Interest rate cut chances tumble on inflation rise

Inflation has risen to 1.8 per cent, further reducing the likelihood the RBA will trim the cash rate next week.

Inflation has risen to 1.8 per cent, partly because of the drought, further reducing the likelihood the Reserve Bank will trim the cash rate when it holds its first meeting for the year next week.

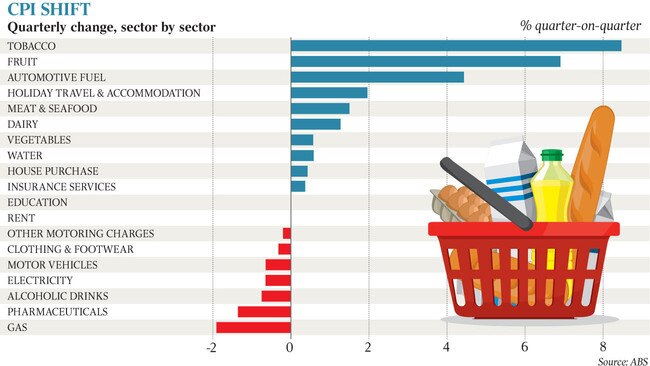

Consumer prices rose 0.7 per cent over the three months to December — a little higher than expected — up from 0.5 per cent in the previous quarter, the ABS said on Wednesday, pointing to price increases for pork, beef, fruit and veal.

It was the “final nail in the coffin for hopes of a February rate cut”, said Ben Udy, an economist at Capital Economics.

“The combination of strong retail sales data in November, the decline in the unemployment rate in December and now the inflation pick-up means the RBA will almost certainly leave rates on hold in February,” he added.

The chance of an official rate cut was about 10 per cent on Wednesday, based on market pricing, down from more than 60 per cent a week ago.

The rise in consumer prices was underpinned by a surge in fruit prices — up 6.8 per cent in the quarter — as drought and bushfires hindered supply, a 4.4 per cent jump in petrol prices and a legislated increase in tobacco excise. “The rise in the price of tobacco accounts for a massive 0.4 percentage points of the increase in the CPI. Put another way, without the rise in tobacco prices, headline CPI in Australia would be 1.3 per cent a year,” said Commonwealth Bank senior economist Gareth Aird. “The RBA’s inflation target of 2 to 3 per cent feels more like an inflation aspiration in the current climate.”

The Reserve’s preferred measure of inflation, which strips out volatile items, was flat over the quarter, rising 0.4 per cent in the lead-up to Christmas, which left the annual rate at 1.6 per cent — well below the RBA’s inflation target.

The RBA’s latest forecasts, scheduled to be updated next Friday, have “core” inflation rising gradually to 1.8 per cent by the end of this year and 1.9 per cent in 2021. The biggest drags on the CPI in the quarter were pharmaceuticals (down 1.3 per cent), gas prices (down 1.9 per cent) and cars (down 0.6 per cent).

Housing costs — rent and purchases of a new dwelling — rose very slightly, and at the lowest pace in more than 20 years.

Successive interest rate cuts, including three in 2019, have struggled to increase core inflation, which has been outside the RBA’s band since the end of 2015.

JPMorgan analyst Tom Kennedy said higher food prices could damage household disposable income growth, complicating the RBA’s hope for a pick-up in consumption to help bolster economic growth.

“Drought effects are becoming increasingly pronounced and will continue to bias food prices higher through 2020,” he said.

News last week that the unemployment rate had fallen to 5.1 per cent in December, the second consecutive monthly decline, prompted many economists to push back the timing of a further easing of interest rates by the RBA.

JPMorgan on Wednesday pencilled in a 0.25-percentage-point cut in May. “The main impact of the bushfires and coronavirus are likely to be evident by then and the pace of recovery,” they said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout