GDP: Exports, government spending lift September quarter growth

Josh Frydenberg seizes on a rise in economic growth as evidence government strategy is on track.

Josh Frydenberg has seized on a small rise in economic growth as evidence the government’s strategy is on track, but faces the challenge of sluggish consumer spending and a fall in business investment ahead of the mid-year economic statement.

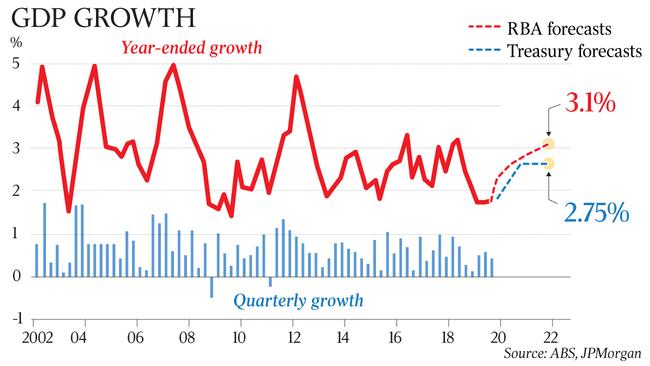

National accounts for the September quarter showed gross domestic product expanded by 0.4 per cent, down against the upwardly revised June quarter’s 0.6 per cent, but enough to bring the annual rate to 1.7 per cent from a revised 1.6 per cent over the year to June.

“Australia is back in black and back on track,” the Treasurer said.

The consensus among economists had been for 0.5 per cent growth over the three months, and 1.7 per cent growth over the year.

The mild acceleration in annual growth backs the Reserve Bank of Australia’s argument that the economy has reached a gentle turning point, driven in large part by booming exports and government spending.

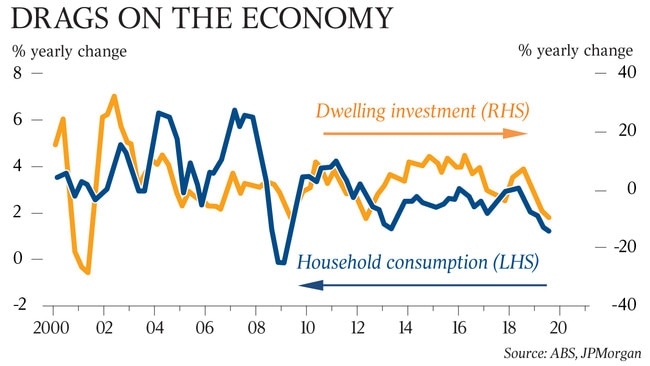

But Wednesday’s figures suggest that the economy, while past its worst, may be struggling to build momentum amid persistent weakness in household spending and a severe residential construction downturn.

This sparked predictions from economists that the RBA would move again to cut official interest rates early in the new year.

The national accounts, released by the Australian Bureau of Statistics, showed Australia clocked its weakest private consumption growth since the GFC.

Household expenditure slowed from 0.4 per cent to 0.1 per cent — the weakest since the final quarter of 2008. The household savings rate rose from 2.7 per cent to 4.8 per cent — the highest since the first quarter of 2017.

There was some recovery in NSW, the nation’s biggest state economy, which delivered 0.3 per cent growth for the September quarter versus flat growth for the June quarter. Victoria slowed slightly to 0.4 per cent from 0.5 per cent, while Queensland picked up slightly at 0.1 per cent from 0 per cent previously.

Mr Frydenberg pointed to the “good story in net exports” from the national accounts, and focused on robust jobs growth that led to a “strong pick-up” in total labour income through the quarter.

He also emphasised Australia’s economic resilience and strength relative to other major, developed economies.

He would not be drawn on whether the government would announce any new spending or policy initiatives at its upcoming mid-year economic update, other than to say it would include updated forecasts.

He said major infrastructure spending as well as industrial relations reforms, such as the Ensuring Integrity Bill and the next rounds of legislated tax cuts, would further stimulate the economy.

Labor criticised the outcome. “The Morrison government has ignored repeated calls for responsible, proportionate and measured stimulus to support the economy from the Reserve Bank, the business community, economists, experts and Labor,” opposition Treasury spokesman Jim Chalmers said.

Government spending was the main contributor to growth in domestic demand, the ABS noted, reflecting ongoing spending on services in disability, health and aged care. Domestic final demand contributed 0.2 percentage points to GDP growth over the quarter.

Net exports were responsible for the remaining 0.2 percentage points of growth.

However, the fourth consecutive fall in dwelling investment and only a 0.1 per cent quarterly increase in household expenditure showed continued weakness in spending by businesses and households.

Households received a 2.5 per cent quarterly boost to disposable income but the accounts showed further evidence that Australians chose to save rather than spend July’s tax rebates, as well as the boost to income from lower borrowing costs after the RBA cut rates in June and July.

Mr Frydenberg made a virtue of households’ prudence, while pointing to a growing pool of future spending power.

“Of course we would like consumption to be higher, there’s no doubt about that,” he said.

“At the end of the day, people are doing what we are doing at the federal level, which is paying down debt.

“If people pay down their debt, then ultimately they will have lower interest payments, and that will free up more money to spend across the economy.’’

More Coverage

An update of this chart: for the first time in nearly ten years a tax cut has seen the proportion of income tax paid by households decline materially.. but because it was temporary people just saved the windfall, more could be achieved with permanent cuts IMO #ausbiz pic.twitter.com/B560wpjWRc

— Alex Joiner (@IFM_Economist) December 4, 2019

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout