Covid drives used car demand to rev up prices 30pc in 2020

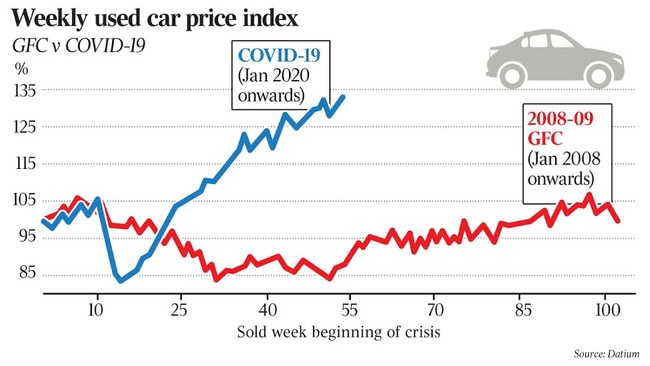

The ‘improbable’ price spike has been driven by multiple factors and delinked from traditional indicators.

The price of used cars jumped by more than a third last year as Covid and money-conscious Australians traded the bus for a cheaper and safer option – but prices are set to fall in 2021.

Research by Moody’s Analytics shows that during 2020 the wholesale prices of used vehicles grew by 35 per cent, with the price of popular light trucks, SUVs and utes rising by 46 per cent.

Some of the most popular second-hand models include the Ford Mondeo and Ranger, the Holden Commodore, Mitsubishi Outlander, Toyota Hilux and the Subaru Outback.

The “improbable” price spike is attributable to multiple factors pushing up prices and de-linking used car prices from traditional indicators like the employment rate and economic growth.

Michael Brisson, auto economist at Moody’s Analytics said that although new car sales rebounded in November ending 31 consecutive months of year on year decline, an overall low volume of transactions through the year limited “the used supply of younger vehicles,” constraining used car inventories.

At the same time Australians were shunning public transport. Mobility data from Veitch Lister Consulting shows that the use of suburban rail networks in Sydney, Melbourne and Brisbane fell below 25 per cent of typical usage in April and May, with Sydney only at half usage and Melbourne at one-third by early December.

“Pandemic-induced changes to tastes and preferences caused people to shun public and shared transportation such as aeroplanes and public transport,” Mr Brisson said.

Major auto dealers have also seen the potential in the used car market: Listed dealer group AP Eagers has prioritised the scaling of its pre-owned vehicle division through its Easy123 and Carlins Automotive auction house brand.

The group, which has seen its share price more than quadruple to $13.21 since April, said it expected underlying profit before tax for the 9 months to September 30 of $96.9m, a 45.4 per cent increase on the previous corresponding period.

Carsales.com said the “resilience” of the used car market and steady volumes helped propel dealer revenues by 10 per cent to $168.7m in the 2020 financial year, while managing director Cameron Mcintyre said in October that time to sell had come down by 34 per cent to “levels I can’t recall seeing before.”

But Mr Brisson said the unique confluence of factors driving up used car prices is unlikely to persist into 2021.

“Used-vehicle prices are expected to have peaked across Australia in the fourth quarter of 2020,” he said, predicting a three per cent price decline in the first quarter of the year and a further one per cent in the second quarter.

“This will mark the first quarter-over-quarter drop in prices in the past two years outside of the lockdown-driven drop in the second quarter of 2020.”

Risks to current price levels include a higher amount of newly purchased vehicles returning to the used car market, an increasing level of production of new cars and a resumption of normal levels of public transport usage – but the price decline could be slow or sudden.

“A comparable rise in used-vehicle prices has never been experienced in the Australian market. A lack of precedent is driving considerable uncertainty about how prices will wind down: slow and steady or steep and sudden,” Mr Brisson said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout