Fed will declare victory over inflation but businesses still face a profit squeeze: Oaktree

The US Federal Reserve is close to claiming victory over inflation but companies will still face a squeeze on their profits, predicts one of the world’s most influential distressed debt players.

The Federal Reserve will soon claim victory on inflation, but companies face a squeeze on profits amid an elevated rates outlook, one of the world’s most influential distressed debt players predicts.

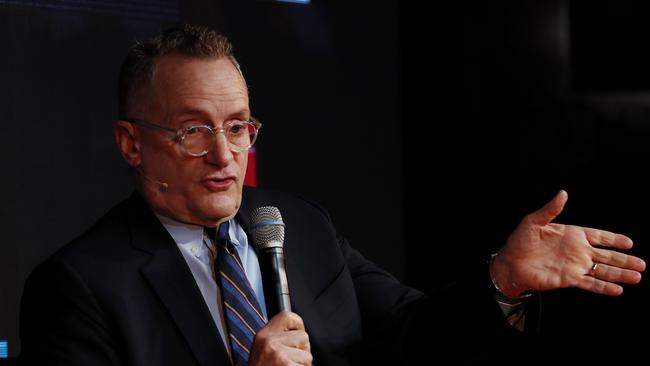

Howard Marks, co-chair of Oaktree Capital, said the “sea change” of declining rates from about 20 per cent in the 1980s was now over and rates would stay at a more normal level going forward.

This would open opportunities to those who could provide immediate liquidity, including Oaktree, the firm he co-founded in 1995 and that now manages more than $US189bn ($291bn) in funds on behalf of investors.

The firm has been a prolific investor in the distressed debts of Australian companies in the past, including GenesisCare, Billabong, Nine Entertainment and Blue Sky Asset Management.

The US central bank could have taken a hands-off approach to pandemic-era inflation which would probably have subsided on its own over time as excess money was spent and supply chains recovered, he said.

But the Fed “with good reason” acted to curb demand via the most aggressive rate rises in generations to bring inflation down more quickly, and “one of these days” would declare victory over inflation and begin to lower rates.

“But the important thing is not … what month will they start?” Mr Marks told an event hosted by the Australia-Israel Chamber of Commerce. “The important thing is, where will rates end up?”

His thesis, he said, was that the Fed funds rate would need to stay at 3-3.5 per cent, compared to the current 5.25-5.5 per cent.

That level seems high but in a historical context “those are not high rates,” he said. “They are certainly lower than I’ve lived with most of my investing life. They are just higher than the recent past.”

This would still probably impede economic and business growth, as companies struggled to adjust their finances to a less accommodative environment and secure the capital needed to expand output and profits.

“Things will be tougher in the years ahead and we’re already doing big business lending money to companies that are in a jam,” said Mr Marks, who pioneered distressed debt investing in the late 1980s.

Many companies, while not at risk of defaulting on their debts yet, had large debt “gaps” in their balance sheets because banks are now charging much higher rates than two or three years ago, and many lenders had shrunk the loans they are willing to grant.

“So we lend it to them. They have a need, we will fill their need, but we’ll charge them for it,” Mr Marks said. “And we can do much more of that in this environment. This is a much more propitious environment for us.”

Oaktree counts several big superannuation funds as investors and has an investment team headed by former Macquarie Capital executive Byron Beath.

Mr Marks said credit investments such as bonds, loans, and high yield debt could offer equity-like returns but with less risk and volatility because of the contractual nature of the cash flows involved in such investments.

Opportunities in distressed debt and corporate restructurings may abound in coming years as problem sectors such as commercial real estate and healthcare companies face challenges servicing or refinancing maturing debts, putting stress on overleveraged balance sheets.

However, Mr Marks said the future of office towers in the US remained so uncertain that it was difficult even for Oaktree to deploy investment capital with confidence.

When it came to dealing with geopolitical and economic uncertainties, he said those did not necessarily mean avoiding major markets such as China, despite its economic struggles and geopolitical risks.

Many investors see China as “uninvestable” because of the economic challenges and geopolitical risks involved, but Mr Marks has been highly successful investing where others haven’t seen value.

“I’m not as afraid of China as everybody else is,” he said. “The one thing we know is that China’s market has really suffered. Many people have applied the label uninvestable, and I have made my whole career investing in things that other people considered uninvestable, like bankrupt debt.

“When other people say I wouldn’t touch that with a 10 foot pole, then that’s where the bargains are. So we are open to investing in China carefully.”

He said he believed the Chinese economy needed to grow at about 5 per cent every year to accomplish its government’s goals. Doing that internally would be difficult given its demographic challenges and its lack of a sizeable consumer class.

And external demand from China’s “buddies”, Russia, North Korea and Iran, wouldn’t be enough to make up the shortfall, and so the second-largest economy needed demand from the rest of the world, Mr Marks said.

“Which in my opinion means they can’t go rogue, so they’ll rattle their sabres and they’ll threaten, but the world is in a place with regard to the developed powers where it’s hard to think about a war. And I think that includes China,” he said.

Mr Marks also said he believed there was a path to peace in the Middle East.

There were several countries that would support a responsible Palestinian government and the building of its economy so that people there could have a future to look forward to: “Many of us believe there is a path to peace. Israel will have to make some tough decisions, but I just don’t think the future is hopeless.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout