Crestone’s Scott Haslem joins chorus against RBA rate cut on Melbourne Cup day

Crestone Wealth Management’s Scott Haslem says the RBA will be doing more harm than good if it cuts the cash rate this week.

The Reserve Bank will be wasting its time and doing more harm than good if it cuts the cash rate this week, according to Crestone Wealth Management chief investment officer Scott Haslem.

Speaking to The Australian ahead of a widely expected rate cut on Melbourne Cup Day, Mr Haslem instead urged the central bank to start cheerleading the economy again.

“I can’t see how moving the cash rate 15 basis points is going to have any incremental impact on an already super accommodative monetary policy.

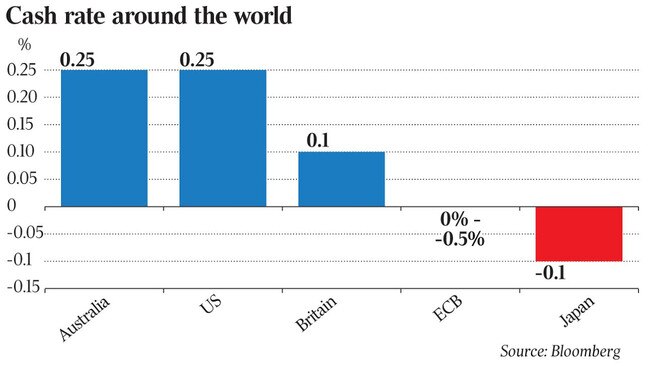

“They’re nervous that our currency might face upward pressure because our cash rate at 0.25 per cent is higher than some others, say the UK at 0.1 per cent, or the US. But the effective rate in the market is not 0.25 per cent, it’s lower than that anyway.

“So why wouldn’t you reserve the ability to do that until the currency was under some upward pressure?”

The market is pricing in a 15 basis point cut on Tuesday after the central bank held rates steady at its October meeting. The RBA has also sent strong signals that it will kick off a full-blown quantitative easing program, buying longer-term bonds in the five-to-10-year range.

“On the quantitative easing, I’m not convinced that it’s going to be in the range of the five to 10-year part of the curve. I suspect it’ll be more around the five-year part, maybe five to seven (years). But I don’t think the RBA will move out towards the 10-year part of the curve,” Mr Haslem said.

Mr Haslem joins a growing chorus of industry experts, including ANZ Bank’s chief executive Shayne Elliott, who see little benefit from a rate cut at this point in time.

“The RBA seems to have taken the view that the risk of doing nothing outweighs the risk of doing what little remains,” Mr Haslem, the former UBS chief economist for Australia and New Zealand, said.

“Despite the concern, it’s not obvious that the Aussie dollar is under material upward pressure. And if we look at where bond yields are in the market, Australia’s bond yields are pretty much one basis point different from where they are in the US.

“So it’s difficult to understand what incremental benefit can come from this. And my preference would be to see the RBA returning to its past history of cheerleading the economy a little bit more.”

Mr Haslem and his team have been advising clients to be disciplined in their strategic asset allocation and portfolio construction amid an uncertain and volatile environment.

Given the near-term uncertainty, sparked by the US presidential election and spiking COVID-19 cases in Europe and elsewhere, he is also telling clients that now is not the time to take big tactical bets.

Crestone’s clients include high net worth individuals and family offices, as well as not-for-profits and financial institutions.

“We are running portfolios reasonably close to their benchmark allocations, although we do have a bias towards equities over fixed income, reflecting our four- to six-month views,” he said.

“We’re more interested in long-term strategic tactical positions on a six- to 12-month view. So the message for our clients at the moment is, coming into the US election it’s going to be volatile, so be disciplined.

“We‘re not making big tactical bets. But we are constructive on the 12-month outlook. And we’d be looking to add risk over time, but we’re not quite doing it yet.”

Clarity around the US election outcome, control of Congress and COVID-19 trends around the globe are the signals Mr Haslem is looking for before adding risk.

If equity markets decline further in the coming weeks, he sees the potential for a number of opportunities in different sectors, particularly in those associated with the economic reopening through COVID-19.

“You would expect to see value appearing in some of the more industrial, manufacturing sectors. Those areas that would benefit from reopening will probably still underperform in that draw down. Whereas the uncertainty about the outlook would probably see bonds rally, and that would support many of the growth tech areas of the market.

“Regionally, we think Australia, which would probably get caught up in that draw down, has a significantly improved outlook from here,” he said.

“And arguably, emerging markets, particularly China and Asia, had a much better COVID-19 experience and their economies are doing better, so we are overweight Australia and emerging markets. Those are areas we’d be encouraging our clients to implement into.”