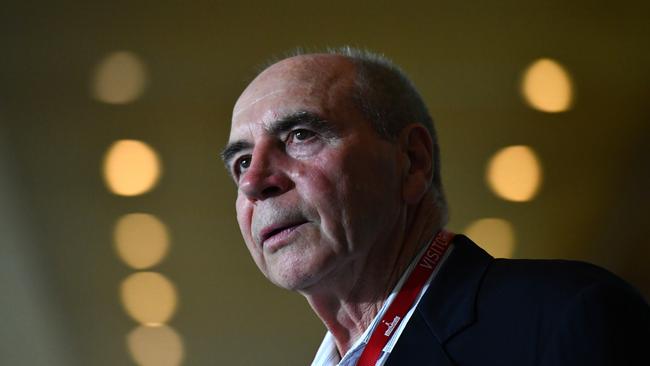

Former RBA boss Bernie Fraser warns of inflation risk from low rates

The ultra-low rates designed to fire up the economy threaten to bring inflation back into play, a former Reserve Bank governor is warning.

If house prices continue to surge, ultra-low interest rates designed to fire up the economy could be undermined by inflation, former Reserve Bank governor Bernie Fraser has warned.

But the former central bank boss has also noted it was not the RBA’s responsibility to keep a check on rising house prices, rather the banking regulator, the Australian Prudential Regulatory Authority was well placed to tighten lending controls as it did in 2016.

House prices have been on accelerating over the past month, jumping 2.1 per cent in February.

Annually the housing market is up 4 per cent, led by regional Australia where prices are up a combined 9.4 per cent.

The huge price rises come as the Reserve Bank of Australia is set to meet on Tuesday, but few are expecting rate changes after RBA Governor Philip Lowe said he expected the bank would not lift interest rates until 2024 “at the earliest”, when full employment is reached and inflation moves back into the target range of 2 to 3 per cent over the medium turn.

“ (Dr Lowe’s) forgetting that housing prices are a significant component of inflation and the bank should be very concerned with inflation,” Mr Fraser told The Australian.

“House prices are a significant component of the inflation target not directly but through rents and cost of building materials. Inflation finds its way, a booming housing construction pushes up labour costs and material costs.”

Mr Fraser also said he was concerned as the global economy recovered from the COVID-19 pandemic, thanks to the rollout of vaccines, inflation would rear its head sooner-than-expected.

“I don’t have any confidence in the forecast 3-4 years out that interest rates are going to stay where they are. That’s an extremely courageous forecast,” he said.

His comments came as the RBA doubled its daily quantitative easing program on Monday to $4bn, wading into the market to push down long-term interest rates as inflation expectations creep back into broader markets.

The intervention – which takes unscheduled RBA spending to $7bn since Friday – sent yields plummeting, with the 10-year benchmark Australian Government Bond extending its decline as low as 32 basis points following confirmation the RBA was extending its buying before late Monday trading down 24 basis points at a yield of 1.672 per cent.

The RBA’s bond purchase followed a record $3bn intervention of yield curve control bond buying on Thursday to defend its three-year bond yield target.

Vice president of macro rates strategist at RBC Capital Markets Rob Thompson told The Australian that even though the RBA’s remit does not include regulating housing price growth, it will become impossible to ignore.

“We think that the pace of house price growth will increasingly come on to the RBA’s radar in the second half of the year as a concern for macro stability,” he said.

“Even if you do have very creditworthy borrowers borrowing on low rates, if something happens in the economy, then it can lead to a situation of some concern.”

“You get to the point where first home buyers are potentially locked out of the market because of the upfront requirements.”

“But there’s no real sign of that right now – first home buyers are a large and growing portion of the market.”

ABS data released on Monday showed new owner-occupier housing loans lifted 10.5 per cent month on month to $28.75bn, against economist estimates of just 1 per cent.

Meanwhile, RBC Capital Chief Economist Su-Lin Ong said the central bank would ideally move to “step up” its weekly purchases in the three-to five-year bond range “to keep key borrowing rates low.”

“(Monday’s) actions suggest that the RBA is adopting a more flexible approach to unconventional policy which we would commend,” she said.

“It is a bolder, more decisive action which is needed at a time when markets are testing the RBA’s resolve.”

Ms Ong anticipated the RBA would reaffirm its commitment to controlling the bond yield at its monthly meeting today and might flag a willingness to be more flexible.

“We would expect the RBA to add a firmer commitment in its post-board meeting statement noting that it ‘will act to ensure its (yield curve control) target is met’ and “key borrowing rates stay low”.

“Indeed, it may even add that it will adjust purchases accordingly”.

The RBA’s board has a scheduled meeting on Tuesday, marking the second time it has met for the year.

RBC’s Mr Thompson said the recent bond yield movements did not mean Dr Lowe’s prediction that interest rates will not rise until 2024 was now defunct.

“We still think it’s highly unlikely that wages and inflation will return meaningfully for the RBA to have to hike rates before 2024,” Mr Thompson said.

“But the market is clearly questioning that narrative. Market pricing suggests around two rate hikes by the end of 2023 …. In our mind that’s not going to happen – we think that’s quite considerably overshot – but it is there in market pricing.”

Commonwealth Bank’s head of interest rate strategy Martin Whetton said recent global bond sell-off – which has sent yields soaring – were not just about testing the limits of central banks.

“The market is not just testing his theory out, they are testing out market positioning, what risk appetites people have” Mr Whetton told The Australian.

“What risk appetite people have – there is clearly a limit to how much risk you can have, and what your appetite for it is when trades go against you.

“So as far as it links back to the RBA inflation policy, they are separate. The preconditions of a rate hike is sustainable inflation above 2 per cent. And to get there, you need a lot to go right.”

“We are headed in the right direction for economic recovery, but that doesn’t mean inflation.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout