Federal Election 2022: UBS sees no change to economic outlook if Labor wins

The Prime Minister has warned voters of the risks posed by a Labor government but economists at UBS are more sanguine.

Prime Minister Scott Morrison has warned voters of the economic risks posed by a Labor government but economists at UBS are more sanguine, saying they see no material change to the economic or sharemarket outlook regardless of the winner.

But in the same breath the investment bank has issued a stark warning on the threat of rising interest rates, predicting a housing market crash and a recession if the Reserve Bank moves too aggressively.

With a Federal Election now locked in for May 21, both Labor and the Coalition will spend the coming weeks courting voters. Mr Morrison kicked this off on Sunday as he announced the election date.

“Above all, this election … is a choice,” Mr Morrison said.

“(A) choice between a strong economy and a Labor opposition that would weaken it.

“It’s a choice between an economic recovery that is leading the world and a Labor opposition that would weaken it, and risk it.”

In a note to clients, UBS economists led by George Tharenou point out the differences between this and the 2019 poll, which saw a “miracle” Coalition win.

“Leading into the last election there were material policy differences proposed by the main opposition Labor Party, especially for housing and taxation,” they said.

“These included: negative gearing, capital gains tax, franking credits, trusts, income tax, penalty rates, and a ‘living wage’ which could have seen the minimum wage rise by around 10 per cent.

“This time, policy differences between the government and Labor are narrower; and the economic and market implications are not expected to be as material.”

One key economic difference from a potential Labor victory would be new policies aimed to increase the minimum wage or change the EBA wage system, the economists added.

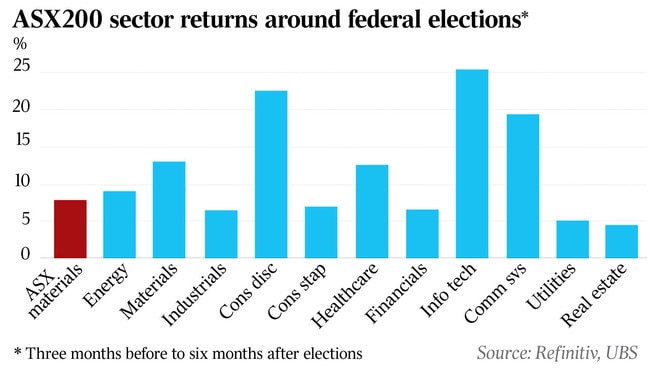

Meanwhile, the outlook for the sharemarket was positive, they said, with Australian equities posting strong returns in the three months before and six months after over the 18 federal elections since 1974. The equities market in the past has been unfazed by a change in government, while the consumer discretionary sector has outperformed during these times, UBS said.

The bigger economic risk, as UBS sees it, comes from rising interest rates. Following a reading of the central bank’s latest Financial Stability Review, the investment bank’s economists say the RBA appears hawkish and not that concerned by the prospect of much higher rates.

But UBS’s own analysis paints a different picture, most notably from the expiry of fixed rates.

“Even for the longest possible duration mortgage of 30 years (which mutes the impact), an increase in mortgage rates, from 2 per to 4 per cent, raises required repayments by around 29 per cent; and a lift in rates to 4.5 per cent (ie, a 250 basis point increase reflecting the shift from fixed to variable, plus an assumed 200 basis point rise in variable rates) increases repayments by around 37 per cent,” the economists warned.

“Hence, we still expect the market pricing for the cash rate of around 3.25 per cent by end-2023 is too aggressive, as it would crash the housing market and cause a recession.

“We expect the terminal cash rate to be ultra low at around 1.25 to 1.5 per cent.”

Last week, RBA governor Philip Lowe abandoned his guidance of “patience” after the central bank’s April board meeting, signalling that the cash rate could be lifted from its record-low of 0.1 per cent as early as June, depending on next month’s inflation and wages data.

UBS sees the key upside risk to its dovish view on rates as more persistent inflation, wage rises and aggressive central bank hikes.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout