Jobless rate of 5.2pc fails to reflect coronavirus damage

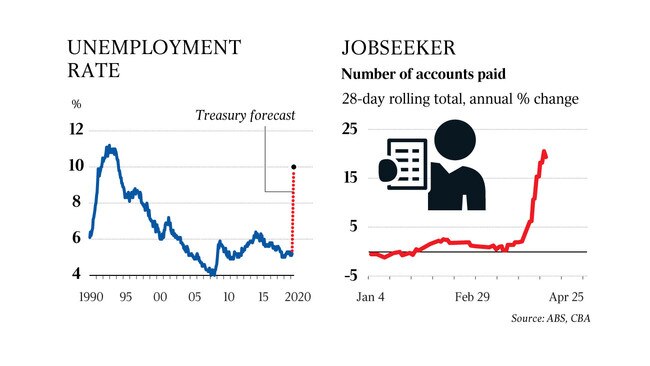

The official unemployment rate edged up to 5.2pc in March, but survey was too early to show Australia’s wave of COVID-19 job losses.

A 20 per cent spike in dole payments into Commonwealth Bank accounts has provided fresh evidence that enforced business closures and social isolation aimed at battling COVID-19 have triggered an unemployment tsunami.

The shocking figures from Australia’s biggest retail bank contrasted with official statistics, also released Thursday, which showed the labour market had been relatively untroubled in the first half of March, before the implementation of strict anti-virus restrictions from March 22.

The unemployment rate rose by 0.1 percentage point to 5.2 per cent, based on seasonally adjusted data from the Australian Bureau of Statistics.

Economists and policymakers were quick to note that the ABS release was outdated, and warned of worse to come.

“Forget March, April could see up to 900,000 job losses,” Citi chief economist Josh Williamson said.

Scott Morrison foreshadowed the difficult period ahead for many households.

The March jobless rate was “the best figure we will see for some time”, the Prime Minister said.

“We do need to prepare ourselves as a country for some very sobering news on the economic front in the months ahead.”

Treasury forecasts the jobless measure will peak at 10 per cent this year, with the unprecedented $130bn JobKeeper wage subsidy program likely to stave off an even more steep increase.

The highest jobless rate in the history of the labour data, which stretches back to 1978, was 11.2 per cent in November 1992.

CBA senior economist Belinda Allen said she expected a peak in the unemployment measure of 7.5 per cent in the June quarter, implying 575,000 job losses in the coming months.

Ms Allen said the government’s wage subsidy program would keep many attached to their work and out of dole queues, although it remained too early to tell exactly how many. She also predicted a falling rate of participation in the labour market – a double-edged sword which will flatter the jobless measure.

The CBA figures showed a 20 per cent increase in April in the number of accounts receiving JobSeeker payments versus a year ago.

But Ms Allen said that didn’t suggest a one-for-one increase in unemployment, as some workers may have lost enough income to become eligible for welfare support.

The government has also eased jobseeking requirements and increased the income threshold for partners of applicants, suggesting some may have become eligible for payments without a significant change in their own circumstances.

Nonetheless, “all this is pointing towards the fact the labour market is deteriorating in April – and quickly,” she said.

The impact of anti-COVID measures on “non-essential businesses” and their workers has already been severe.

Casino operator Crown Resorts announced on Thursday it had now stood down, either partially or fully, 95 per cent of its workforce.

Westpac’s household survey for April, released Wednesday, showed a fifth of respondents had suffered a total loss of wage income. That same survey showed the most rapid decline in consumer confidence in its 47-year history.

There have now been over 850,000 applications for the JobKeeper program, which will pay a $1500 a fortnight payment to employees of businesses who have suffered a severe drop in revenue due to the COVID-19 crisis.

Sole traders in a similar position are also eligible, with payments backdated to March 1 and payable from the start of May.

Minister for Employment Michaelia Cash on Thursday warned that employers who don’t pass on the government support to staff will be breaking the law.

“Let us make this very, very clear: as an employer, if you qualify for JobKeeper, you must – and I underline must – pass on the full $1500 benefit to the employee,” Ms Cash said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout