And we are seeing the beginnings of the new era unfold on Wall Street, as investors scramble out of low-yielding bonds into shares. If the trend continues, it will be growth-related shares that will perform better than income related securities.

However, we need to be on the alert. According to the leaks, the imminent trade deal does not cover Huawei or telecommunications and artificial intelligence. If that is right then, as I pointed out last week, it has major implications for Australia and Telstra. (The commentary is on our website under the heading “Huawei ban will force Telstra to play catch up and hurt dividends”).

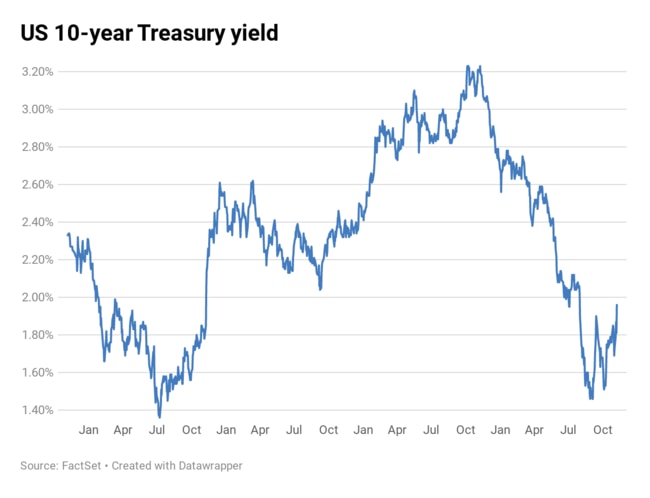

Right now, the action is in US bonds. On Friday morning (our time) 10-year yield jumped 15 basis points to 1.96 per cent; the biggest jump since the 20-basis-point move the day after Trump was elected in 2016.

Two months ago, those same bonds were trading at a yield of 1.43 per cent – we have seen a rise of some 37 per cent. Bond holders gave suffered a big loss because as the yield rises the bond prices fall.

Australians banks are increasingly relying on overseas borrowing, so if the higher US bond rates are maintained it will increase their costs. Given the Reserve Bank is actually depressing the economy by lowering rates, if the US rate rise flows to local depositors, it will help big chunks of our economy.

Not surprisingly, as the US bond yields were rising so was the Australian dollar. If China’s economy bounds ahead under a trade deal we benefit.

However, beware. These trends depend on an end to the tariff trade war and that is not certain. The sharemarket was overjoyed when China Commerce Ministry’s Gao Feng said that the US and China agreed to simultaneously cancel some existing tariffs on one another’s goods. He added that both sides were closer to a so-called “phase one” trade agreement following constructive negotiations over the past two weeks.

But traders who are following US-China trade discussions have growing concerns that the signing of the “phase one” deal could be delayed until December.

Political pressure

For a long time, along with many others, I have been predicting that there would be a US-China tariff deal because President Trump needs that deal to enhance his chance of re-election next year. His Republican support base hate tariffs and he needs that support base to overturn the impeachment thrust.

Over in China, their economy is slowing, and they need to do a deal for economic reasons.

Outside of agriculture, that’s not the case in the US. Last month the jobs growth was greater than expected. Services data showed a rise in new orders while manufacturing data showed continued expansion. Apart from the trade deal speculation, these forces were pushing up bond yields.

It’s fascinating that at the end of July 2019, after the Federal Reserve rate cut, the 10-year US bond yield closed at 2.01 per cent. A day or so later, at the beginning of August, Trump fired off his tweets about more tariffs on China. As a result, in around four weeks the 10-year bond yield fell to a low of 1.429 per cent. The latest jump in interest rates unwinds that fall and if the trade deal is secured then the bond rate is likely to rise further.

Meanwhile there is movement on the US wages front, albeit slow. The income of an average family has now risen by about $5,000 since Trump came into office, from $61,000 in January 2017 to $66,000 in August 2019.

Trump supporters say that under George W. Bush, the household income gains were a little over $400 in eight years, and under Barack Obama the gains were $1,043.

Along with the General Motors strike, it is a sign that US labour shortages are pushing up wages rates. If that continues inflation will edge up, although technology will keep a lid on the rise.

Assuming markets are right, and the US and China are about to call a truce on the tariff related trade war, then we enter a new era of higher interest rates and a different set of valuations for shares.