Coronavirus: major hit, big job losses ahead, says RBA

Australia is facing ‘a major hit to economic activity and incomes that will last for a number of months’, Reserve Bank governor Philip Lowe said.

Australia is facing “a major hit to economic activity and incomes that will last for a number of months”, one of which is likely to involve “significant job losses”, Reserve Bank governor Philip Lowe said.

Dr Lowe pledged the central bank would do “whatever is necessary” to help businesses and households navigate their way through the coronavirus crisis as he made it clear that rates would stay at historic lows for at least three years, despite his expectation for a rebound later this year.

In a press conference following the announcement of an emergency rate cut to 0.25 per cent, Dr Lowe warned that the impact on the economy from the pandemic and measures taken to contain the spread of the virus would be severe, but expressed faith that the damage would prove temporary.

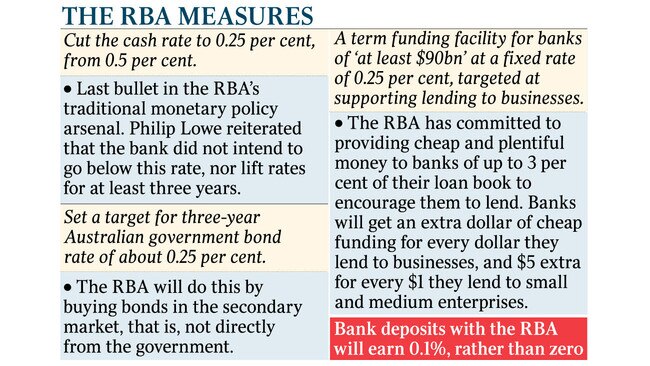

He said by offering at least $90bn in cheap funding to banks, the RBA would help ensure businesses, specifically small and medium-sized firms, had access to cheap and readily available financing to help them “build a bridge” to the other side of the health crisis, and minimise job losses.

“By doing all we can to lower funding costs in Australia and support the supply of credit to business, we will help our economy and financial system get through this difficult period,” he said.

Nonetheless, Dr Lowe said, “we are not going to see much job hiring, and the reality is we’ll see quite a few job losses.

“We need to steel ourselves for a rise in the unemployment rate.

“My hope is that it is a temporary event and that those who lose jobs will find them again — and if we can contain the virus, it will happen quite quickly.”

Dr Lowe noted that the RBA joined its peers in the US, Britain and New Zealand, which all now had cash rates at 0.25 per cent.

He confirmed that the bank had no intention of pushing the cash rate lower.

“The focus for us now is not changing the cash rate — it’s taking other measures to support low funding costs in Australia (such as) lowering the government bond curve and providing the banks cheap funding directly from our balance sheet,” Dr Lowe said.

As part of the monetary package, he said the RBA would buy as many bonds as necessary to keep the three-year rate at 0.25 per cent, less than half the prevailing yield before the announcement.

Dr Lowe declined to rule out additional monetary measures, without outlining what else the RBA could do.

“Nothing is off the table,” he said. “We are in extraordinary times.”

He said he was happy for the Australian dollar, which fell as far as US55c during the day, to play its normal roll as a “shock absorber” for the economy, and there was no evidence of a market dislocation to warrant intervening in the economy, as it did during the global financial crisis.

Dr Lowe flagged an upcoming drop in housing market activity but would not be drawn on whether house prices faced a significant correction.

“The housing market will be what it will be,” he said.