Covid pain ‘still to come’ for economy, says bank regulator APRA

The full financial impact of the Covid shock to the economy is ‘still to be felt’.

Financial regulators remain on full alert heading into 2021, despite a faster-than-expected rebound in the economy with a rapidly rising housing market and tapering JobKeeper support set to provide risks.

Bank regulator the Australian Prudential Regulation Authority cautioned that the full financial impact of the Covid shock to the economy last year is “still to be felt”.

“And in some ways, 2021 could be just as difficult as 2020,” APRA chair Wayne Byres cautioned on Friday.

His comments come as the banking system is still sitting on more than $52bn of deferred loans – mostly tied up in housing loans – with a little over seven weeks until the end of the JobKeeper scheme.

Meanwhile the Reserve Bank separately on Friday said tapering fiscal policy support from the federal government might complicate the Reserve Bank’s task as it plans to sustain a high degree of monetary policy stimulus to get the economy above its pre-pandemic level to boost wages growth and lower unemployment.

In his opening statement to the House of Representatives Standing Committee on Economics, RBA Governor Philip Lowe said the economy downturn in Australia “was not as deep as we had feared” and the recovery started earlier and has been stronger expected.

However the central banks was “paying close attention” to how households respond to the tapering of the fiscal and other support measures.

“The fiscal response has supported people’s incomes has boosted household savings, with the result that household balance sheets have strengthened noticeably. We are expecting these stronger balance sheets to support spending, but there are uncertainties in both directions here,” Dr Lowe said on Friday.

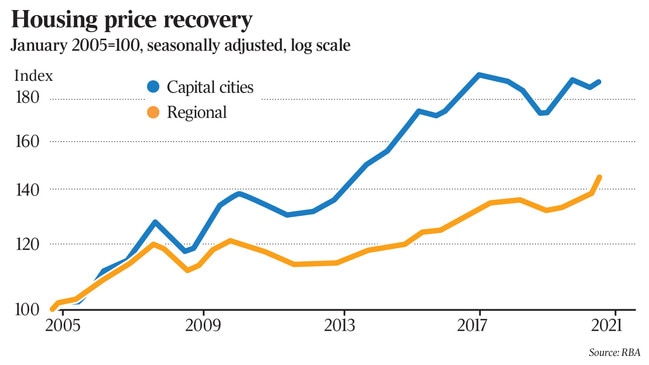

And while the housing market has been recovering strongly and helping to lift the economy from the Covid downturn “there are many moving parts” to the recovery.

This includes record low interest rates; a shift in preferences towards houses and regional locations; large government incentives for first home buyers; the slowest population growth in a century; very high rates of house building; and a decline in apartment rents in Sydney and Melbourne.

Dr Lowe said the economy is in much better shape than a few months ago with the “baseline scenario” of the RBA’s latest quarterly Statement on Monetary Policy predicting 2020 growth averaged minus-2.5 per cent versus minus-3.5 per cent previously forecast.

Growth should rebound to 4 per cent over 2021 and hold that pace over 2022 before gradually slowing to 3 per cent over the 2022-23 financial year, it said.

However, the RBA noted that the speed of the recovery has “underlined the importance of timely and substantial policy support” and “how spending responds to the tapering of some fiscal support measures remains a source of uncertainty for the outlook.”

“The JobKeeper program (ending in March) preserved employment relationships and supported the incomes of both households and businesses,” the RBA said.

“Increased social assistance payments, temporary rent relief and loan repayment deferrals have also assisted, as did the lower debt-servicing costs resulting from the monetary policy measures”.

“Unusually for a period of rising unemployment, both household income and business profits increased. This supported the sharp recovery in household consumption, after many types of spending were constrained by health-related restrictions in the June quarter”.

Beyond the risks associated with the virus, a key uncertainty is how Australian households and businesses respond and adapt to the tapering of some fiscal and other temporary support measures in coming quarters following the extraordinary boost to cash flows they received last year.

The RBA’s new forecasts – incorporating this week’s announcement of a $100bn extension of its bond buying program – have the unemployment rate falling to 5.25 per cent by mid-2023.

The RBA’s “upside scenario”, based on a sustained run of positive health outcomes that enables a faster easing of domestic restrictions and a stronger rebound in private consumption and investment, has unemployment falling to 4.75 per cent by the end of 2022.

Su-Lin Ong, Head of Australian and NZ Fixed Income and Commodities Strategy at Royal Bank of Canada noted that the RBA’s “uber dovish” stance this week was in contrast to that of foreign central banks including the Bank of England and the Bank of Canada last month.

“Both hinted at tapering QE, directives to start work around (an) exit of accommodative settings – despite COVID-19 and economic conditions considerably worse than Australia,” she said.

“This suggests that the Australian dollar is likely playing a key role in policy deliberations.

The RBA will keep buying bonds after its second $100bn package ends and interest rate hikes won’t start until “later than 2024”, according to RBC’s Ms Ong.

Westpac chief economist, Bill Evans, noted that despite a substantial improvement in the RBA’s forecasts for the unemployment rate the expected change in wages growth was “insignificant” and “there would need to be a non-linear lift in the pace of wages growth through 2023 and 2024 for the Bank’s current conditions for a ‘tight’ labour market to be achieved.”

“These forecasts highlight the Governor’s assessment that prospects for raising the cash rate in the context of 3.5 – 4.0 per cent wages growth amid a tight labour market would be in 2024 at the earliest,” Mr Evans said.

“Indeed, such forecasts suggest that the RBA may be extremely doubtful that even 2024 seems a realistic goal.”

The RBA’s forecasts suggest its yield curve control policy is likely to be in place throughout 2021 and while it’s satisfaction with the QE policy also points to further extensions, according to Mr Evans.

“We agree with the RBA that the overriding assessment of the growth outlook is around the development and management of the pandemic and the response of economic agents to the unwinding of the support packages that we can expect over the course of 2021.

In that regard the consumer will play the key role with the financial buffer that has been built up through the extraordinary near 20 per cent household savings rate providing considerable comfort that the 3.5 to 4.0 per cent growth rate that both RBA and Westpac expect to be achieved in 2021.”

Separately, APRA’s Mr Byres writing in the regulator’s “Year in Review” said while risks remain, the Australian financial system remains “fundamentally sound” after one of the most challenging and testing years banks, insurers, and super funds have ever faced.

“Thankfully, Australia went into this crisis with a financial system in a strong, stable position, which has been a critical factor in allowing the financial sector to perform its role in absorbing risk and acting as a shock absorber for the rest of the economy,” Mr Byres said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout