Freight sector slams port operator DP World over fee increases

The Dubai-owned group that dominates ownership of Australia’s ports has been slammed over a steep double-digit hike in fees at a time when the economy can ill-afford it.

The freight industry has slammed a double-digit hike in import and export charges by the country’s largest port operator, saying it is unjustified during a global trade slump.

The International Forwarders and Customs Brokers Association of Australia (IFCBAA) said DP World’s announcement that would increase terminal access charges by up to 13 per cent from May 1 was “out of step with industry and community expectations”.

DP World is Australia’s leading container terminal stevedore, operating terminals in Brisbane, Melbourne and Sydney. The IFCBAA said any increased costs would have to be passed through the supply chain, with the consumer paying more.

Terminal access charges, previously known as infrastructure charges, are collected by stevedores from land transport companies when collecting or delivering laden containers.

“Importers and transport providers should not be paying ever escalating fees landside, which should be borne by shipping lines,” the association said.

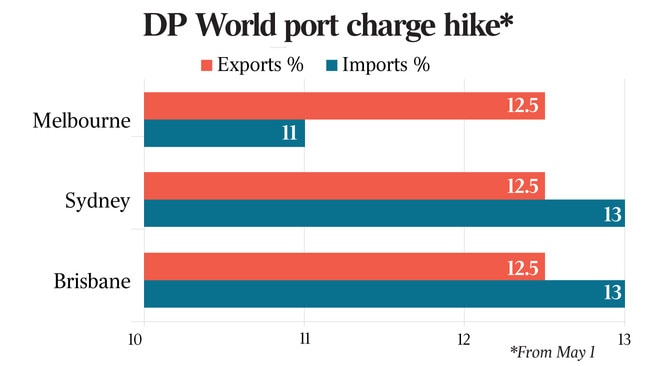

Import access charges will increase 13 per cent in Sydney and Brisbane to $126.60 and $124, respectively, per container from May.

Melbourne import charges will rise 11 per cent to $139.20 per container. Export charges will rise 12.5 per cent to $89.50 per container at all three ports.

The freight industry has been lobbying federal and state governments to reduce what it calls “continued uncontrolled and opaque increases in stevedore infrastructure charges”.

“The issue becomes one of increased costs which then have to be passed through the supply chain and at the end of the day it’s the consumer who has to pay,” the association said.

DP World Australia said its operating costs were increasing, including ongoing investments in terminal equipment, infrastructure and technology.

The company said it recognised the country’s ports had remained a key driver of economic recovery and it had deferred a review of its access charges last year in recognition of the unprecedented challenges faced by both consumers and businesses during COVID-19.

DP World Australia chief operating officer Andrew Adam said the company had been proud of its response to COVID-19 and had worked to facilitate the efficient flow of goods.

The Australian Competition & Consumer Commission, which monitors container stevedores at Adelaide, Brisbane, Fremantle, Melbourne and Sydney ports, said stevedores’ revenue and profit margins had increased despite the pandemic causing the largest contraction in container volumes in a decade.

The ACCC said stevedore revenue from terminal access charges had climbed almost 52 per cent last year but conceded ports had increased capital investments in some areas in 2019-20.

ACCC chair Rod Sims said excessive terminal charges would nullify the benefits of greater competition between stevedores in providing services.