Household wealth rising at fastest rate in two years

Households will begin the new decade with surging levels of wealth as property prices and the sharemarket drive the fastest rise in prosperity in almost two years.

Australian households will begin the new decade with surging levels of wealth as rebounding property prices and a buoyant sharemarket drive the fastest rise in prosperity in almost two years.

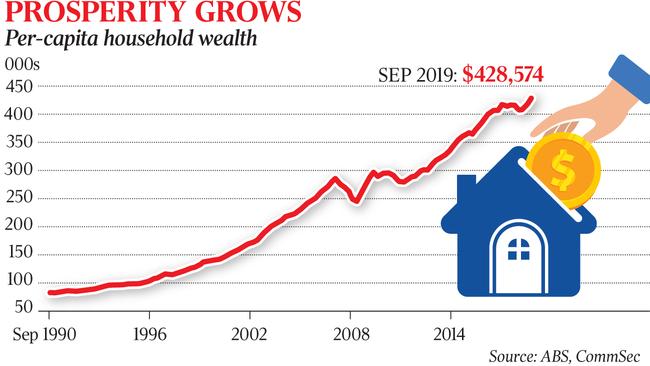

Household net worth on a per capita basis jumped over the three months to September by $10,699, or 2.6 per cent, to a record $428,574 — the largest quarterly increase since December 2016, Australian Bureau of Statistics data shows.

Rises in national housing prices of almost 3 per cent and the sharemarket of almost 2 per cent over October and November mean the financial position of households is almost certain to improve again in the December quarter.

The figures are fuelling hopes that consumers may open their wallets in the new year, delivering a boost to growth after a year of sluggish spending.

The official wealth data, from the September national accounts figures, comes amid anecdotal evidence that shoppers were out in force during the Boxing Day discount sales.

PwC chief economist Jeremy Thorpe said: “There is a general rising tide … as house prices rise, Australians should feel more confident in spending, or at least we hope that’s the case.

“A lot depends on people having jobs, and the last labour market release was more positive than anyone had expected.”

Josh Frydenberg said Australians could look to the new year with confidence about their economic future.

“Not only did they dodge Labor’s $387bn of higher taxes but, under the Coalition, tax cuts we took to the election have been legislated, putting more money in people’s pockets and helping to increase household disposable income at its fastest rate in a decade,’’ the Treasurer said on Friday.

“In the face of challenging economic headwinds, with the drought at home and trade tensions abroad, the Australian economy has proven to be remarkably resilient.’’

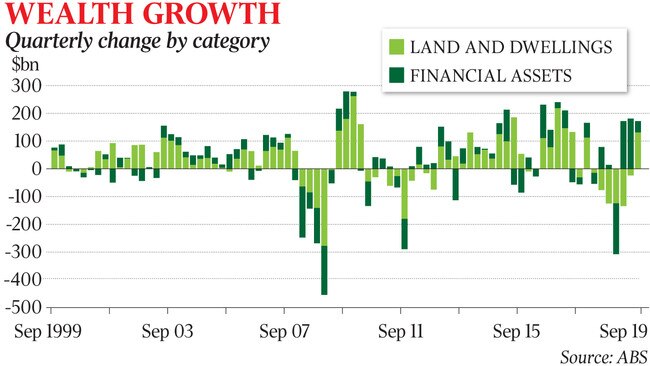

The ABS said the property market revival was the key driver of wealth accumulation over the September quarter.

“The value of residential land and dwellings increased by 2.9 per cent, driven by holding gains of $174.4bn — the first quarter of real gains after six successive quarters of losses,” the ABS said.

The bounce put an end to 18 months of declining values, and aggregate net worth at the end of the September quarter increased 3 per cent to $10.9 trillion.

The rise continued in the latest quarter, with national home values jumping 1.7 per cent in November and 1.2 per cent in October, bringing the total gain to 2.9 per cent, according to CoreLogic data.

Since September 30, the sharemarket has added 1.9 per cent.

With only two trading days left in the year, the benchmark S&P/ASX 200 index was up by more than 20 per cent in 2019. Once dividends are included, the annual returns for shareholders could push closer to 25 per cent.

Household net worth on a per capita basis has surged 60 per cent over the past 10 years, from about $270,000 in September 2009, mostly off the back of rising property values and the increasing pool of superannuation savings.

The Reserve Bank’s and the government’s optimistic growth targets for 2020 hinge on households lifting consumption from the slowest pace of growth in a decade, and economists point to a potential “wealth effect” as the potential catalyst.

Deloitte Access Economics director Chris Richardson said rising wealth, and particularly climbing property wealth, did help the economy in the short term, although this year it “has not helped as much as it usually would”.

“A handful of homes getting exchanged at relatively high prices is not enough to give confidence to a public that’s feeling somewhat conservative about where the economy heads next,” Mr Richardson said.

“It’s probably still fair to say it is helping to keep something of a floor under retail spending.

“The missing ingredient is confidence.”

Two continuing drags on the economy are the historically high level of household debt and stagnant wage growth, which appear likely to stay well into the new decade.

But the ratio of household debt as a proportion of total assets fell to 18.5 per cent from 18.9 per cent in the previous quarter as households paid down loans.

Liabilities grew by 0.2 per cent to $2.47 trillion — the slowest pace in more than 26 years and well behind the 2.5 per cent lift in total assets.

Annual growth in wages slipped to 2.2 per cent over the year to September, according to the ABS’s wage price index, from 2.3 per cent over the year to June.

Amid concerns that the wealth gain was disproportionately going to older Australians who had bought homes, Mr Thorpe said dealing with the intergenerational wealth gap would be “one of the great challenges from a political and economic perspective in coming years’’.

Mr Frydenberg highlighted a strong employment market, with the creation of 40,000 new jobs in November and the unemployment rate falling to 5.2 per cent. “Australia’s employment growth rate is now faster than the US, Canada and the euro area, more than double the OECD average and nearly three times what we inherited upon coming to government,’’ the Treasurer said.

“With around 1.5 million new jobs created since the Coalition took office, the first current account surplus in 40 years, welfare dependency at its lowest level in 30 years, the biggest tax cuts in 20 years and the first balanced budget in 11 years, the Morrison government is getting on with implementing its economic plan.’’

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout