Coronavirus: Stimulus sparks 15pc surge in company profits

Company profits surged 15 per cent over the June quarter, even amid plunging sales, as government stimulus poured into corporate coffers.

Company operating profits surged 15 per cent over the June quarter amid plunging sales as government stimulus alongside rent and loan relief handed Australian businesses a massive bottom-line boost through the worst of the COVID-19 crisis.

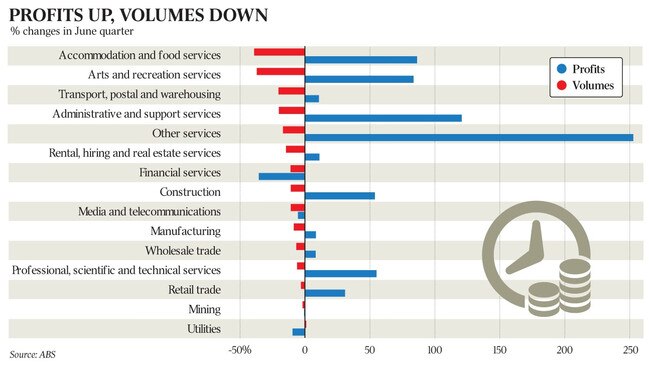

In the latest sign of how unprecedented government spending has distorted the economy, some industries most damaged by social restrictions enjoyed the largest lift in gross operating profits, seasonally adjusted Australian Bureau of Statistics data shows.

Against a background of dire warnings from business groups and a record collapse in corporate confidence, economists had been tipping a 6 per cent fall in quarterly profits. Instead, the latest data “on average suggest businesses have done very well”, ANZ senior economist Felicity Emmett said.

“They are certainly doing well out of the stimulus — it’s an amazing result, really, given the situation,” Ms Emmett said.

The sharp 9.4 per cent collapse in sales through the quarter, alongside a 3.3 per cent slump in total wages paid by firms, revealed the dramatic drop-off in demand and activity as many businesses were forced to close or operate under restricted conditions as a result of social distancing measures.

Yet the sharp increase in quarterly company profits — the largest since the mining boom in late 2016 — showed the $35bn in wage subsidies paid over the quarter through the JobKeeper program, alongside a further $15bn via the business cashflow boost program, had helped not just sustain profits but hand corporate Australia a sizeable boost.

This was especially evident in sectors hardest hit by restrictions. Gross operating profits in the hospitality industry jumped 86 per cent, the data showed, while sales income dropped 39 per cent and firms paid 18 per cent less in wages.

Profits in the arts and recreation sector surged 84 per cent versus the March quarter, as sales volumes collapsed by 37 per cent and wages dropped 14 per cent.

Gross operating profits in the construction industry climbed by more than 50 per cent, while the retail sector recorded a gain of 31 per cent as sales dropped 11 per cent and 3 per cent, respectively.

Firms’ bottom lines have also been buoyed by a massive fall in operating costs thanks to rent and interest relief offered to many businesses to assist them to navigate the COVID-19 recession.

Landlords have recently expressed outrage that retail boss Solomon Lew’s refusal to pay rent helped his company, Premier Investments, deliver record profits for the recent financial year. Large listed companies that have benefited hugely from stimulus payments raised eyebrows during the recent reporting season when they boosted dividend payouts or handed their executives big bonuses.

Australian Retailers Association chief executive Paul Zahra said the government support and concessions provided by landlords over the three months to June had helped ensure “people could remain employed and that industries were allowed to continue”.

Mr Zahra said retailers now faced an extra hit from the Victorian lockdowns, and would need any cash reserves to adapt their businesses to a changed operating environment in the wake of the pandemic.

Council of Small Business Australia chief executive Peter Strong said, however, that there was no doubt in hindsight that the government had spent too much in its effort to shield businesses and households from the pandemic.

Treasury’s mid-way review of the JobKeeper program found it had overpaid part-time workers $6bn.

“They’ve spent too much, but they are better off spending too much than too little,” Mr Strong said. “(Businesses) that can would be building up their cash reserves.

“Most business people are sensible, and what they are showing is what consumers are showing in downturns: they stop spending.”

There were exceptions. With the major banks ineligible for JobKeeper, the financial services sector suffered an 11 per cent fall in sales alongside a 36 per cent drop in gross operating profits. Similarly, mining sales fell by 2 per cent as the sector recorded a slight drop in profits, while the utilities sector reported a 1 per cent rise in sales and a 10 per cent fall in profits.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout