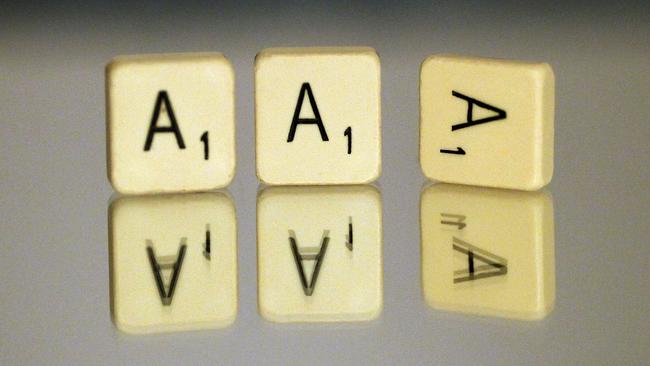

Coronavirus: S&P warns Australia’s prized AAA rating may be lost in a long recession

S&P has become the first ratings agency to warn it could cut the government’s prized AAA credit rating if the economy fails to bounce back quickly.

The world’s biggest ratings agency has become the first to warn it could cut the government’s prized AAA credit rating if the economy fails to bounce back from recession quickly, pointing to a “substantial deterioration” in public finances.

As parliament meets to vote on the federal government’s $130bn wage subsidy package, Standard and Poor’s said it had qualified its AAA rating for Australia with a “negative outlook”, pointing out that net government debt would double by next year to 32 per cent of GDP.

“We could lower our rating within the next two years if the COVID-19 outbreak causes economic damage that is more severe or prolonged than what we currently expect,” the agency said in a statement.

“The COVID-19 outbreak has dealt Australia a severe economic and fiscal shock. We expect the Australian economy to plunge into recession for the first time in almost 30 years, causing a substantial deterioration of the government’s fiscal headroom at the AAA rating level.’’

The government has been at pains to stress the temporary nature of its $214bn of planned new spending, including the $130bn JobKeeper wage subsidy scheme, being rolled out to insulate the economy from social-distancing measures that have shut down swaths of the economy.

S&P said the government’s relatively strong fiscal position would put it in good stead to ride out the economic shock.

“While fiscal stimulus measures will soften the blow presented by the COVID-19 outbreak and weigh heavily on public finances in the immediate future, they won’t structurally weaken Australia’s fiscal position,’’ it said.

“This expected improvement is a key supporting factor of our AAA rating.

“Australia’s general government budget, including the commonwealth and subnational governments, will deteriorate sharply in fiscal years 2020 and 2021 as the economy moves into a COVID-19 -induced recession and governments across the country implement large stimulus packages.’’

S&P has rated Australia at AAA, the highest rating, since 2003. Prior to that it was AA+.

The statement follows more upbeat analysis from rival ratings agency Moody’s, which said earlier this week that the federal government’s efforts to curb the downturn were “unlikely” to threaten its AAA rating.

“The packages are unlikely to generate significant downward pressure on the sovereigns’ credit profiles because both governments have effectively reduced fiscal deficits alongside strong levels of economic growth over the past decade,” Moody’s said.