Growth surge won’t lift cash rate, say economists

An expected surge in growth won’t dissuade the RBA from keeping the cash rate on hold for the year, economists say.

An expected surge in economic growth won’t dissuade the Reserve Bank from keeping official interest rates on hold for the rest of the year — the longest period of stability ever — economists predicted yesterday.

The Reserve Bank board, as widely expected, kept the cash rate on hold at a record low of 1.5 per cent for the 22nd month in a row at its June meeting, torn between signs house prices are falling and credit growth slowing on the one hand, and improved economic growth and higher inflation on the other.

“Even if the economy did continue to perform well, the RBA probably still wouldn’t raise interest rates until the cloud of uncertainty caused by the royal commission has lifted,” Capital Economics chief economist Paul Dales said.

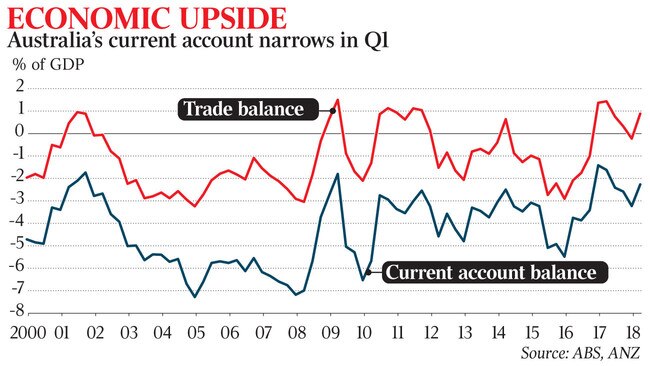

The current account deficit, which measures the excess of imports and payments over exports and income, narrowed by $4.5 billion to $10bn in the first quarter of 2018, the ABS said, enough to add 0.3 percentage points to the first reading of GDP growth for the year, due out today at 11.30am.

After the release, both UBS and Barclays lifted their forecasts for growth in the March quarter, pencilling in annual rises of 2.8 per cent and 3 per cent respectively, which would put growth on track to meet RBA and Treasury expectations.

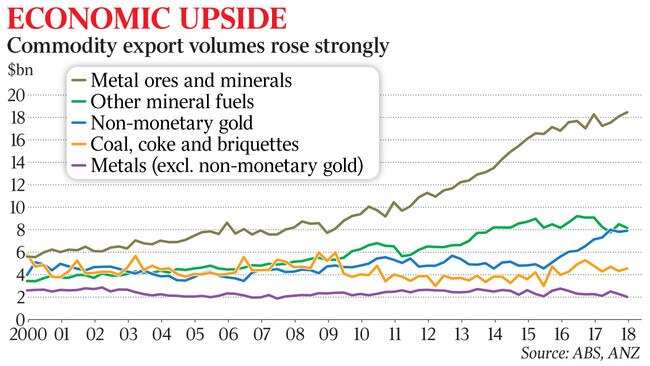

George Tharenou, an economist at UBS, said the “solid” net export performance, boosted in particular by surging LNG exports, and fast-growing public-sector spending, would increase economic activity by 0.9 per cent in the first quarter, more than double the 0.4 per cent in the previous quarter.

“The key uncertainty remains household consumption given that retail volumes in the first three months of the year slowed sharply to only 0.2 per cent between December and March,” Mr Tharenou said, playing down the likelihood of any credit crunch as banks tightened their lending standards in the wake of the royal commission.

In his monthly monetary policy statement, RBA governor Phil Lowe said further falls in unemployment, which rose to 5.6 per cent in April, and higher rates of inflation would be “gradual”.

Over the past four years, annual growth in the CPI has been above 2 per cent, the bottom of the Reserve Bank’s medium-term target, only twice.

Mr Dales said: “We’re not convinced that the apparent acceleration in GDP growth in the first quarter will be sustained as subdued wage growth and the weaker housing market take their toll on consumption and dwellings investment.”

Prices in financial markets yesterday put the chance of an increase in the cash rate by December at less than 10 per cent, down from almost 50 per cent earlier this year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout