Step back from the IMF forecasts of lower growth and low interest rates and we see a fundamental change taking pace in developed countries, including Australia and the US.

And, because this change is linked to lower population growth rates, it will last for decades and will create boom and bust industries that will distort economic patterns and share markets.

One of the world leaders in researching these trends is Kiwi Bank chief economist Jarrod Kerr, who was previously CBA’s director of interest rate strategy.

When you look at his work you can see a looming transfer of wealth from the retiring Baby Boomers to the Millennials born between 1981 and 1996 and now aged between 23 and 38.

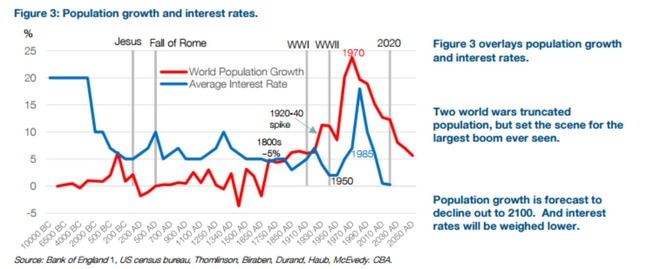

Kerr believes interest rate moves and intergenerational wealth transfers can be explained by population trends and are part of a pattern that extends back centuries.

Read more | IMF forecasts global growth at decade low

Millennials have been great drivers of discretionary spending, causing booms in a vast number of products, including hi-tech devices. But token interest rates will see their spending change towards dwellings and less discretionary items.

The interest rate swings are much greater than “normal” because we are in the middle of the largest demographic shift ever experienced. That shift has reached a tipping point which will keep a lid on overall potential growth and real yields for decades.

A history lesson

To understand what is happening we need to go back into history.

Kerr says that between 500BC and 1910 interest rates averaged around 5.5 per cent. By 1950, following two world wars and a great depression, interest rates had fallen to the lowest levels seen in history - until now.

The 1970s and 1980s are the anomaly. Those decades generated by the largest surge in population ever recorded. That boosted growth but put an enormous strain on resources, causing inflation to spiral to levels no longer allowed. Baby Boomers became productive in the late 1960s and demanded to be able to borrow.

Accordingly the greatest spike in global population growth was a huge contributor to the greatest spike in global interest rates.

Fast forward to today. There is push‑back against immigration, competition and globalisation. While eventually that could give rise to an inflation rise, retiring Baby Boomers have created a glut in global savings. This particularly applies developed countries, so there is still a global wave to flow through as populations age in many developing countries.

The savings supply “glut” has occurred at a time of higher global production capacity. China’s export‑led investment boom hasn’t yet developed a consumption model of its own. We’re simply producing much more, for less.

Slowing population growth

From 2020 to 2055, population growth will halve again, because in developed countries society has changed. Fertility rates have declined since the 1960s and family sizes have declined. There has been a steady rise in childlessness, higher divorce rates, and later marriage.

In this environment, over the next 20 to 30 years, the Baby Boomers will slowly unwind their savings. Eventually, the supply curve (of loans) will contract back. But it will be a long, slow process. But the severity of the impact on countries will be different

Australia, New Zealand, Canada and the United States have well above average population growth. China’s growth is slowing, quickly, but off a very high base. India’s population looks set to keep rising.

Real rates in the US are higher than those in ageing peers such as Germany, Japan, and Italy. US rates will remain well above Japanese and European rates. Australian rates may remain above US rates but everyone will be low as part of the wealth transfer. It will create opportunities for enterprises that understand the game.