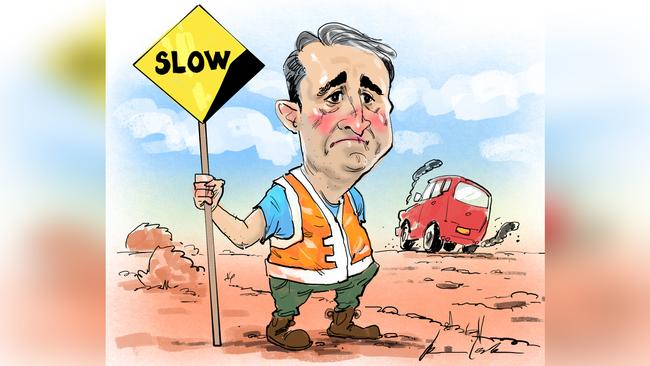

The incoming federal government faces an urgent problem to jump-start the economy, which is slowing and looking increasingly fragile.

The election itself may be part of the problem because business and consumers tend to put big-ticket spending on hold pending the outcome.

But each day as the election approaches the anecdotal evidence builds of an economy in need of a jump-start.

This is not good for either party, with economists noting that while the economic impact of the keynote ALP revenue measures — negative gearing and a crackdown on franked dividend perks — is uncertain, “they won’t help”.

Pensioners may not be big spenders but if they are losing a government handout this will restrict consumption spending and the impact of the ALP’s negative-gearing plans will create some uncertainty in a weak housing market.

The government’s reputation as the preferred economic manager also looks decidedly sick in the wake of the Reserve Bank’s cut in growth forecasts to 1.7 per cent in February.

Neither party has presented any detailed plans to boost the economy through productivity gains and by definition the government has failed to do anything about slowing productivity.

To be fair, according to the Productivity Commission, Australian productivity since 2004 has been either negative or barely positive.

Without gains there is no incentive to invest and that means no incentive to increase wages.

The economists declined to be named for obvious reasons ahead of the election, but consensus says whichever party wins the election they should fast-forward the tax cuts and forget the boasts about returning to a surplus.

ABS figures showed home lending fell 3.7 per cent in March against market estimates of a 0.5 per cent gain, and personal finance lending was down 11.2 per cent in the month.

Commonwealth Bank on Monday joined the other big banks in outlining third-quarter numbers, which showed a 9 per cent fall in profits excluding the $714 million increase in remediation costs.

The bank also said that bad loan charges were edging higher.

UBS noted that, in line with the other banks, troublesome assets increased from $6.7 billion to $7.2bn, mortgage delinquencies rose four basis points to 71 points and, while still very low by historical levels, the trend is clear.

Core Logic data showed capital city dwelling prices declined a further 0.5 per cent over April 2019, with Sydney house prices down 18 per cent from October 2017 peaks and Sydney apartments down 13 per cent from September 2017 peaks.

CLSA analyst Brian Johnson said in a recent note that “we do not believe the correction in Australian house prices poses a catastrophic risk for the Australian banks”.

“Continuing immigration-fuelled population growth and falling construction sees the previous excess 12-month forward ‘bulge’ of excess apartment settlements much reduced with an emerging shortfall relative to historical demand in Sydney,” Johnson added.

Also on Monday, global plumbing supply company Reliance Worldwide slashed profit forecasts in part due to the slowdown in home building. A mild North American winter was the major cause for its gloom because fewer pipes cracked.

But last week Rob Sindel from building products group CSR noted that, with housing credit harder to get, approvals were down.

Adelaide Brighton said the same thing in its annual meeting, and Woolworths boss Brad Banducci said his market-leading liquor outlet Dan Murphys stores had seen a marked swing from high-priced French champagne to Australian sparkling wine.

Travel group Flight Centre reported less demand for leisure travel.

Qantas boss Alan Joyce noted this month: “We’re seeing increased softness in parts of the domestic corporate market for May and June, particularly financial services, telecommunications and some areas of construction. Growth is also slowing in the small business market.”

He added: “We’ll have a better sense of how temporary this is after the federal election, which always has a dampening impact on travel demand.”

Joyce’s caution was matched by others, with Coles boss Steven Cain recently pointing to two markets with some consumers trading down from branded goods to house brands.

The official data is more worrying, with the RBA finally catching up with market predictions of a slowdown.

Elections may have a dampening effect on sentiment, but the trends are clear and consumer spending figures are only holding up thanks to government spending. This suggests the government will have to do more lifting to keep the expansion moving and better still to make meaningful changes to government delivery through productivity changes rather than simple tax cuts.

Sims stays busy

ACCC chief Rod Sims is spending much of this week in Cartagena, Colombia, for the annual International Competition Network conference for global regulators and invited practitioners.

But on his return he may face a vastly different regime with some policies to his liking including significantly increased penalties and the forced inclusion of competition principles in planning laws.

If the banks have had enough of government oversight, opposition spokeswoman Clare O’Neil will disappoint, maintaining the pressure with policies including “major companies, industry bodies, APRA and ASIC, to publicly report to the Royal Commission Implementation Taskforce about their progress in implementing recommendations every six months”.

The ABA, four major banks, APRA and ASIC are to develop royal commission implementation plans by August 1 and submit them to the Royal Commission Implementation Taskforce and all of the above must report progress to parliament every six months.

One of the principles behind competition law is it should be sector-neutral, which the ALP ignores with some of its policies like a specialised dairy commissioner and to “prioritise conduct that targets or disproportionately impacts disadvantaged Australians”.

The ACCC is supposed to act on behalf of all consumers on an economy-wide basis.

Sims would enjoy the promised doubling of his budget and plans to boost his market studies power.

The latter would mean the ACCC would be able to select its own topics and have full statutory power to collect evidence in those inquiries.

Today it only has that when the government makes the direction.

Labor assistant Treasury spokesman Andrew Leigh was clever enough to get one of his policies passed before the election, with parliament approving the move to give the Federal Court the authority to waive costs orders against losing litigants when they are small companies fighting big ones.

He wants to extend the help to small business by making unfair contract terms illegal and legislative power to ensure all car repairers have access to the same data and hotels have unfettered rights to charge what they like in contrast to demands from some big platforms today that they shouldn’t undercut platform advertised rates.

The ALP will ask the ACCC to investigate the impact of market concentration on income equality and to produce policy reports on how the impact can be mitigated.

All the extra reviews will need extra funding, which will be forthcoming along with a doubling of the ACCC’s litigation budget.