Accordingly, a further interest rate cut will accelerate the downturn causing, an ignorant market to demand even more cuts, which, in the absence of offsetting measures, will send the nation into a nasty downward spiral.

READ MORE: Let’s get the cash flowing | Small business, big lift

The Reserve Bank appears to be a prisoner of the market and is only vaguely aware of the damage they are doing to parts of the economy. These conclusions come the latest data from Australia’s premier retail analysts, Foreseechange.

Something is clearly very wrong with the economy.

Foreseechange points out that in volume terms, household consumption expenditure, — which constitutes 55 per cent of GDP – has been very weak since late 2011.

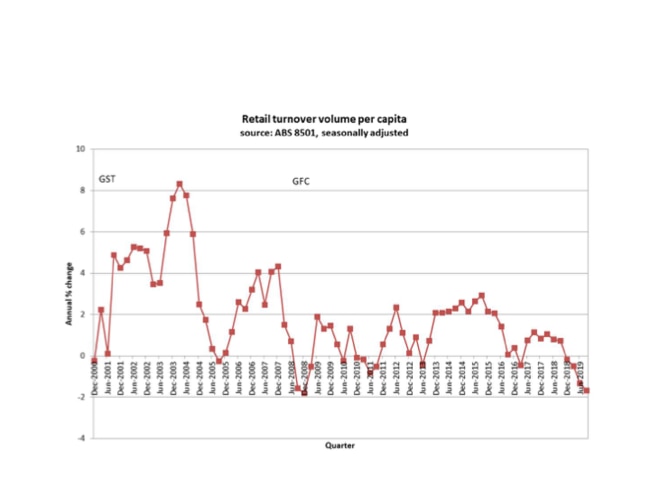

Retail sales volume per capita, to the September 2019 quarter, has been in recession since the December 2018 quarter and continues to weaken despite cuts in interest rates and lower income taxes. The retail decline is as bad as during the GFC.

New vehicle sales to private buyers collapsed in 2018 and are still declining.

Business confidence slumped after mid-2018, making business decision makers more likely to cut budgets and spending. There has been no growth in median household real disposable income.

Why is this happening? Three forces stand out, according to Foreseechange:

- The most obvious cause is very weak wages growth. Since June 2014, gross compensation of employees has increased by 19.3 per cent while income tax payable has increased by 36.7 per cent. Some 25 per cent of employment growth in the five years since August 2014 has been in health care and social assistance and these positions appear have lower than average salaries. Social assistance received has increased by only 1.6 per cent since June 2014. This is only in part due to lower unemployment

- Since the start of 2018 falling residential property prices have negatively affected consumer spending, especially on motor vehicles. While prices have reversed, there has been no noticeable change in spending.

- While the two forces above are important, the monster in the room is lower interest rates. Since June 2011, household bank deposits have lifted from $643 billion to $1,126 billion at the June 2019 quarter and are still increasing. Over the period October 2011 to October 2019, interest paid on a $10,000 one year term deposit at a bank has dropped from 5.3 per cent to 1.15 per cent.

Over that period, interest received has fallen by 10.7 per cent, despite deposits increasing by 75 per cent!

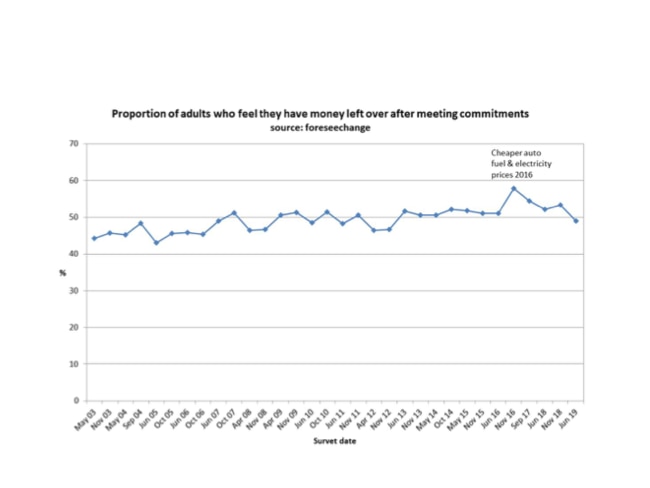

The proportion of adults who feel they have money left over after meeting commitments has fallen since 2016 and there has been no net increase since 2007

One of the most important statistics calculated by Foreseechange is its “willingness to spend” data. This shows that retirees are the most willing to spend, followed by people in full time work without mortgage repayments. Retirees been savaged by lower interest rates and those saving for a house have fallen further behind. In reducing interest rates, we are attacking those most willing to lift their spending. Those with large mortgages simply save more when interest rates fall so there is little benefit to retail sales.

Foreseechange says the way to boost spending is to provide help to those willing to spend and the easiest way is to assist aged pensioners. They will spend the money and there will be a direct injection into retail spending. Secondly, financial institutions should be instructed to pay double the interest paid since 2014 into personal accounts. Treasury would finance this, or it could be a form of unconventional monetary policy financed by the Reserve Bank.

Foreseechange suggest the help be capped at $1,000 per person in each measure. I would add that we also need to speed the money flowing in the small to medium sized business sector and remove the brakes, and not just talk about vague concepts like productivity.

When this week the economic statistics showed the Australian economic decline was accelerating, markets immediately assumed that a further interest rate reduction was certain. The markets are likely to be right, but new data shows that a major cause of the downturn has been the previous reductions in interest rates.