Central banks are working in concert, and aggressively, to defeat inflation and signs the US Federal Reserve may be taming the beast have provided a shot of optimism that interest-rates won’t be heading much higher.

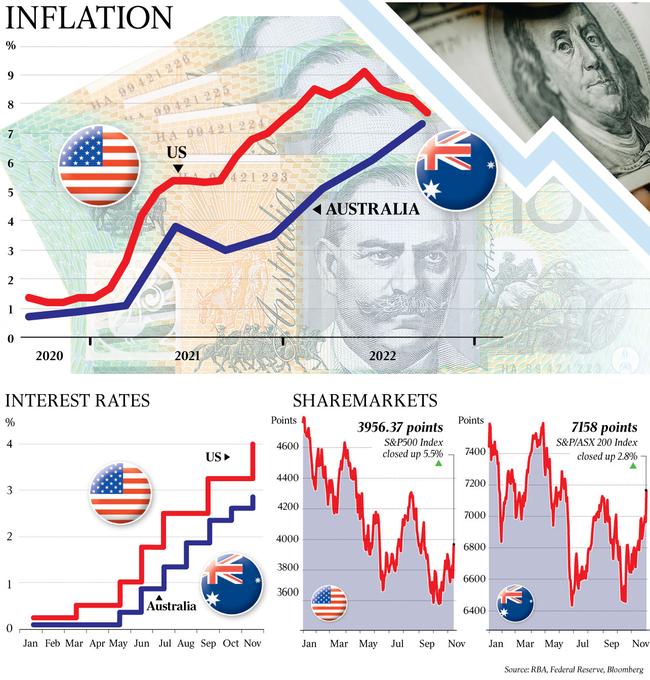

The US consumer price index rose 7.7 per cent in the year to October, down from 8.2 per cent in September and 9.1 per cent in June.

The core annual inflation rate, which excludes energy and food costs, crept down from a 40-year peak of 6.6 per cent in September to 6.3 per cent last month.

The data were a “welcome relief”, said one Fed official, as stock prices on Wall St had their biggest rally in more than two years and investors started to believe that “scorched earth” monetary policy could be coming to an end. That optimism spilt over to our share market, with the ASX 200 gaining 2.8 per cent on Friday to reach a five-month high.

The story of rampant US inflation, driven by pay outcomes, is different to our own, although wage pressure is increasing.

The benchmark US federal funds rate is between 3.75 per cent and 4 per cent, compared with the Reserve Bank’s 2.85 per cent cash rate target. There are a few more turns in this cycle.

Headline inflation here is expected to reach 8 per cent this year, with energy costs, strong consumer demand and supply snarls driving prices growth.

The RBA keeps saying it’s on a narrow path to managing inflation back to the 2 to 3 per cent band that is its mandate and keeping things on an “even keel”, banker’s code for not putting the economy underwater.

Officials have provided a surfeit of public commentary since the Melbourne Cup day rate rise. It can often seem there’s a swirl of narratives about what’s going on: an each-way bet for hawks and doves. RBA deputy governor Michele Bullock told economists on Wednesday that if there’s bad news on inflation or evidence of a wages breakout, “don’t doubt our resolve to increase interest rates quite quickly”.

The next day at Senate estimates, Bullock said interest rates were at “a level now that is getting up to where, maybe, there might be an opportunity to sit and wait and look a little bit at what’s going to happen next”.

The central bank’s latest forecasts show inflation won’t be in the policy band until 2025, and the next two years will see feeble growth in gross domestic product and a steady rise in unemployment to about 4.3 per cent.

Much of the data, such as next week’s wage and job figures, might be on the stale side, but at least help us understand the state of play.

Consumer sentiment keeps tanking and yet we’re tapping our cards and hitting ATMs like Christmas is tomorrow and forever. Or acting like a premier getting ready for a date with the people in a fortnight.

Westpac’s Bill Evans, however, reckons “the signs of early cracks are appearing” as inflation and tighter budget and monetary policies weigh on households.

The RBA may not be on a preset path, promising it can do more or less, depending on matters in the real world. The board meets on December 5, and then there’s a nine-week break until the February meeting.

Officials hope to see household spending easing off over the summer hiatus, so that supply can catch up; that businesses don’t get greedy and absorb a little more of the cost increases in wages, rents and power; and, that the hard-won gains in employment aren’t blown when mortgage pain and housing stress set in next year.

One-third of the world economy is tipped to slide into recession, so anything resembling good news will give insipid markets and investors some B-B-Bounce.