GDP: Economy grows faster than expected

GDP figures show economic growth beat forecasts in the March quarter, as stimulus measures fuelled a strong rebound from Covid.

Australia’s economy grew faster-than-expected in the March quarter as unprecedented fiscal and monetary policy stimulus continued to fuel a strong rebound from the Covid-19 pandemic.

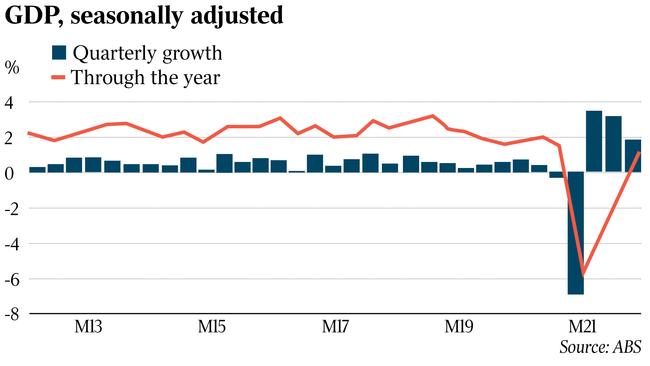

The economy grew 1.8 per cent in seasonally adjusted terms compared to the December quarter, exceeding a 1.5 per cent rise expected by economists.

Year-on-year growth of 1.1 per cent also beat the consensus estimate of 0.6 per cent.

December quarter growth was revised up to 3.2 per cent on quarter and minus 1 per cent on year, a little stronger than growth of 3.1 per cent and -1.1 per cent first recorded.

Western Australia, fuelled by a mining boom, continued to drive the state based growth which was up 3 per cent during the quarter. This was followed by Victoria which delivered state-based growth of 2.3 per cent in the first three months of this year, powered by household spending. Tasmania came in at 1.6 per cent, followed by NSW at 1.5 per cent, South Australia at 1.4 per cent while Queesnland’s growth came in at 0.4 per cent.

Queensland was the only big state where household spending went backwards in the quarter.

Economists said the rise in growth reflected the continued easing of Covid-19 restrictions and the recovery in the labour market, but some slowing in the pace of recovery was inevitable.

“With the reopening gains behind us, the Victorian snap lockdown and potentially others impacting this quarter and some sectors remaining slower to recover – notably travel and higher education given closed international borders – the pace of growth is likely to slow further over the year ahead,” said Shane Oliver, head of investment strategy and chief economist at AMP Capital.

He said the ongoing hit to immigration means it will take longer for Australia to regain its pre-virus trend compared to other countries that normally have relatively lower immigration.

But Australia is one of the few developed countries with GDP above pre pandemic levels.

“This reflects a combination of better control of coronavirus – which meant lower hospitalisations and deaths, less severe lockdowns and less self-regulation limiting mobility – and a good well-targeted policy response that protected incomes, jobs and businesses,” Dr Oliver said. “Countries with less coronavirus-related deaths have had better GDP outcomes.”

The terms of trade rose 7.4 per cent to its highest level since 2011 amid stronger export prices, particularly for iron ore and LNG, contributing to a 3.5 per cent rise in nominal GDP.

Domestic final demand contributed 1.6 percentage points to GDP growth, while private investment contributed 0.9 percentage points and household consumption contributed 0.7 percentage points.

Private investment rose 5.3 per cent in the March quarter to be 3.6 per cent higher through the year, the first such rise since the June quarter of 2018.

Both business and housing investment increased, supported by government initiatives and improved confidence, with an 11.6 per cent rise in machinery and equipment marking the strongest increase since December quarter 2009.

Dwelling investment rose 6.4 per cent with increased construction activity on renovations and detached housing, coinciding with the federal government’s HomeBuilder scheme.

Household expenditure rose 1.2 per cent amid a 2.4 per cent rise in services spending.

However, household expenditure remained 1.5 per cent below pre-pandemic levels.

Hotels, cafes and restaurants, recreation and culture and transport services continued to rebound as movement and trading restrictions eased. Spending on services remains down on pre-pandemic levels, particularly those impacted by the closure of international borders.

Spending on goods declined 0.5 per cent, but remained at elevated levels.

Spending on food and alcoholic beverages fell amid a shift to dining out as restrictions eased.

The household saving to income ratio declined from 12.2 per cent to a still-elevated 11.6 per cent as household consumption outpaced the rise in gross disposable income.

Gross disposable income rose 1.0 per cent in the quarter.

Compensation of employees rose 1.5 per cent, reflecting increases in employment and hours worked as economic activity continued to recover.

This was partly offset by a decline in benefit payments as Covid support was wound back.

But AMP’s Dr Oliver was optimistic about Australia’s economic outlook.

He expected vaccinations to fuel economic reopening, while global monetary and fiscal stimulus and pent up demand should continue to buoy commodity prices, high levels of consumer confidence and savings should support consumer spending, dwelling and business investment has turned up strongly, and fiscal and monetary policy remains supportive.

Nomura head of interest rate strategy, Andrew Ticehurst, said the national accounts data reinforced his expectation that the Reserve Bank will decide to lessen its bond buying.

“We think the key message is that the economy has continued to recover, at an above-consensus pace, and this continues to set the stage for an RBA tapering announcement in July,” he said. “We note that this was the third consecutive above-consensus GDP print.”

“Moreover, we judge the quality of growth to be good – it was led by the private sector; it has broadened nicely over the past six months to include private capex; and it has exhibited a continuing rebound of service sectors, along with further growth in goods sectors.”

“Nominal growth was strong, boosted by another sharp rise in the terms of trade, and the household savings ratio declined only modestly in Q1, and from elevated levels, suggesting that consumers have retained considerable firepower.”

“The breadth of this recovery will likely not be lost on the RBA and could add to its confidence that the recovery is more likely to be sustained,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout