Expect more of the “gentle taps” on the economy to come into next year as the central bank seeks to put inflation back into a box without substantially crashing Australia’s growth momentum.

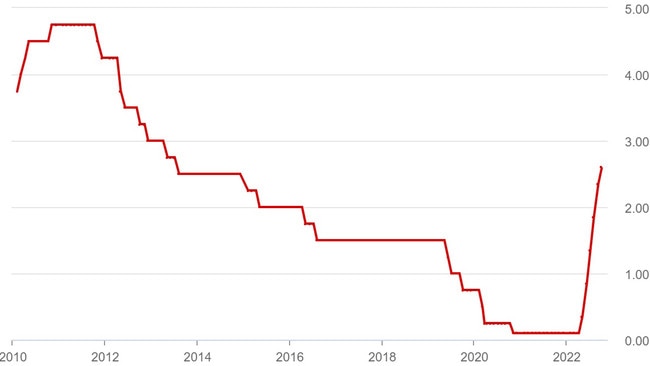

Tuesday’s smaller-than-expected 25 basis point cash rate hike to 2.6 per cent clearly took the market by surprise, with the dollar crashing as Australia moved into the interest-rate laggard camp among global economies. Local shares surged 3.8 per cent turbocharged by the RBA’s afternoon statement. The move was the biggest one day rise this year for the S&P/ASX 200 and its biggest daily rise in nearly two-and-a-half years.

This dovish hike gives the central bank breathing space to assess the outlook for inflation and growth. But if Lowe blinked too early in his inflation fight, expect much tougher cash rate pain to come early next year. Indeed the RBA will be in a tight spot if the September quarter inflation figures out later this month surprise on the upside.

The RBA governor has taken the view that he wants to spare us the pain of more super-sized interest rate hikes with the outlook for the global economy significantly deteriorating over the past month. The US is facing a recession as the Federal reserve takes a hard line stance on raging inflation there. Europe is set to endure a winter energy crisis, which will hit growth there. Elsewhere – and significantly for Australia – China’s ‘Covid Zero’ approach and troubled property market will weigh on growth there.

Australia may just miss a recession although odds are fast rising it could happen here.

Lowe has acknowledged the lag effect of four back-to-back 50 basis point cash rate hikes previously is about to be felt, particularly as tens of billions of dollars of fixed mortgages are now rolling over onto higher interest rates.

This combined with six rate hikes all up means higher payments for households. At the same time consumer confidence is falling and the RBA called out softening house prices after the earlier large increases.

Giving support for the Australian economy is a very hot jobs market, signs of wages growth and the fact that households are still sitting on large levels of savings.

The way the RBA is reading the signals is that it has the economy carefully balanced on a slowing path and another 50 basis point rate hike threatens to tip it over. Make no mistake, it is an extremely difficult manoeuvre where the RBA is trying to slow spending while keeping the supply side – or business and production – open.

There will be more rate rises to come, but if Australia continues on this path the moves will be in the order of 25 basis points. Expect to see some market economists revise down their outlook for the peak in the cash rate back to between 3 per cent to 3.5 per cent, particularly as the RBA reiterated its view that inflation will start moderating into next year, with some of the global supply side issues working through the system.

Of course a caveat to this all comes down to how inflation behaves in coming months, if it flames out at 7.75 per cent for this calendar year, all is going to plan. If the RBA gets this call wrong and inflation takes off again, then hold on because future rate hikes will come hard and fast.

johnstone@theaustralian.com.au

Reserve Bank governor Philip Lowe’s dovish instincts have kicked in with an early Christmas relief for households in the form of a modest interest rate rise.