Coronavirus Australia: Panic buying a distant memory as retail sales take a dive

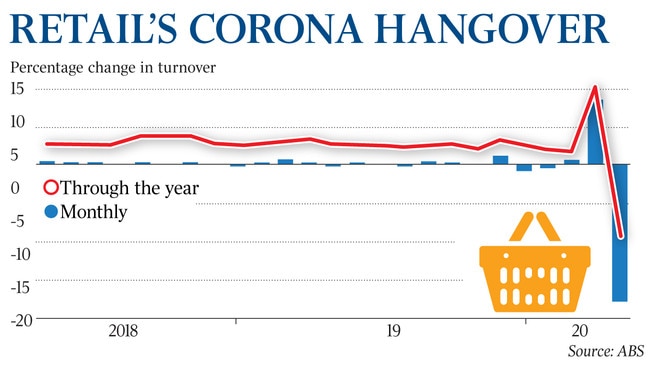

Retail spending suffers historic collapse in April, plunging 18 per cent after previous month’s spike in panic shopping.

Retail spending suffered a historic collapse in April, plunging 18 per cent after the previous month’s spike in panic shopping gave way to sharp falls across the board.

The abrupt end to stockpiling of essential grocery items and the forced closure of shops due to shutdown measures caused retail spending to plunge by $5.4bn, or 17.9 per cent, last month. Turnover in April was close to 10 per cent lower than a year earlier, according to preliminary seasonally adjusted figures released by the Australian Bureau of Statistics.

However, economists are hopeful the easing of restrictions will lead to a recovery in spending in the coming months, even if it is only a tentative one.

ANZ economist Adelaide Timbrell said April saw “the worst of the COVID-19 effects for consumers, including the strictest of lockdowns and the most job losses”.

More up-to-date card spending data from CBA also suggested a trough in April, and that in May there had been “an improvement in momentum”, the bank’s senior economist, Belinda Allen, said.

A 17 per cent drop in food retailing — which includes spending in supermarkets and liquor stores and accounts for 40 per cent of total retail turnover — drove the April plunge. Supermarket shopping remained relatively elevated, however, with spending 5 per cent above the same month in 2019.

But with the strictest anti-virus restrictions put in place from March 30, the dramatic fall in turnover in April also reflected the first full month of the forced closures of many businesses, especially those in hospitality, and clothing and footwear retailing.

Spending in cafes, restaurants and on takeaway “fell heavily”, the ABS said, as did turnover in clothing and shoe retailing, and also in department stores. Trade in these categories was only half what it was in April last year, the ABS said.

The share of online shopping continued to climb — reaching 10 per cent of turnover, up from 5.7 per cent a month before.

Analysts expect a legacy of the pandemic will be a sharp increase in the growth of spending online. Economists at UBS estimate that online market penetration will climb to 17 per cent by 2024.

Australian Retailers Association chief executive Paul Zahra said that as the country started its gradual economic recovery from lockdown, “there is reason to feel cautiously optimistic”.

“We are encouraged by the obvious enthusiasm from Australians to return to physical stores, as reflected in the crowds of shoppers in stores around the country over the recent weekend trading,” Mr Zahra said.

“However, our retail recovery will be slow and will track alongside our economic recovery, which remains in uncharted territory, for the short term at least.”

EY chief economist Jo Masters said while there might be a “bump” in spending in May, “we expect households to tighten the purse strings and likely remain cautious about being ‘out and about’, which will put added pressure on the retail sector”.

The preliminary retail trade figures cover about 80 per cent of total turnover and will be subject to some revision come the final, more detailed release on June 4.

Data released this week from the ABS suggested the billions spent via the JobKeeper wage subsidy program and the expanded JobSeeker has bolstered household incomes, particularly for the country’s youngest workers who have enjoyed a 17 per cent increase in wages since mid-March.