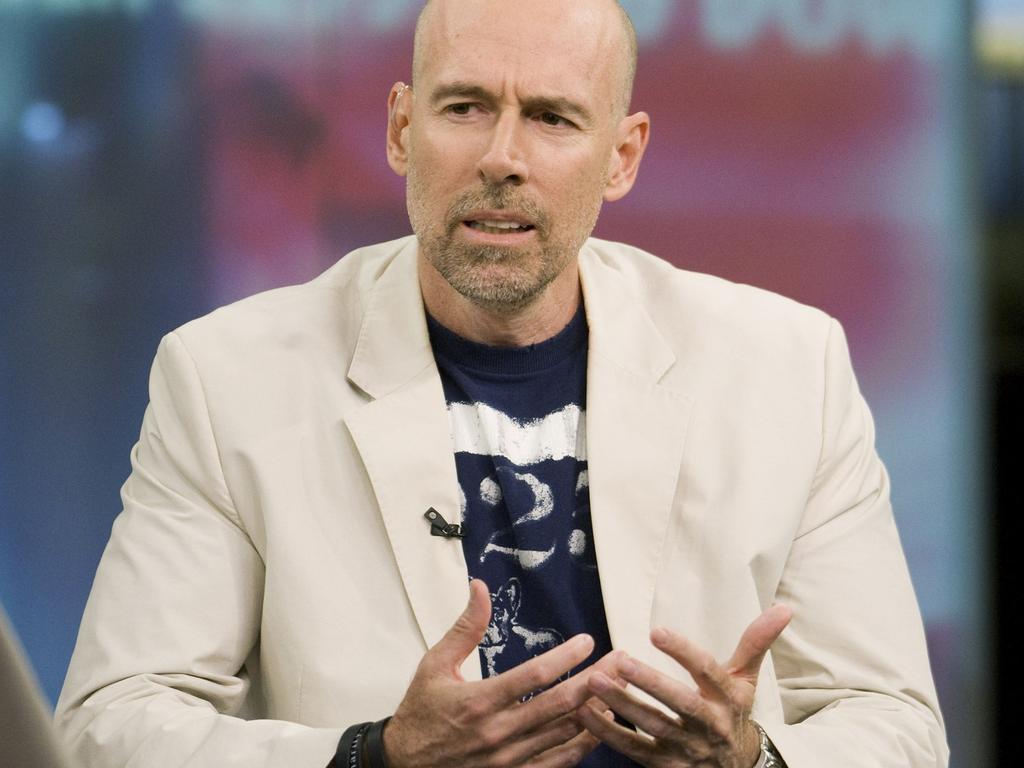

Ken Courtis: Trump is toast and market faces reality check with Biden

The chairman of Starfort Investment Holdings and former vice-chairman of Goldman Sachs Asia argues that three structural issues have been on the agenda for months, which make an election victory from Donald Trump on Tuesday extremely difficult.

“Trump is toast because his core electoral base is 1.5 per cent smaller relative to the overall US electorate today than it was in 2016. And in 2016 it was almost a lucky punch that he won — he won by really a sliver of votes.

“Secondly, there is no significant party here to drain votes off from the Democrats like there was in 2016. And thirdly, although Bernie Sanders, the progressives candidate in the Democratic primary, got shafted like he did last time, this time he very quickly fell in line behind Biden and brought his supporters along with him.

“I think it’s going to be ugly for the Republicans,” he adds, “because I think they also lose the House and the Senate.”

To Courtis, still an economist at heart, the election represents a watershed change in policy terms. He recalls how four decades ago, Federal Reserve governor Paul Volker’s mandate was to kill inflation, at any cost to the economy. A year later, a Reagan presidency delivered tax cuts and regulation cuts which together entrenched a neoliberal policy for three decades, until the crash of 2008.

“Today we have a central bank which is going in exactly the opposite direction, a central bank that wants to create inflation. And now we’re going to have a big spending government, that will announce the green new deal, a big COVID-19 spending program, they are going to increase taxes, they’re going to increase regulation, they are going to put a tax on incoming foreign investment.”

In the short term, he argues, the huge spending program will see a further boost to the sharemarket, but there will be a reality check for investors.

“After that you’ll have a significant rerating downward of the equity market as investors come to terms with the impact of the re-regulation and the much higher taxes,” he says.

Ken Courtis’s deep and rich career has included directorships on boards of Daimler, McKinsey, Emerson and Capitaland. Today Starfort is involved in three areas which give him a global insight into market forces and corporate strategy. The private equity business is focused on China.

“In February and March things fell off a cliff, but now our businesses are back to, say, 95 per cent of where they were in December.” By year’s end, Courtis expects a return to full strength.

The company’s global commodity trading business saw commodities fall but the trading side is buoyed by market volatility. “Our final business is a distressed debt or special situations business,” Courtis says. “And we have never ever seen more opportunity.”

Before lockdowns, Courtis almost passed himself in the air between New York, Tokyo and Paris, and then kicking tyres in the Middle East or more remote places like the “stans”. He has lived in Asia for more than 25 years. Like many close observers of the region, he sees the disciplined handling of the pandemic by China and neighbouring countries positioning them well strategically.

“Anyone who says they’re a China expert, that’s an oxymoron,” he prefaces. “The Chinese were caught with the pandemic in the first few months but in the interval they have taken no prisoners, they have been very aggressive in dealing with the pandemic. If you are in China today, you’ll find that the economy is almost back to normal. It will do 2.5 per cent growth this year, Vietnam 4 per cent, Taiwan has done a good job. Southeast Asia this year is an engine of the world economy.”

In contrast Europe is contracting and Japan, as Courtis puts it, is flat on its back.

The issue now facing both President Xi and an incoming Biden government, says Courtis, is building a new architecture so the countries can live with each other.

In the northern hemisphere, now in the grip of a second wave of COVID-19 and new nationwide lockdowns, the risk is in monetary policy: a shift by central bankers towards Modern Monetary Theory — helicopter money and negative rates.

“We are already seeing that,” says Courtis. “In a sense we have a ‘bank put’ on the world economy. And if the economy doesn’t restart, I can see central banks in Europe and America buying equities like the central bank in Japan buys. The central bank in Japan today is the biggest buyer of equities in the Japanese sharemarket.”

Courtis sees the rationale for aggressive priming of the economy with liquidity as an attempt to push inflation up to deal with the eye-watering debts amassed by governments.

“You inflate it away,” he says. “That is part of the game that we are going to start to see, and see over the next decade.”

His advice to investors? In the mid-term, they want to own hard assets. “Anything you can’t print, like prime beachfront property, vintage wine and gold. Because as they put more and more Australian and US dollars and euros in the market, relative to real assets, those currencies will fall.

“I wouldn’t be surprised if you see in addition, a 25 per cent to 35 per cent US dollar devaluation over this next four or five years, in part to deal with their chronic trade deficit.”

“Trump is toast.” That’s the blunt assessment of a man who has advised four former US presidents, Dr Ken Courtis. And he expects an incoming Biden administration to bring in both new regulation and new taxes which, after an initial sugar hit, will drive a rerating of the sharemarket.