Delta variant outbreak threatens building boom: Deloitte Investment Monitor

A Deloitte report warns the Delta disruption in NSW, including its recent construction ban, is placing further pressure on an already stretched building industry.

The emergence of the Delta variant of Covid-19, which has triggered a string of state-based lockdowns, threatens to sap confidence and derail the nation’s infrastructure and construction boom.

The latest quarterly Investment Monitor by consultancy Deloitte warns the Delta disruption in NSW, including its recent construction ban, is placing further pressure on an already stretched building industry, which could lead to delays and cost blowouts for major projects.

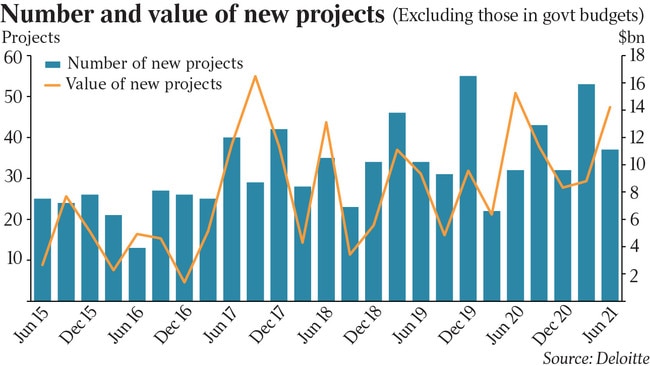

The report, which tracks major engineering and commercial construction projects across Australia, notes that before the June outbreak Australia was experiencing one of the biggest building booms of the past decade.

Industries such as mining and energy are underpinning the boom with the value of all projects – under way and announced – increasing by $25.1bn to $783.4bn during the June quarter, Deloitte said.

This represents a 3.3 per cent increase from the previous quarter, with much of this gain due to additional government-backed infrastructure investment and private investment in the mining and utilities industries.

The value of definite projects (those under construction or committed) tracked by Deloitte increased by $18.8bn over the June quarter.

A total of $323.4bn worth of definite projects is included in the database, the highest level seen since the end of the liquified natural gas (LNG) construction boom, which ran from 2010 to 2014.

Key projects added in the June quarter include the $4.7bn Barossa gas and condensate project, HyperOne’s $1.5bn national fibre optic network, Australis Energy’s $1bn Western Australia Offshore Windfarm and the $800m upgrade of the Darwin LNG plant.

However, major projects exposed to Covid-19 such as offices, shopping centres and hotels have slowed down, Deloitte said.

“The Delta outbreak threatens to derail the remarkable recovery in business investment. The downturn in business investment has been smaller than first thought and the subsequent recovery has, so far, been both earlier and faster than first thought,” Deloitte said.

“Private business investment has grown since late 2020 and is now only 2.2 per cent below pre-Covid levels.

“This is the first time since the peak of the mining construction boom that business investment has grown for two consecutive quarters.”

Sydney’s multibillion-dollar construction industry has been given the conditional green light to return to work following a two week suspension – except for projects in eight local government areas deemed high-risk – but delays are possible.

“The Delta disruption places further pressure on an already stretched construction industry. There have been few changes to project timelines announced to date, but it is too early to tell the full extent of the impact.

“The best case scenario is that … construction activity catches up to plan, but the worst case scenario is that lockdowns lead to project delays and cost blowouts.

“And given the scale of the infrastructure investment pipeline, the risks are larger than they have ever been,” Deloitte said.

Deloitte noted that the significant construction spending and investment could lead to supply-side challenges with material shortages and a skilled labour squeeze on closed borders pushing up costs. Deloitte is expecting Australian GDP to fall by approximately 1 per cent in the September quarter because of the Sydney lockdown.

AMP Capital chief economist Shane Oliver said that with the NSW lockdown now extended, its direct cost had been pushed up to around $14bn, with less time to rebound at the end of this quarter.

“The further boost to government support is costing about $1bn a week,” he said.

Mr Oliver still expects a strong rebound in the economy in the December quarter, aided by pent-up demand from another round of government support payments.