Inflation risks are rising, says Reserve Bank of Australia

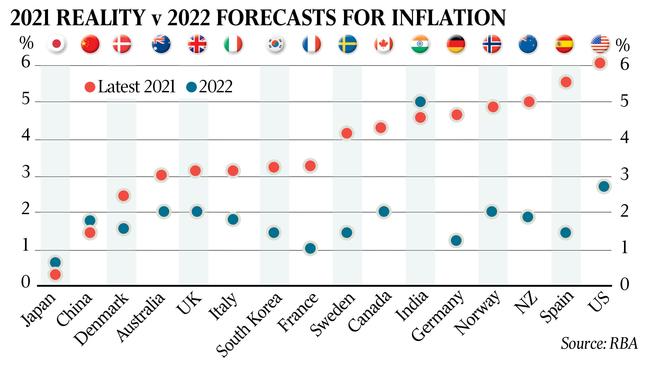

The Reserve Bank has again discounted market pricing of official interest-rate hikes in 2022 but acknowledged the inflation risk was ‘shifting upwards’.

The Reserve Bank has continued to push back against market pricing of official interest rate hikes in 2022 but acknowledged that the risks to its inflation forecasts were “shifting upwards”.

Minutes from the RBA’s November board meeting – where it abandoned its pandemic-era target of 10 basis points for the April 2024 bond – said the risks to the inflation forecast had “changed” with the main uncertainties related to the persistence of disruptions to global supply chains and to the behaviour of wages at the lowest unemployment rate in decades.

But the central bank reiterated that for inflation to stay up in its 2 to 3 per cent target band, the labour market would need to be tight enough to generate “materially higher wages growth”.

Wednesday’s release of Australia’s Wage Price Index for the September quarter was expected to show year-on-year growth at a more than two-year high of 2.2 per cent.

But that would still be well shy of the 3 per cent level RBA Governor Philip Lowe has nominated as the minimum needed to sustain inflation around the middle of the target band. Wages growth has not exceeded 3 per cent since the resources boom in 2013.

In the Q&A of his Australian Business Economists speech Recent Trends in Inflation, Dr Lowe said a lift in the official cash rate in 2022 seemed a “very, very low probability”.

Investors may be expecting rate hikes next year because they mistakenly thought the RBA would increase rates to “stamp out the rises in house prices”.

“That’s not in our reaction function, so if you think that’s why we’re going to raise interest rates next year, I would encourage you to rethink,” Dr Lowe said.

“The other possibility is that you think that inflation is going to pick up much more quickly and you think that our condition for meeting the cash rate will be met next year,” he added.

“We can’t rule that out – I can’t say that has a zero probability, but I think it has a very low probability because it would require wages growth to pick up very substantially … above 3 per cent.

“It was quite a few years ago that wages growth at the aggregate level was above 3 per cent (and) Australia was going through the resources boom, so the probability of us unwinding that decade-long decline in wages growth in just six months seems very very low to me.”

The RBA would “look through” a rise in core inflation to 3 per cent or higher that was not accompanied by much stronger wages growth and inflation of 3 per cent or above would not be sustained by supply-side pressures alone, according to Dr Lowe.

While a collapse in productivity growth could mean wages growth would not need to be 3 per cent or more for inflation to stay up in the target band, this wasn’t the only determinant of inflation.

“Rather, we are using wages growth as one of the guideposts in assessing progress towards our goal and whether inflation is sustainably in the target range,” Dr Lowe said.

“As we get closer to that goal, you could expect us to provide further guidance, including our projections for inflation.”

Moreover, it’s “hard to precisely define what ‘sustainably in the target range’ means”.

The RBA wanted to see underlying inflation well within the 2-3 per cent range and have a reasonable degree of confidence that it will not fall back again, yet a slow drift up in underlying inflation would have “different policy implications to a sharp rise”.

If underlying inflation reached the middle of the target by the end of 2023 it would be the first time in nearly seven years, but by itself “does not warrant an increase in the cash rate”.

“Much will depend upon the trajectory of the economy and inflation at the time,” Dr Lowe said. “It is still plausible that the first increase in the cash rate will not be before 2024.”

That seemed a “weaker commitment” compared to the RBA’s other post-meeting communications, according to David Plank, ANZ’s head of Australian economics.

But Dr Lowe’s response to a question about the use of market expectations for interest rates in the RBA forecasts “might turn out to be important when the RBA does start to move”.

A flat relationship between the unemployment rate and inflation could mean it would not make much difference over the forecast horizon if market pricing of lots of rate hikes is used or not.

In its Statement on Monetary Policy forecasts last week, the RBA assumed “market pricing” of multiple interest rate hikes in 2022 and 2023 to drive its economic forecasts.

“This has implications for the potential speed and size of RBA policy adjustments when it does start to tighten,” Mr Plank said. “If the Phillips curve is truly very flat, then the RBA may need to tighten quite a bit to impact the economy.”

In response to a question about what the neutral cash rate might be, Dr Lowe said he was “hopeful” that the neutral cash rate would be at least 2.5 per cent, reflecting the RBA’s inflation target and Lowe’s view that the neutral real cash rate should be higher than zero.

“This estimate for the neutral rate seems higher than what many market commentators are thinking,” Mr Plank said.

“Certainly, we think a world of very high debt levels is likely to be one in which real rates are structurally low.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout